A Look Back at Consumer Internet Stocks' Q1 Earnings: Booking (NASDAQ:BKNG) Vs The Rest Of The Pack

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the consumer internet stocks, including Booking (NASDAQ:BKNG) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 43 consumer internet stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 2.6%. while next quarter's revenue guidance was in line with consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the consumer internet stocks have fared somewhat better than others, they collectively declined, with share prices falling 1.6% on average since the previous earnings results.

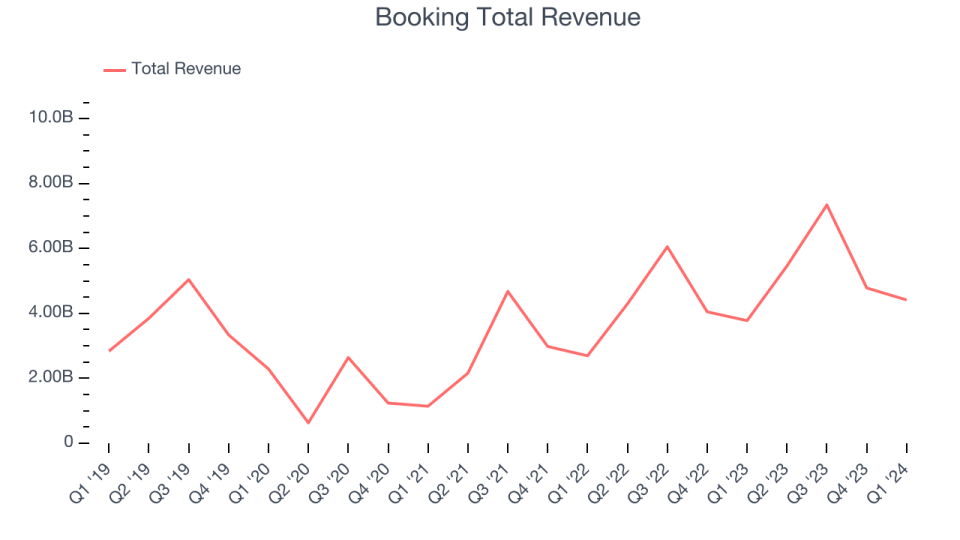

Booking (NASDAQ:BKNG)

Formerly known as The Priceline Group, Booking Holdings (NASDAQ:BKNG) is the world’s largest online travel agency.

Booking reported revenues of $4.42 billion, up 16.9% year on year, topping analysts' expectations by 3.7%. It was a good quarter for the company, with a decent beat of analysts' revenue estimates but slow revenue growth.

The stock is up 9.1% since the results and currently trades at $3,799.99.

Is now the time to buy Booking? Access our full analysis of the earnings results here, it's free.

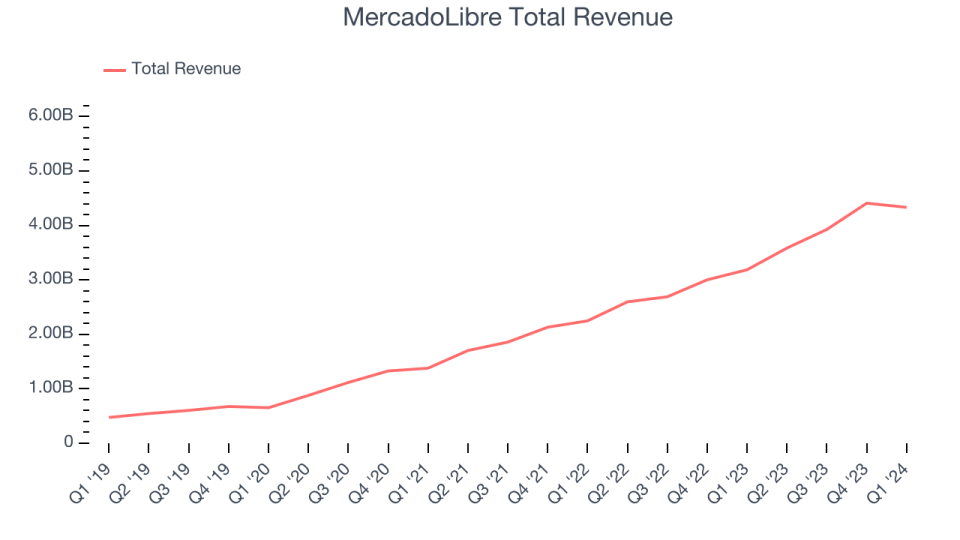

Best Q1: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $4.33 billion, up 36% year on year, outperforming analysts' expectations by 12.1%. It was a stunning quarter for the company, with an impressive beat of analysts' revenue estimates and exceptional revenue growth.

The stock is up 12.5% since the results and currently trades at $1,695.99.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $25.24 million, down 43.1% year on year, falling short of analysts' expectations by 12.6%. It was a weak quarter for the company, with a decline in its users and slow revenue growth.

Skillz had the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 121,000 monthly active users, down 43.5% year on year. The stock is down 3.3% since the results and currently trades at $6.2.

Read our full analysis of Skillz's results here.

Udemy (NASDAQ:UDMY)

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ:UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

Udemy reported revenues of $196.8 million, up 11.6% year on year, in line with analysts' expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and slow revenue growth.

The company reported 1.44 million active buyers, up 3.6% year on year. The stock is down 4.2% since the results and currently trades at $9.47.

Read our full, actionable report on Udemy here, it's free.

Netflix (NASDAQ:NFLX)

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Netflix reported revenues of $9.37 billion, up 14.8% year on year, in line with analysts' expectations. It was a decent quarter for the company as Netflix beat analysts' estimates for nearly every metric we track: paid subscribers, revenue, operating income, EPS, and free cash flow.

The company reported 269.6 million users, up 16% year on year. The stock is up 6% since the results and currently trades at $647.32.

Read our full, actionable report on Netflix here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance