Who Are The Major Shareholders In Wisdom Education International Holdings Company Limited (HKG:6068)?

If you want to know who really controls Wisdom Education International Holdings Company Limited (HKG:6068), then you’ll have to look at the makeup of its share registry. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said ‘Show me the incentive and I will show you the outcome.’

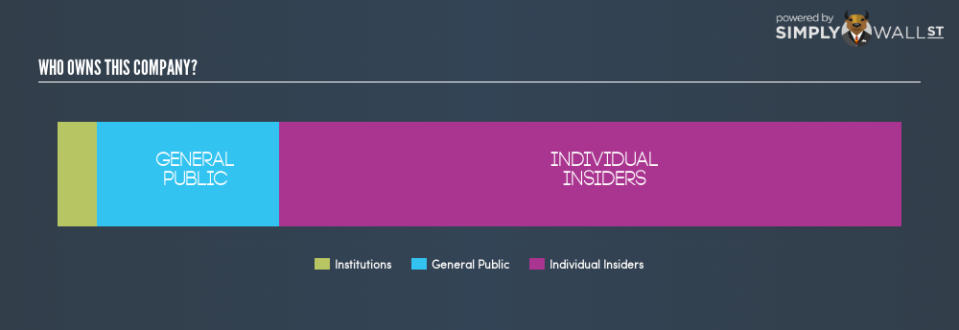

With a market capitalization of HK$8.72b, Wisdom Education International Holdings is a decent size, so it is probably on the radar of institutional investors. Our analysis of the ownership of the company, below, shows that institutions don’t own many shares in the company. Let’s delve deeper into each type of owner, to discover more about 6068.

Check out our latest analysis for Wisdom Education International Holdings

What Does The Institutional Ownership Tell Us About Wisdom Education International Holdings?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

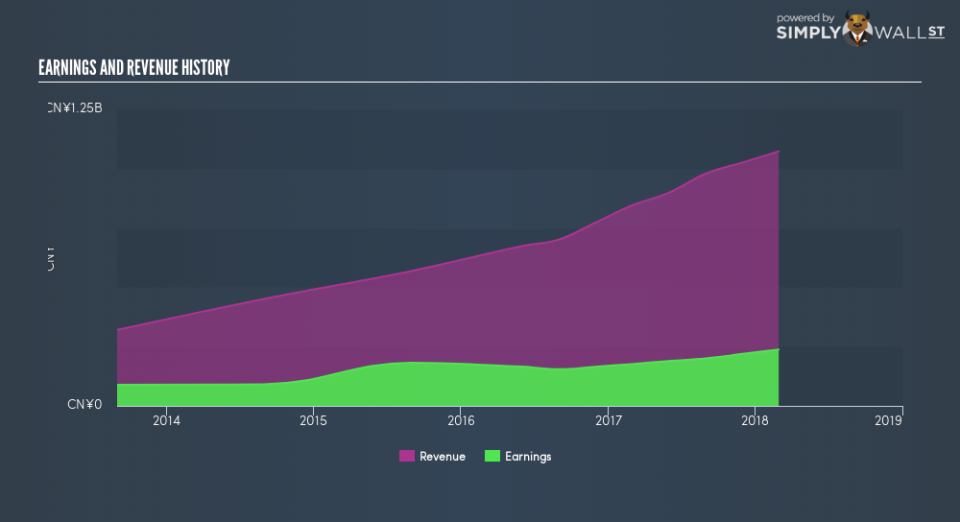

Less than 5% of Wisdom Education International Holdings is held by institutional investors. This suggests that some funds have the company in their sights, but many have not yet bought shares in it. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. It is not uncommon to see a big share price rise if multiple institutional investors are trying to buy into a stock at the same time. So check out the historic earnings trajectory, below, but keep in mind it’s the future that counts most.

We note that hedge funds don’t have a meaningful investment in Wisdom Education International Holdings. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Wisdom Education International Holdings

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems that insiders own more than half the Wisdom Education International Holdings Company Limited stock. This gives them a lot of power. Given it has a market cap of HK$8.72b, that means insiders have a whopping HK$6.42b worth of shares in their own names. Most would be pleased to see the board is investing alongside them. You may wish to discover if they have been buying or selling.

General Public Ownership

With a 21.6% ownership, the general public have some degree of sway over 6068. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

It’s always worth thinking about the different groups who own shares in a company. But to understand Wisdom Education International Holdings better, we need to consider many other factors.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance