M/I Homes (MHO) Jumps 53.1% YTD: Will the Upward Trend Persist?

M/I Homes, Inc. MHO has been riding high, given its diverse markets and product offerings, and strong balance sheet. Importantly, the lack of existing homes for sale and more stabilized mortgage rates have been boosting the confidence of homebuilders. Also, lumber prices have been declining since March 2023, helping companies drive margins to some extent.

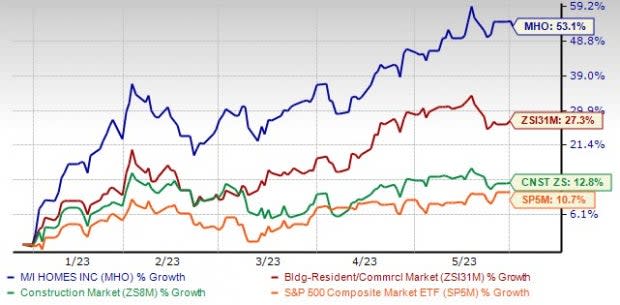

Shares of this Zacks Rank #1 (Strong Buy) company have gained 53.1% year to date, outperforming the Zacks Building Products - Home Builders industry’s 27.3% rally. The stock has fared better than the Zacks Construction sector and the S&P 500 Index’s 12.8% and 10.7% rallies, respectively.

The solid price performance was backed by the above-mentioned factors and an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in the trailing 13 quarters, with the average surprise being 30%.

Image Source: Zacks Investment Research

Earnings estimates for 2023 have moved north to $12.40 per share from $11.12 over the past 60 days, depicting analysts’ optimism over the company’s prospects. This bullish trend justifies the stock’s addition to investors’ portfolios. Again, it carries an impressive VGM Score of B. This helps to identify stocks with the most attractive value, growth and momentum.

Let’s delve into the driving factors.

Diverse Offerings: Based in Columbus, OH, M/I Homes is one of the nation's leading builders of single-family homes. The company designs, markets, constructs and sells single-family homes and attached townhomes to first-time, millennial, move-up, empty-nester and luxury buyers under the M/I Homes brand name.

Owing to this tailwind, the company has been benefiting, which is reflected in the homes closed. In the first quarter of 2023, homes delivered increased 10% to 2,007 homes. M/I Homes had 200 communities at Mar 31, 2023 compared to 176 communities at Mar 31, 2022.

MHO increased first-quarter 2023 revenues by 16% to a record $1 billion, increased pre-tax income by 11% to $136 million and delivered 2,007 homes. In addition, quarterly results reflect a 50-basis point improvement in the overhead expense ratio.

Improving Builders’ Sentiment: Builders are now cautiously optimistic for 2023 as the lack of existing inventory is shifting demand to the new home market. Builder confidence in the market for newly-built single-family homes in May inched up five points to 50, according to the National Association of Home Builders /Wells Fargo Housing Market Index. This marks the fifth straight month that builder confidence has increased and is the first time sentiment levels have reached the midpoint mark of 50 since July 2022.

Stable Financial Condition: The company ended the quarter with record shareholders' equity of $2.2 billion (increasing 28% year over year), book value of $79 per share, cash of $543 million, zero borrowings on $650 million credit facility, and a homebuilding debt-to-capital ratio of 24%.

Higher Return on Equity (ROE): The company’s trailing 12-month ROE is 25.8%, higher than the industry’s 21.4%. This implies that the company is getting less efficient at creating profits and increasing shareholders’ value with respect to its industry.

Other Top-Ranked Stocks From the Construction Sector

Meritage Homes Corporation’s MTH strategic shift to a pure-play entry-level and first-move-up builder is expected to yield higher absorptions, aided by an improving community count growth trajectory.

Meritage Homes currently sports a Zacks Rank #1. Its shares have gained 28.4% this year so far. MTH has seen an upward estimate revision for 2023 and 2024 earnings by 19.6% and 18% over the past 30 days, respectively. Again, it carries an impressive VGM Score of A.

You can see the complete list of today’s Zacks #1 Rank stocks here.

PulteGroup Inc. PHM has been reaping benefits from the successful execution of strategic initiatives to boost profitability, with a focus on entry-level homes.

PulteGroup, presently flaunts a Zacks Rank #1, has jumped 46.5% year to date. The Zacks Consensus Estimate for its 2023 and 2024 earnings has been upwardly revised by 7.6% and 9.9%, respectively, over the past 30 days. Its earnings topped consensus estimates in three of the trailing four quarters and missed on one occasion, with the average surprise being 15.6%. Again, it carries an impressive VGM Score of A.

NVR Inc.’s NVR lot acquisition strategy helps the company to avoid financial requirements and risks associated with direct land ownership and land development. This strategy allows it to gain efficiencies and a competitive edge over its peers.

NVR, currently sports a Zacks Rank #1, has gained 21.9% this year. NVR has seen an upward estimate revision for 2023 and 2024 earnings over the past 30 days by 1.4% and 2.1%, respectively. Again, it carries an impressive VGM Score of B.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

M/I Homes, Inc. (MHO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance