Major bank’s huge move on scammers

Westpac has introduced an AI-based questionnaire to combat the hundreds of millions of dollars siphoned from Australians through scams each year.

Australian Bureau of Statistics data shows the number of people who have fallen victim to a scam has decreased slightly during the past three years, to about 2.5 per cent of the population - about 514,000 people.

Westpac said its team of more than 500 financial crime experts had repelled scammers from taking $400 million during the past two years.

On Tuesday a new lining was added to the bank’s shield, with the launch of a questionnaire feature for online banking and in-app transactions.

Be cautious – if the price looks too good to be true, it probably is.

Never click on a suspicious link, scammers may target you with emails with promotional links that appear legitimate.

Use approved payment methods outlined on the legitimate website. Known payments solutions from established providers offer some digital safeguards, making sure your details are secure.

If you receive an email out of the blue from a stranger offering a great deal, do not click on any links or open attachments – just press ‘delete’.

Pay attention to the details – A key rule when shopping online is to check that you’re on an encrypted page, meaning that you should check that the page’s URL starts with “https”. If you don’t see it, the site you’re on may not be legit.

Always keep your computer security up to date with anti-virus and anti-spyware software, and a good firewall.

If you think you have provided your financial details or sent money to a scammer, contact your financial institution immediately.

“This innovation is the first of its kind in Australia and will add important friction to payments deemed to have high scam risk,” Westpac chief executive Peter King said.

Payments deemed suspicious will be flagged, and AI-generated questions like ‘is this an investment’ or ‘is this money going to a friend?’ will pop up.

Westpac analyses the answer, and asks requisite follow-ups to compare the transaction against common scams.

The bank’s chief executive said while prevention measures had led to a “considerable drop” in customer losses during the past year, fraudsters were still taking millions of dollars from customers each month.

The banks do not publish total scam and fraud losses themselves, instead handing figures over to the Australian Competition and Consumer Commission.

The ACCC reports Australians lost $567m to scams in 2022, and $476m the following year.

ABS data shows 35-44 year olds actually suffered the highest prevalence of scams last year, with 3.5 per cent of people in that age bracket falling victim. However, people over the age of 65 lost the most amount of money collectively to scams.

Buying or selling scams are most prevalent, followed by requests for information and upfront payments.

Card fraud is actually far more common than scams, the ABS data shows.

About 1.8m people were card fraud victims last year - 8.7 per cent of Australians over the age of 15.

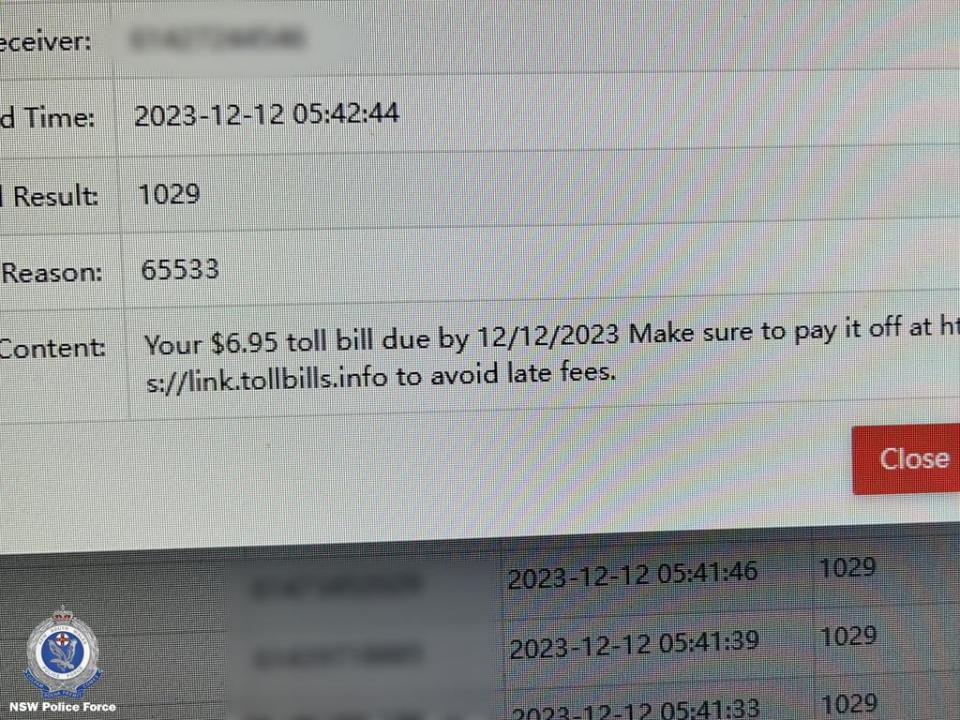

The type of scams circulating is always changing. In January the alarm was raised about a scam taking a three second audio recording of a person’s voice; AI then impersonates that person and scammers target friends and family.

This month Westpac is reporting emails made to appear to be from the bank which contains a link to a phishing website that will take your personal information.

“Never use a link received in an email or SMS to sign into your banking,” the latest scam alert says.

Yahoo Finance

Yahoo Finance