Livent's (NYSE:LTHM) three-year earnings growth trails the 35% YoY shareholder returns

It hasn't been the best quarter for Livent Corporation (NYSE:LTHM) shareholders, since the share price has fallen 23% in that time. In contrast, the return over three years has been impressive. In three years the stock price has launched 147% higher: a great result. It's not uncommon to see a share price retrace a bit, after a big gain. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

The past week has proven to be lucrative for Livent investors, so let's see if fundamentals drove the company's three-year performance.

Check out our latest analysis for Livent

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

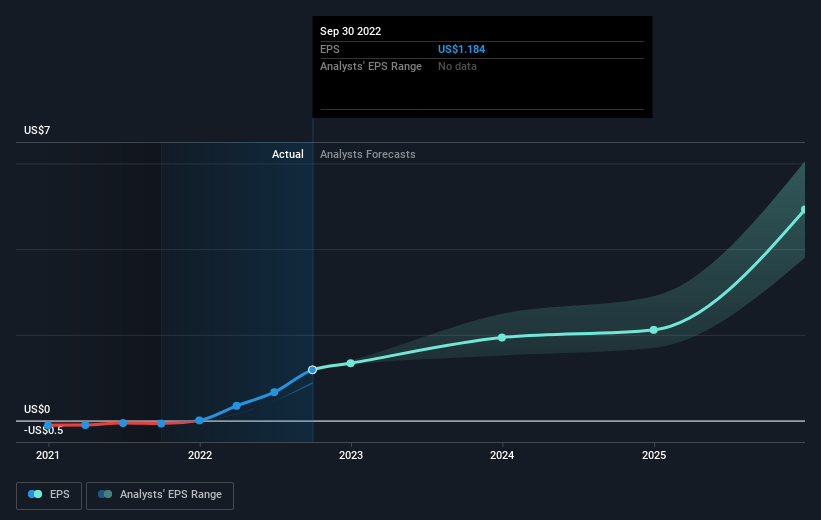

During three years of share price growth, Livent moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Livent has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

While it's never nice to take a loss, Livent shareholders can take comfort that their trailing twelve month loss of 16% wasn't as bad as the market loss of around -19%. Shareholders who have held for three years might be relatively sanguine about the recent weakness, given they have made 35% per year for three years. It's possible that the recent share price decline has more to do with the negative broader market returns than any company specific development. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Livent is showing 1 warning sign in our investment analysis , you should know about...

But note: Livent may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance