Market Wrap: Bitcoin Little Changed as Analysts Remain Skeptical

Bitcoin (BTC) rose above $36,000 on Tuesday but was still down about 0.38% over the past 24 hours, compared with a 0.76% fall in ETH. Considering the rebound earlier today, it appears that buyers are starting to return, but some analysts expect choppy price action ahead of the U.S. Federal Reserve's press conference on Wednesday. Fed officials kicked off their policy meeting today.

The Fed is expected to provide details about ending its asset-purchase program in March, which could coincide with a rate hike. Concerns about a tighter monetary policy have contributed to a sharp sell-off across speculative assets, including equities and cryptocurrencies over the past two weeks.

Some crypto buyers could remain on the sidelines given macroeconomic and regulatory uncertainty. As for regulation, Russia's Ministry of Finance opposed calls for a crypto ban by the nation's central bank. "We need to regulate, not ban," Ivan Chebeskov, head of the financial policy department at Russia's Ministry of Finance, said during a conference on Tuesday.

For now, it appears that short-term traders have returned to the bitcoin spot market. BTC's trading volume has increased over the past few days after the cryptocurrency dropped below $40,000. That could signal higher volatility ahead.

Latest prices

●Bitcoin (BTC): $36679, −0.38%

●Ether (ETH): $2424, −0.76%

●S&P 500 daily close: $4356, −1.22%

●Gold: $1848 per troy ounce, +0.35%

●Ten-year Treasury yield daily close: 1.78%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

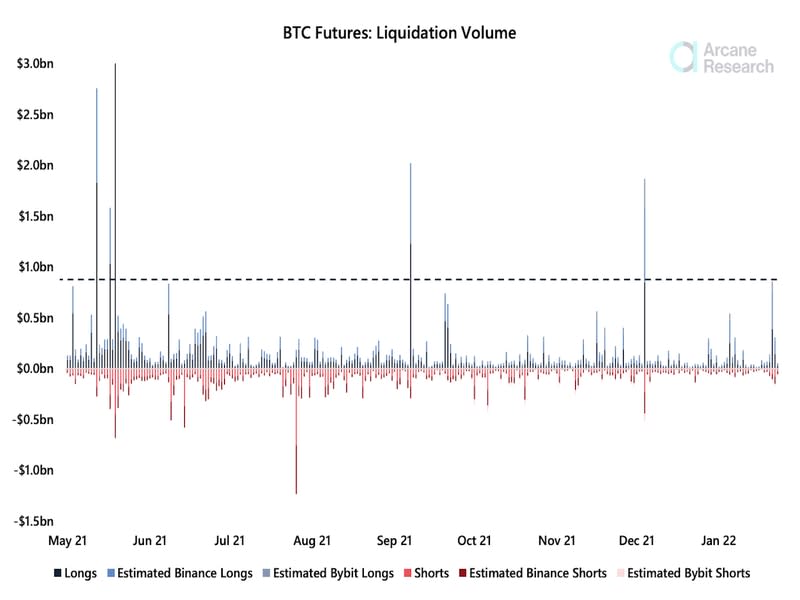

Several market indicators such as long BTC liquidations and open interest suggest further downside is likely.

"The muted liquidations experienced amid the turmoil compared to what we’ve seen earlier might also suggest that underwater longs are exposed for further decline," Arcane Research wrote in a Tuesday report.

Bitcoin dominance rises

Another sign of caution is the recent rise in bitcoin's dominance ratio, which is BTC's market capitalization relative to the total crypto market cap. Typically, a rise in the dominance ratio indicates a flight to safety among crypto traders as bitcoin is viewed as less risky than alternative cryptocurrencies (altcoins).

Altcoin roundup

Solana and Polkadot lead altcoin gains: Several major cryptocurrencies moved with bitcoin today and rose as high as 12%. Polkadot (DOT), Solana (SOL) and Avalanche (AVAX) were among the biggest gainers. The broader crypto market added 5% to the $1.76 trillion total market capitalization in the past 24 hours, according to CoinDesk’s Shaurya Malwa. Read more here.

Ethereum money markets see record liquidations as bitcoin-ether ratio hits three-month high: The bitcoin-ether ratio rallied to its highest level in three months on Monday, signaling continued bitcoin outperformance in the near term, according to Omkar Godbole. Ether’s recent sell-off triggered liquidations of collateral locked in prominent Ethereum-based lending and borrowing protocols such as AAVE, Compound and MakerDAO. MakerDAO alone made more than $15 million in liquidation penalty fees. Read more here.

Fantom transactions surpass Ethereum as users look to farm yields: Transactions on the Fantom blockchain exceeded those of Ethereum for the first time ever on Monday as investors seek new avenues to farm yields and accrue value. In the past 24 hours, more than 1.2 million transactions were processed on the Fantom network. That was slightly higher than Ethereum’s 1.1 million transactions. Read more here.

Relevant news

Republic Capital Leads $6M Round in Cross-Chain Bridge Swing

YouTube Considering Offering NFTs to Allow Creators to ‘Capitalize’ on Work

Russia's Finance Ministry Opposes Central Bank Call for Crypto Ban

Fed Preview: How Rate Hikes Could Stimulate Demand for Stablecoins

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Largest gainers:

Asset | Ticker | Returns | Sector |

|---|---|---|---|

Dogecoin | +3.8% | ||

Polkadot | +3.0% | ||

Polygon | +2.0% |

Largest losers:

Asset | Ticker | Returns | Sector |

|---|---|---|---|

Cardano | −4.2% | ||

Litecoin | −2.7% | ||

Algorand | −2.1% |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

Yahoo Finance

Yahoo Finance