Lowe's Q2 Preview: Can the Earnings Streak Continue?

The Zacks Building Products – Retail Industry has been hot over the last month, gaining a rock-solid 11.8% and just marginally underperforming the S&P 500’s gain of 12.2%. Below is a table illustrating the industry’s performance vs. the S&P 500 over several timeframes.

Image Source: Zacks Investment Research

An absolute titan in the industry, Lowe’s LOW, is on deck to reveal Q2 results on Wednesday, August 17th, before the market open.

Incorporated in 1952, Lowe’s has evolved as one of the world’s leading home improvement retailers, offering services to homeowners, renters, and commercial business customers.

We see their stores at seemingly every turn. How does the home improvement retailer stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, LOW shares have tumbled, decreasing more than 18% in value and extensively underperforming the S&P 500.

Image Source: Zacks Investment Research

However, over the last month, the price action of LOW shares has been stellar – shares have gained a rock-solid 12.5%, outperforming the general market by a fair margin.

Image Source: Zacks Investment Research

Lowe’s shares carry solid valuation levels; the company’s 15.4X forward earnings multiple is well beneath its five-year median of 18.3X and represents an enticing 8% discount relative to its Zacks Industry.

In addition, LOW sports a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been overwhelmingly bearish for the quarter to be reported, with five downwards estimate revisions coming in over the last 60 days. Still, the Zacks Consensus EPS Estimate of $4.63 pencils in a notable 9% year-over-year uptick in earnings.

Image Source: Zacks Investment Research

The company’s top-line looks to register some growth as well – Lowe’s is forecasted to have generated a mighty $28.3 billion revenue throughout the quarter, good enough for a 2.4% year-over-year uptick.

Quarterly Performance & Market Reactions

LOW has been the definition of consistency within its bottom-line results, chaining together an impressive 13 consecutive EPS beats. Just in its latest print, the company posted a solid 8.3% bottom-line beat.

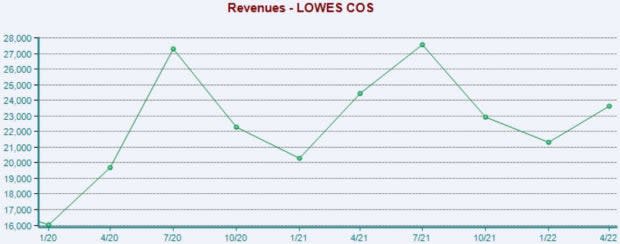

Top-line results have also been remarkable; Lowe’s has posted eight revenue beats over its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, it’s worth noting that following each of its last two quarterly prints, shares have moved each time downwards.

Putting Everything Together

LOW shares reside deep in the red year-to-date, but over the last month, they’ve outperformed the market marginally, signaling that buyers have finally arrived.

In addition, shares trade at solid valuation levels, well beneath their five-year median and representing a slight discount relative to its Zacks Industry.

Quarterly estimates reflect growth within both the top and bottom-lines and the company has consistently reported quarterly results above expectations.

Heading into the print, Lowe’s LOW carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -1.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance