Major Stock Indexes Hit Record-High Level: 5 Top-Ranked Picks

Wall Street has returned to its north bound journey as bulls are roaring in October after September’s market mayhem. On Oct 20, the Dow recorded a fresh all-time high of 35,669.69 surpassing the previous high recorded on Aug 16. On Oct 21, the S&P 500 registered a new all-time high of 4,551.44, outpacing the previous high posted on Sep 2. The Nasdaq Composite is currently just 1.2% below its all-time high recorded on Sep 7.

Month to date, the Dow, the S&P 500 and the Nasdaq Composite, have rallied 5.2%, 5.6% and 5.3%, respectively. This performance is impressive as October is also known for its historically volatile trading pattern. In September, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — plummeted 4.3%, 4.8% and 5.3%, respectively.

An impressive start to the third-quarter 2021 earnings season and a series of solid economic data released in October confirmed the unhindered recovery of the U.S. economy amid prolonged supply-chain disruptions, labor shortage and higher inflationary pressure.

Impressive Start to Q3 Earnings Season

The third-quarter 2021 earnings season has picked up from where it ended in the second quarter. We are in the early stage of the reporting cycle and results are highly encouraging. Overall earnings of corporate America are likely to remain robust after skyrocketing in the second quarter.

As of Oct 21, 100 S&P 500 companies reported third-quarter results. Total earnings of these companies are up 45.3% year over year on 16.6% higher revenues with 87% beating EPS estimates and 75% surpassing revenue estimates.

At present, total third-quarter earnings of the market's benchmark — the S&P 500 Index — are projected to jump 31.5% from the same period last year on 14.3% higher revenues. This suggests a steady improvement from 26.1% earnings growth on 14% higher revenues, estimated at the beginning of the reporting cycle.

Strong Economic Data

Several economists and financial experts have raised their eyebrows regarding the continuation of U.S. recovery after nonfarm payrolls measurably failed to meet consensus estimates in the two consecutive months of August and September. Despite this, the unemployment rate dropped sharply to 4.8% in September from 5.2% in August.

However, weekly jobless claims stayed at the low-end of the pandemic era over the last three months. Initial jobless claims fell below 300,000 in the last two reported weeks. This is the best level since Mar 14, 2020, just before the COVID-19 outbreak in the United States.

The Institute of Supply Management reported that both manufacturing and services PMIs showed exceptional results in September. Robust data for both manufacturing and services sectors will eventually lead to strong economic growth. Notably, the services sector accounts for 70% of the U.S. GDP while the manufacturing sector commands around 12% of economic activities.

Retail sales in September rose 0.7% in contrast to the consensus estimate of a decline of 0.1%. Moreover, the data for August was revised upward to 0.9% from 0.7% reported earlier. Year over year, retail sales climbed 13.9% in September.

Core retail (excluding auto) sales in September rose 0.8%, beating the consensus estimate of 0.5%. Moreover, the data for August was revised upward to 2% from 1.8% reported earlier. Year over year, core retail sales jumped 15.6% in September.

Retail sales rose steadily despite the termination of the weekly unemployment benefit on Sep 6. This is important since retail sales consist of a major part of consumer spending, the largest driver of the U.S. economy. The main reason for the strong retail sales data was a sharp decline in the Delta variant cases of the COVID-19 infection.

Our Top Picks

We have narrowed down our search to five stocks that are members of any of the above-mentioned three major stock indexes. These stocks have seen positive earnings estimate revisions in the last 7 seven days indicating that the market is expecting these companies to do robust business for the rest of 2021.

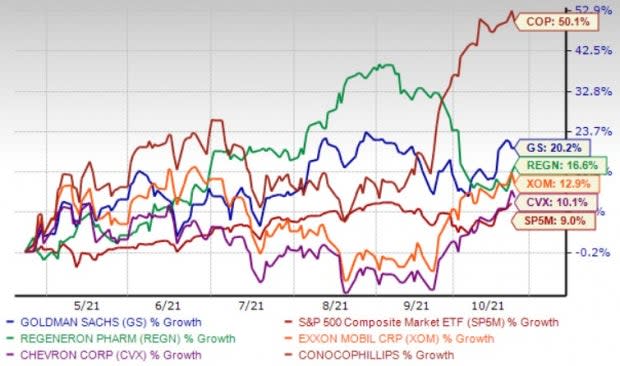

These stocks have provided double-digit returns in the past six months. Finally, each of our picks carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks in the past six months.

Image Source: Zacks Investment Research

The Goldman Sachs Group Inc. GS has been undertaking initiatives to boost its asset management and wealth management business, while expanding its digital consumer banking platform. The company remains on track to roll out digital checking facilities in 2022. A solid position in announced or completed mergers & acquisitions globally is likely to drive its investment banking revenues in the near term.

Business diversification moves, including digital platforms and fee-based revenue sources, should offer earnings stability. Steady capital deployment activities should act as a tailwind. Backed by a solid capital position, Goldman has consistently enhanced shareholders’ wealth.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings improved 12.8% over the last 7 days. The stock price has jumped 20.2% in the past six months.

Chevron Corp. CVX is one of the best-placed global integrated oil firms to achieve a sustainable production ramp-up. Its existing project pipeline is one of the best in the industry, thanks to its premier position in the lucrative Permian Basin.

Chevron’s Noble Energy takeover has expanded its footprint in the region and the DJ Basin. The company now has access to Noble Energy’s low-cost, proven reserves along with cash-generating offshore assets in Israel – particularly the flagship Leviathan natural gas project — thereby boosting its footing in the Mediterranean.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings improved 2.5% over the last 7 days. The stock price has advanced 10.1% in the past six months.

ConocoPhillips COP holds a bulk of acres in the three big unconventional plays, namely Eagle Ford shale, Delaware basin and Bakken shale, which are rich in oil. The upstream energy player also has a foothold in Canada’s oil sand resources and exposure to developments related to liquefied natural gas.

Recently, ConocoPhillips announced an agreement to purchase all of Royal Dutch Shell’s assets in the prolific Permian. The deal reflects ConocoPhillips’ aim of broadening its Permian presence. The transaction is highly accretive and involves the acquisition of roughly 225,000 net acres in the heart of the core Delaware basin.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings improved 2.9% over the last 7 days. The stock price has soared 50.1% in the past six months.

Regeneron Pharmaceuticals Inc. REGN is benefiting from strong demand for Eylea and Dupixent. Continued growth in Eylea and Dupixent through further penetration in existing indications and a promising late-stage pipeline bode well. The approval of Libtayo in the lucrative indication of NSCLC and BCC should also boost sales.

The company has an expected earnings growth rate of 98.2% for the current year. The Zacks Consensus Estimate for current-year earnings improved 0.1% over the last 7 days. The stock price has climbed 16.6% in the past six months.

Exxon Mobil Corp. XOM made multiple world-class oil discoveries at the Stabroek Block, located off the coast of Guyana. Recently, the company raised the estimate for discovered recoverable resources from the Stabroek Block to approximately 10 billion oil-equivalent barrels.

Its bellwether status and an optimal integrated capital structure that has historically produced industry-leading returns make it a relatively lower-risk energy sector play. The integrated oil behemoth expects to reduce greenhouse gas emissions by 30% in its upstream business. By the same time frame, the firm expects to reduce flaring and methane emissions by 40%.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings improved 0.4% over the last 7 days. The stock price has surged 12.9% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance