LPL Financial (LPLA) May Metrics Up From April on Upbeat Markets

LPL Financial's LPLA total brokerage and advisory assets were $1.46 trillion at the end of May 2024, increasing 3.6% from the prior month and 23.1% year over year. The rise in the company’s asset balance from April 2024 was mainly driven by a robust market performance.

Of LPLA’s total assets, brokerage assets were $655 billion and advisory assets amounted to $809.4 billion. Brokerage assets grew 2.7% from April 2024 and 16.9% year over year. Likewise, advisory assets rose 4.4% from the previous month and 28.5% from May 2023.

Total net new assets (NNAs) were $11.2 billion in the reported month. NNAs were $12 billion in April 2024 and included $5 billion of acquired NNAs from the acquisition of Crown Capital. Notably, in May 2023, NNAs were $8.1 billion.

The company reported $44.5 billion of total client cash balance, down 2.6% from March 2024 and 11.2% from May 2023. Of the total balance, $31.8 billion was insured cash and $9 billion was deposit cash, while the remaining was money-market and client cash balance.

LPL Financial’s recruiting efforts and solid advisor productivity will likely support advisory revenues. The company is expected to keep expanding through strategic acquisitions, given a robust balance sheet position. However, the challenging operating backdrop remains a near-term headwind.

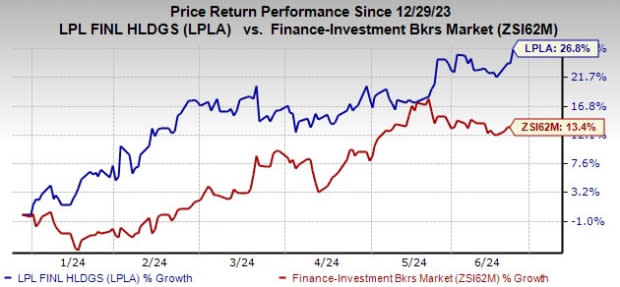

So far this year, LPLA shares have gained 26.8%, outperforming the industry’s growth of 13.4%.

Image Source: Zacks Investment Research

Currently, LPL Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

A couple of other brokerage firms that have released data for May 2024 are Interactive Brokers Group IBKR and Charles Schwab SCHW.

Interactive Brokers has released the Electronic Brokerage segment’s performance metrics for May 2024. The segment deals with the clearance and settlement of trades for individual and institutional clients globally. It reported a rise in client Daily Average Revenue Trades (DARTs).

IBKR’s total client DARTs for May were 2,360,000, which increased 27% from May 2023 and 1% from the last month.

Schwab has reported its monthly activity report for May 2024. The company’s core net new assets of $31 billion surged substantially from $1 billion recorded in the previous month and 50% from the year-ago month.

Schwab’s total client assets in May 2024 were $9.21 trillion, up 4% from the April 2024 level and 20% from May 2023. Client assets receiving ongoing advisory services were $5.25 trillion, rising 17% from the prior month and 35% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance