Luminex (LMNX) Earnings and Revenues Beat Estimates in Q4

Luminex Corporation LMNX reported fourth-quarter 2019 adjusted earnings of 7 cents per share (EPS), beating the Zacks Consensus Estimate of break-even. Notably, the company reported a loss of 5 cents per share in the year-ago quarter.

Revenues in Detail

Revenues came in at $90.5 million, beating the Zacks Consensus Estimate by 0.6%. Moreover, the top line improved 11.5% on a year-over-year basis.

Total sample-to-answer franchise revenues grew 15% from the prior-year quarter.

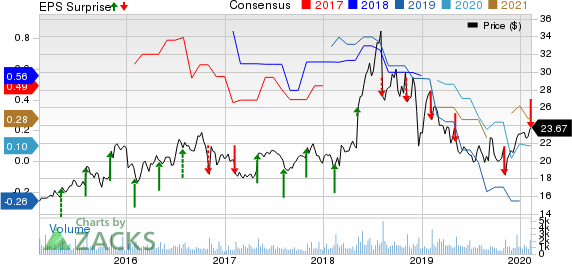

Luminex Corporation Price, Consensus and EPS Surprise

Luminex Corporation price-consensus-eps-surprise-chart | Luminex Corporation Quote

2019 at a Glance

In 2019, the company reported revenues worth $334.6 million, which improved 5.9% from the previous year.

The company reported full-year 2019 loss of 9 cents per share, narrower than the Zacks Consensus Estimate loss of 29 cents per share. The company reported earnings of 41 cents per share in 2018.

Segmental Analysis

System Sales

Revenues at this segment totaled $20.8 million, skyrocketed 103.5% from the year-ago quarter.

Consumable Sales

This segment accounted for $11.7 million of revenues, down 25.2% year over year.

Royalty Revenues

Royalty revenues totaled $13.6 million, up 0.4% on a year-over-year basis.

Assay Revenues

This segment reported revenues worth $36.4 million, down 1.6% on a year-over-year basis.

Service Revenues

Revenues in the segment amounted to $5.7 million, up 75.2% from the year-ago quarter.

Other

Other revenues came in at $2.4 million, up 54.6% from the prior-year quarter.

Financial Update

As of Dec 31, 2019, cash and cash equivalents totaled $59.2 million, down 22.6% from the prior-year quarter.

Cumulative cash flow from operating activities for the three months ended Dec 31, 2019, came in at $5.3 million, up 23.7% from the year-ago quarter.

Margins

Gross profit in the reported quarter was $49.9 million, up 3.2% year over year. Gross margin was 55.1%, contracting 450 (basis points) bps.

Research and development expenses totaled $12.9 million, down 1.8% year over year. Selling, general and administrative expenses in the fourth quarter were $31.1 million, down 2.9% year over year. Total operating expenses amounted to $46.9 million, down 1% from the year-ago reported figure.

The company reported operating income of $5.7 million, which increased significantly from the year-ago quarter’s operating income of $0.9 million. Operating margin of 6.2% expanded 500 bps from the year-ago quarter.

2020 Guidance

Luminex projects first-quarter 2020 revenue to range between $82 million and $84 million.

The company reiterated full-year 2020 revenue outlook of $352-$362 million. The mid-point of this guidance is 7% higher than that of the previous year. The Zacks Consensus Estimate is pegged at $357.5 million.

Notably, the full-year outlook includes around 2-3% headwind associated with the exit of certain remaining sales to LabCorp.

In Conclusion

Luminex exited the fourth quarter on a strong note. The company continues to gain from its flagship ARIES and VERIGENE platforms that currently have a strong customer base. Revenues at System sales, Service and Other revenues also improved significantly.

During the fourth quarter, the company submitted VERIGENE II Gastrointestinal Flex Assay to the FDA and anticipates submitting VERIGENE II Respiratory Flex Assay to the FDA in first-quarter 2020.

Meanwhile, the company’s consumable sales and assay revenues declined in the reported quarter. Contraction in gross margin adds to woes.

Zacks Rank

Currently, Luminex carries a Zacks Rank #3 (Hold).

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks which reported solid results this earning season are Stryker Corporation SYK, Accuray Incorporated ARAY and IDEXX Laboratories, Inc. IDXX. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Fourth-quarter reported revenues of $4.13 billion surpassed the Zacks Consensus Estimate by 0.7%. The company carries a Zacks Rank #2 (Buy).

Accuray reported second-quarter fiscal 2020 adjusted earnings per share (EPS) of a penny, beating the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outpaced the Zacks Consensus Estimate by 0.3%. The company sports a Zacks Rank #1.

IDEXX Laboratories reported fourth-quarter 2019 adjusted EPS of $1.04, which beat the Zacks Consensus Estimate of 91 cents by 14.3%. Revenues were $605.4 million, surpassing the Zacks Consensus Estimate by 0.9%. The company carries a Zacks Rank of 2.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Luminex Corporation (LMNX) : Free Stock Analysis Report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance