LyondellBasell (LYB) to Defer Exit From Refining Business

LyondellBasell Industries N.V. LYB announced plans to defer the exit of its refining business from year-end 2023 to the end of the first quarter of 2025. Favorable inspections and consistent performance have given the company confidence that operations at the Houston location will continue to be safe and reliable.

LyondellBasell anticipates modest maintenance spending to sustain this extension in 2023 and 2024 but remains committed to shutting down its oil refining operations. The extension will mitigate the impact on the workforce as the company continues to research future alternatives for the site and will allow for a better transition between the shutdown and the implementation of the retrofitting and circular initiatives.

One of the three pillars of the company's new strategy is to develop an attractive Circular and Low Carbon Solutions business. LyondellBasell is creating long-term planning for the Houston refinery site in support of this strategy. Green and blue hydrogen, as well as recycled and renewable feedstocks, are a few of the solutions being considered.

The growth projects currently under construction would leverage the infrastructure already present on the refining site, including hydrotreaters, pipes, tanks, utilities, buildings, and laboratories, as well as existing assets in the Houston region. The 700-acre refinery facility is expected to eventually become a part of a Houston regional hub for LyondellBasell's Circular and Low Carbon Solutions division and support the expansion of its Circulen product line.

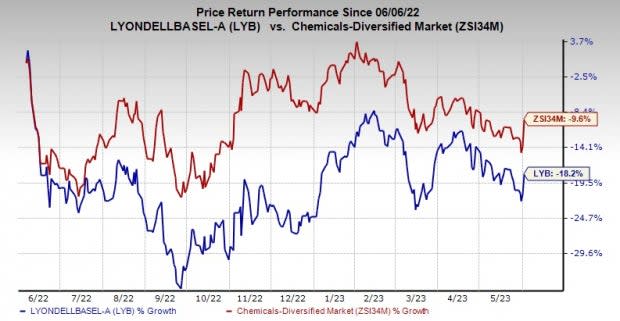

Shares of the company have lost 18.2% over the past year compared with the 9.6% decline of its industry.

Image Source: Zacks Investment Research

LyondellBasell, on its first-quarter call, said that it anticipates a slight increase in global demand driven by usual seasonal trends. The demand for transportation fuels is expected to increase over the summer, supporting oxyfuels and refining margins. Delays at the beginning of industry-wide capacity expansions for polyethylene in North America are likely to lower new market supply and support polyethylene margins.

In order to keep pace with the market expectation, LyondellBasell estimates operating Intermediates & Derivatives assets at 80% and modestly raises global olefins and polyolefins operating rates to 85%. The company will continue to monitor the impact of shifting global monetary policies and strengthening economic conditions in China on petrochemical markets in the second half of 2023.

LyondellBasell Industries N.V. Price and Consensus

LyondellBasell Industries N.V. price-consensus-chart | LyondellBasell Industries N.V. Quote

Zacks Rank & Key Picks

LyondellBasell currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks to consider in the basic materials space include Koppers Holdings Inc. KOP, AngloGold Ashanti Limited AU and Linde plc LIN.

Koppers currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for current-year earnings for KOP is currently pegged at $4.40, implying year-over-year growth of 6.3%. It has a trailing four-quarter earnings surprise of 13.64%, on average. KOP has gained around 12% in a year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AngloGold Ashanti currently sports a Zacks Rank #1. The Zacks Consensus Estimate for AU’s current-year earnings has been revised 22% upward in the past 60 days. The consensus estimate for current-year earnings for AU is currently pegged at $1.94, suggesting year-over-year growth of 50.4%. The company’s shares have gained 38.2% in the past year.

Linde currently carries a Zacks Rank #2. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 3.8% upward in the past 60 days. Linde beat the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 6.9% on average. LIN’s shares have gained 7.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AngloGold Ashanti Limited (AU) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance