Will Macro Issues Continue to Drag on Cognex's Q2 Earnings Results?

Machine-vision leader Cognex Corporation (NASDAQ: CGNX) finally succumbed to weakness in China and a slowdown in the automotive industry in the first quarter. While management usually foregoes full-year guidance, the news that year-over-year revenue would decline sent investors running for cover, with the stock shedding more than 6% on the day following its earnings release.

Cognex will once again make its case directly to investors during its quarterly update, as the company is scheduled to report the financial results of its second quarter after the market close on Monday, July 29. Let's recap the company's first-quarter numbers and what management had to say to see if it provides any insight into what investors should expect when Cognex reports Q2 earnings.

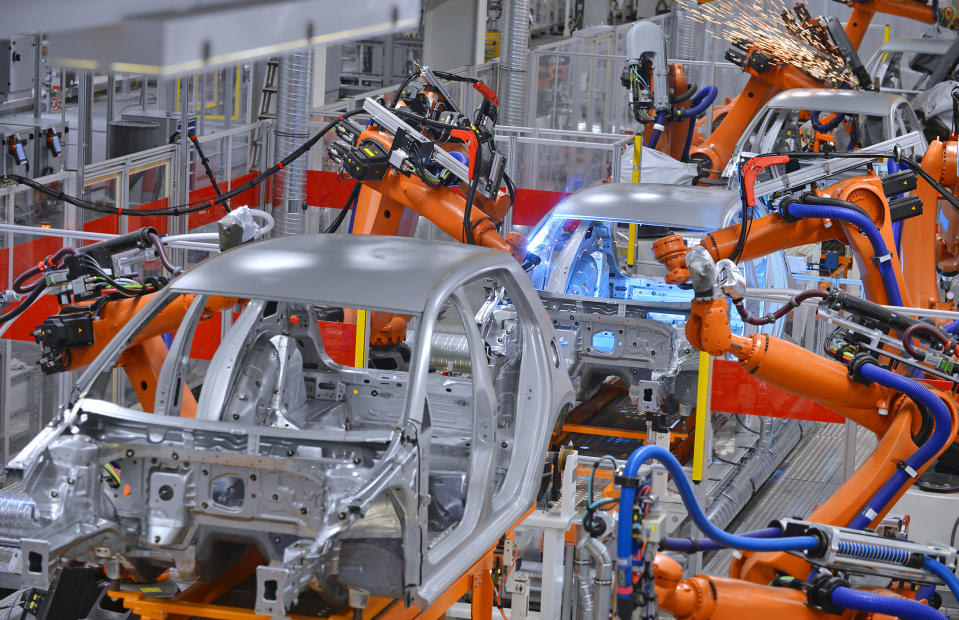

Image source: Getty Images.

Disappointing results

After a string of better-than-expected results, the pendulum swung back the other way for Cognex last quarter. Revenue for the first quarter grew to $173 million, up just 2% year over year and toward the high end of the company's guidance of $165 million to $175 million.

The weakness flowed through to the bottom line, as net income of $45 million declined 27% year over year, resulting in earnings per diluted share of $0.26 -- also down 27%.

Cognex said that weakness in China is one of the big contributors to the slowing results, and the company expects that to continue. On the Q1 conference call, Cognex CFO John Curran explained, "In Greater China, more so than anywhere else, we see customers deferring their capital spending plans. Continued weakness across the region resulted in lower revenue year-on-year."

Curran also pointed out that the negative impact of currency exchange rates was another factor. The company also saw slower spending by consumer electronics and semiconductor capital equipment manufacturers, but noted that overall, underlying demand was still solid.

What to expect this quarter -- and this year

For the second quarter, Cognex is forecasting revenue in a range of $190 million to $200 million, which would represent a decline of between 5% and 10% compared to the prior-year quarter. This is primarily the result of lower spending by customers in China, as well as slower spending in the automotive sector after three years of strong growth. Management is expecting gross margin to be in the mid-70% range, and operating expenses that increase by low single digits on a sequential basis.

Wall Street sentiment can help provide context to Cognex's guidance. Analysts' consensus estimates are calling for revenue of $194.87 million, a decline of 7.8% year over year, and just below the midpoint of management's guidance. Analysts are also expecting earnings per share of $0.30, a decline of about 28%.

Cognex has made it clear that while the long-term growth story for machine-vision is intact, this year will be a challenging one. Cognex CEO Robert Willett said, "While it's not our practice to provide full year guidance, I will say that for all of 2019, we believe revenue will decline slightly year-on-year and be somewhere right between the levels we reported for 2017 and 2018." To put that into perspective, the company reported revenue of $766 million in 2017 and $806 million last year, putting its expectations at $786 million at the midpoint of its guidance.

With two of the major industries it serves -- automotive and consumer electronics -- delaying spending, and weakness in China and a strong dollar further complicating matters, it's no surprise Cognex management is anticipating a challenging year.

More From The Motley Fool

Danny Vena owns shares of Cognex. The Motley Fool owns shares of and recommends Cognex. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance