Literacy Capital Insider Ups Holding During Year

Insiders were net buyers of Literacy Capital plc's (LON:BOOK ) stock during the past year. That is, insiders bought more stock than they sold.

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for Literacy Capital

The Last 12 Months Of Insider Transactions At Literacy Capital

In the last twelve months, the biggest single purchase by an insider was when Independent Non-Executive Director Christopher Sellers bought UK£160k worth of shares at a price of UK£4.92 per share. So it's clear an insider wanted to buy, at around the current price, which is UK£5.10. Of course they may have changed their mind. But this suggests they are optimistic. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. The good news for Literacy Capital share holders is that an insider was buying at near the current price. Christopher Sellers was the only individual insider to buy shares in the last twelve months.

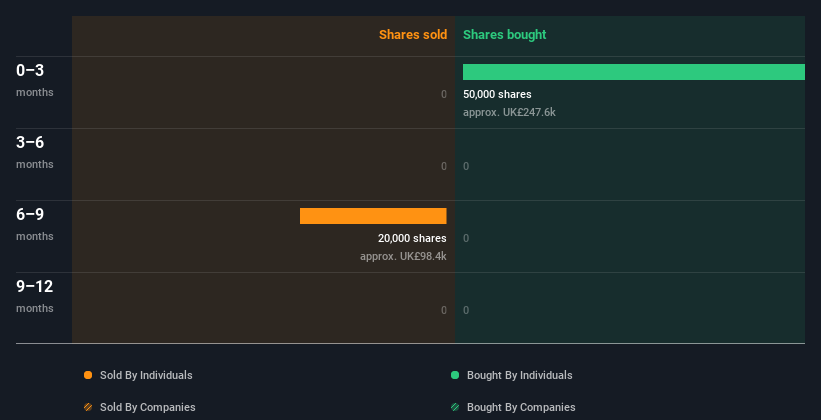

Christopher Sellers bought a total of 50.00k shares over the year at an average price of UK£4.95. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership Of Literacy Capital

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. It's great to see that Literacy Capital insiders own 64% of the company, worth about UK£196m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Literacy Capital Tell Us?

It is good to see the recent insider purchase. And the longer term insider transactions also give us confidence. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about Literacy Capital. Nice! I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

Of course Literacy Capital may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance