Lowe's (LOW) to Report Q1 Earnings: What Awaits the Stock?

Lowe's Companies, Inc. LOW is likely to register top- and bottom-line growth when it reports first-quarter fiscal 2021 numbers on May 19. The Zacks Consensus Estimate for revenues is pegged at $23,415 million, which suggests an increase of 19% from the prior-year quarter’s reported figure.

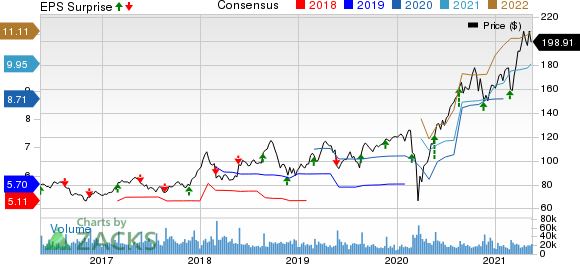

The Zacks Consensus Estimate for quarterly earnings went up 3 cents in the past seven days and is currently pegged at $2.54 per share. The consensus mark suggests a rise of 43.5% from earnings of $1.77 reported in the year-ago quarter. The company delivered an earnings surprise of 9% in the last reported quarter. Notably, this well-known home improvement retailer has a trailing four-quarter earnings surprise of 17.6%, on average.

Key Factors to Note

Lowe's top line, during the first quarter, is likely to have gained from favorable demand conditions. With higher stay-at-home practices amid the coronavirus pandemic, home renovation and refurbishing projects are being widely undertaken. Such trends are likely to have favored the company’s U.S. home-improvement business segment. Also, higher demand from DIY (do-it-yourself) and pro customers across channels is likely to have remained an upside.

Moreover, we expect the company’s first-quarter performance to have benefited from solid omni-channel offerings. In fact, investments in the digital realm have been helping the company meet increased demand from DIY and pro customers. In this context, the company has been striving to boost curbside pickup services as well as installing Buy Online Pickup in Store self-service lockers across U.S. stores. Also, the company’s efforts to expand assortments through the Total Home strategy have been encouraging.

However, we cannot ignore the concerns surrounding rising expenses that may have put some pressure on margins. The company is incurring higher expenses mainly in relation to the pandemic.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Lowe's this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Lowe's currently carries a Zacks Rank #2 and an Earnings ESP of +2.73%.

Other Stocks Poised to Beat Estimates

Here are some other companies you may want to consider, as our model shows that these also have the right combination of elements to post an earnings beat.

The Home Depot, Inc. HD currently has an Earnings ESP of +8.15% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Target Corporation TGT currently has an Earnings ESP of +20.84% and a Zacks Rank #2.

Best Buy Co., Inc. BBY currently has an Earnings ESP of +16.28% and carries a Zacks Rank #3.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

Lowes Companies, Inc. (LOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance