Loss-making Mode Global Holdings (LON:MODE) has seen earnings and shareholder returns follow the same downward trajectory over past -17%

Mode Global Holdings PLC (LON:MODE) shareholders should be happy to see the share price up 13% in the last week. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 17% in one year, under-performing the market.

While the last year has been tough for Mode Global Holdings shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Mode Global Holdings

Mode Global Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Mode Global Holdings saw its revenue grow by 4,311%. That's a strong result which is better than most other loss making companies. The share price drop of 17% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

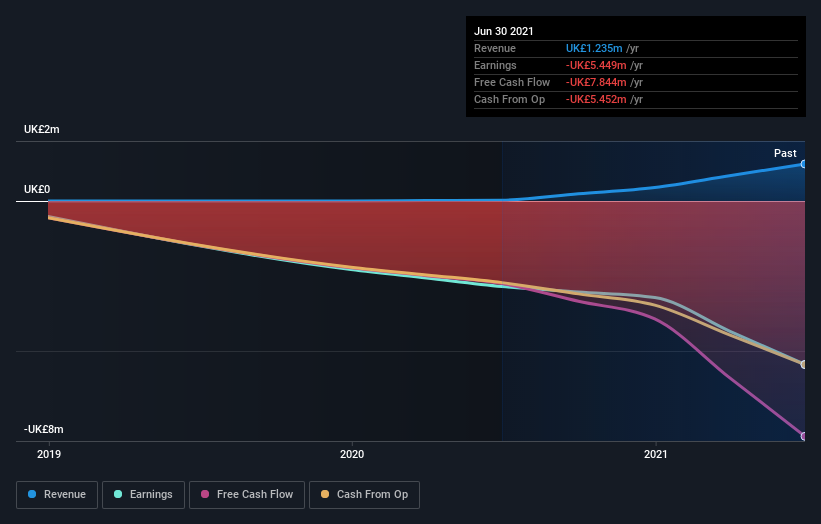

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While Mode Global Holdings shareholders are down 17% for the year, the market itself is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 1.7% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Mode Global Holdings (including 2 which are potentially serious) .

Of course Mode Global Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance