Lithia Motors' (LAD) Q4 Earnings Miss Estimates, Up Y/Y

Lithia Motors, Inc. LAD reported adjusted earnings per share of $2.95 in fourth-quarter 2019, marking a 15% increase from the prior-year quarter’s $2.57. However, the bottom line missed the Zacks Consensus Estimate of $3.08. Lower-than-anticipated revenues from new-vehicle retail and used-vehicle wholesale businesses resulted in the underperformance.

Total revenues grew 9.9% year over year to $3,269 million. The figure also outpaced the Zacks Consensus Estimate of $3,256 million. Total same-store sales grew 7% year over year .Gross profit rose 12.8% to $498.6 million in the reported quarter from $441.9 million in the year-ago period.

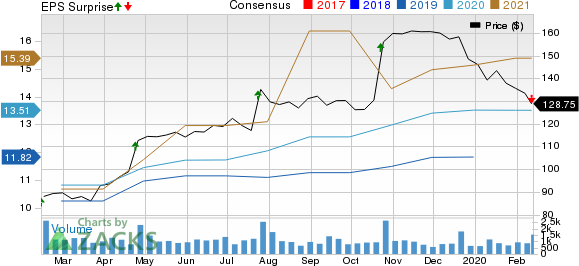

Lithia Motors, Inc. Price, Consensus and EPS Surprise

Lithia Motors, Inc. price-consensus-eps-surprise-chart | Lithia Motors, Inc. Quote

Key Takeaways

Revenues from new-vehicle retail grew 7% year over year to $1,805.8 million but missed the Zacks Consensus Estimate of $1,832 million. New-vehicle retail units sold increased 2.6% from the prior-year quarter to 46,422. The average selling price of new-vehicle retail rose 4.3% year over to year to $38,884.

Used-vehicle retail revenues rose 18.8% year over year to $894.7 million. Revenues from used-vehicle wholesale declined 13.3% year over year to $67.7 million and missed the consensus mark of $81 million. Used-vehicle retail units sold grew 17.8% from the year-ago quarter to 42,740. The average selling price of used-vehicle retail improved 0.8% to $20,934 from the year-ago figure of $20,771.

Revenues from service, body and parts were up 5.7% from the prior-year period to $331.8 million. The company’s F&I business recorded 20.6% year-over-year growth in revenues to $136 million. Revenues from fleet and others were $33 million, up 23.6% year over year.

Dividend & Financial Position

Lithia Motors’ board approved a dividend of 30 cents per share for fourth-quarter 2019. The amount will be payable Mar 27 to its shareholders of record as of Mar 13, 2020.

Lithia Motors had cash and cash equivalents of $84 million as of Dec 31, 2019, up from $31.6 million in the corresponding period of 2018. Long-term debt was $1.43 billion as of Dec 30, 2019, marking an increase from $1.36 billion recorded in the comparable period of 2018. Debt-to-capital ratio stands at 49%.

Zacks Rank & Key Picks

Lithia Motors currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the auto sector include Gentherm Inc THRM, Gentex Corporation GNTX and SPX Corporation SPXC. While Gentherm sports a Zacks Rank #1 (Strong Buy), Gentex and SPX carry a Zacks Rank of 2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gentherm has a projected earnings growth rate of 20.6% for the current year. Its shares have gained 13.5% over the past year.

Gentex has an estimated earnings growth rate of 6% for 2020. The company’s shares have appreciated 55.1% in a year’s time.

SPX has an expected earnings growth rate of 8.1% for the current year. The stock has rallied 61.1% in the past year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gentherm Inc (THRM) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report

SPX Corporation (SPXC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance