Marvell Strengthens Ethernet Portfolio With Aquantia Buyout

Marvell MRVL recently completed the buyout of Aquantia by purchasing all the outstanding shares of the latter at about $13.25 per share in cash.

The acquisition is expected to strengthen Marvell's portfolio of copper and optical physical layer product offerings, and bolster its position in the Multi-Gig 2.5G/5G/10G Ethernet segments.

The company’s Networking segment, which jumped 16% year over year in the last reported quarter, is likely to get a solid boost from this deal.

Moreover, the transaction is expected to be accretive to Marvell's non-GAAP earnings per share immediately and generate annual run-rate synergies of about $40 million, which is likely to be realized within 12 months.

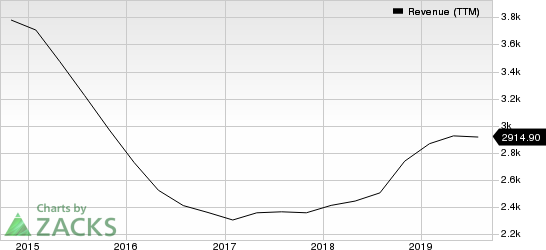

Marvell Technology Group Ltd. Revenue (TTM)

Marvell Technology Group Ltd. revenue-ttm | Marvell Technology Group Ltd. Quote

Scope in Autonomous Vehicle Market

The combination of Aquantia's multi-gig automotive PHYs and Marvell's gigabit PHY and secure switch products is expected to result in an advanced range of high-speed in-car networking solutions.

Notably, Aquantia is a leader in the Multi-Gig technology, which forms the foundation for high speed networking in a broad range of applications, including enterprise campuses and autonomous cars.

This acquisition is therefore expected to boost Marvell's footing in the autonomous automotive market by delivering networking speeds necessary to enable level 4 and 5 autonomous driving.

The automotive industry is increasingly adopting Ethernet in-vehicle networks for autonomous vehicle models. Per Strategy Analytics, the number of related Ethernet ports is expected to witness a CAGR of 62% between 2018 and 2022. This projection bodes well for Marvell.

Marvell’s Ethernet Expertise & Prospects

Marvell’s Ethernet switch and PHY business is gaining traction with new products in the enterprise market. Its refreshed switching products continue to grow with new socket wins.

The fully integrated Cavium business, which has further boosted the company’s capabilities in the Ethernet business, is projected to rake in revenues of approximately $200 million in fiscal 2020.

Moreover, in March this year, the company introduced the Marvell Prestera CX 8500 suit of products to meet the specific requirements of data centers using composable infrastructure. The new family of products is basically a portfolio of Ethernet switches with 2 to 12.8 Tbps of capacity.

Per Zion Market Research, the global industrial Ethernet market is expected to witness double-digit growth and hit $58.98 billion by 2022.

Further, market research firm IDC forecasts that by 2025, the global data sphere will grow to 163 zettabytes (a trillion gigabytes), which is 10 times the 16.1 zettabytes of data generated in 2016.

This exponential growth bodes well for Marvell’s Ethernet Switches owing to the rising demand for higher network speeds for fast processing of data.

Competition a Woe

Like any other growing market, the industrial Ethernet market is witnessing intensifying competition.

Last year, Broadcom AVGO unveiled its latest 200G Ethernet controller known as Thor, establishing itself as a key vendor for Ethernet controller and developers in the IoT and data center market.

Moreover, NVIDIA’s NVDA acquisition of Mellanox increased Marvell’s competition with it. Mellanox boasts a robust portfolio, including the Spectrum-based Ethernet Network Operating System, Mellanox Onyx, which is witnessing strong demand.

In September last year, NXP Semiconductors NXPI acquired OmniPHY Inc., an automotive Ethernet technology developer, bringing high-speed vehicle networking into NXP’s technology portfolio.

Nonetheless, we expect that the strategic acquisitions and other initiatives undertaken by Marvell will help it overcome these headwinds and boost top-line performance.

Marvell currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marvell Technology Group Ltd. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

NXP Semiconductors N.V. (NXPI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance