M&T Bank Corp's Dividend Analysis

Exploring the Dividend Performance and Sustainability of M&T Bank Corp

M&T Bank Corp (NYSE:MTB) recently announced a dividend of $1.35 per share, set to be paid on June 28, 2024, with shareholders required to own the stock by June 3, 2024, to be eligible for this payment. This announcement brings M&T Bank Corp's dividend strategy into focus, prompting an analysis of its dividend history, yield, and growth rates. Leveraging comprehensive data from GuruFocus, this article delves into the sustainability and prospects of M&T Bank Corp's dividends.

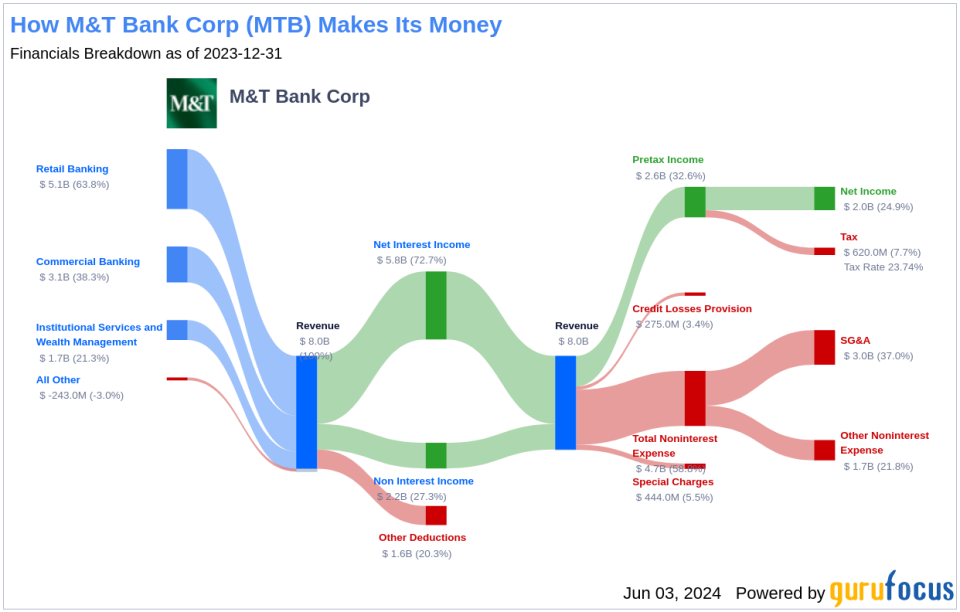

What Does M&T Bank Corp Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

M&T Bank Corp operates as a significant regional banking entity in the United States, with a presence in multiple states including New York, Pennsylvania, and Maryland. Founded to support businesses around the Erie Canal, it now focuses predominantly on commercial real estate and related lending, while maintaining robust retail banking operations.

A Glimpse at M&T Bank Corp's Dividend History

Since 1985, M&T Bank Corp has not only paid but also consistently increased its dividends, earning it the prestigious status of a dividend aristocrat. Dividends are distributed quarterly, reflecting the company's stable financial health and commitment to returning value to shareholders.

Below is a visual representation of M&T Bank Corp's annual Dividends Per Share, illustrating historical trends.

Breaking Down M&T Bank Corp's Dividend Yield and Growth

M&T Bank Corp's current trailing dividend yield stands at 3.43%, with a forward dividend yield projected at 3.56%, indicating anticipated growth in dividend payments over the next year. Over the past three, five, and ten years, the annual dividend growth rates have been 5.70%, 7.10%, and 7.40% respectively. This consistent growth underpins the attractive 5-year yield on cost of approximately 4.83% for M&T Bank Corp's stock.

The Sustainability Question: Payout Ratio and Profitability

The sustainability of dividends is often gauged by the dividend payout ratio, which for M&T Bank Corp stands at 0.35 as of March 31, 2024. This relatively low ratio indicates a healthy balance between distributing earnings as dividends and retaining funds for future growth. The company's profitability rank is 6 out of 10, supported by consistent positive net income over the past decade.

Growth Metrics: The Future Outlook

Looking forward, M&T Bank Corp's growth prospects are crucial for sustaining its dividends. The company's growth rank is 6 out of 10, reflecting fair potential. While its revenue per share growth rate of 6.70% per year is modest, its 3-year earnings per share (EPS) growth rate of 17.10% is robust, albeit slightly below the median for global competitors. Additionally, the 5-year EBITDA growth rate stands at 4.60%.

Conclusion: Evaluating Dividend Sustainability and Growth

Considering M&T Bank Corp's disciplined approach to dividend increases, a conservative payout ratio, and solid profitability metrics, the company appears well-positioned to maintain its dividend aristocrat status. However, investors should keep an eye on growth metrics and market conditions that could impact future dividend sustainability. For those interested in exploring further, GuruFocus Premium offers tools like the High Dividend Yield Screener to discover other high-performing dividend stocks.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance