Liberty Global's (LBTYA) Acquisition to Aid Long-Term Growth

Liberty Global LBTYA is set to acquire shares held by Warner Bros. Discovery WBD in the electric car racing series, Formula E. This acquisition will increase Liberty Global’s ownership in Formula E to 65%, granting it a controlling interest in the rapidly growing motorsport and, therefore, aid the long-term growth of the company.

Formula E is the only FIA-sanctioned electric world motor racing championship and the world's top-rated ESG sport. It is also unique for being the only net zero carbon sport from its inception. Now in its 10th season, the Formula E Championship features 16 races across four continents in some of the world's most iconic cities, making it one of the premier sporting events globally.

With nearly 400 million fans worldwide, Formula E has attracted top-tier motorsport teams and talent. The championship currently hosts 11 teams and 22 drivers, including renowned names, such as Jaguar, Porsche, Maserati, McLaren and Nissan. At the recent Monaco E-Prix, Formula E unveiled its next-generation car, the Gen3 Evo, which can accelerate to 60mph in just 1.82 seconds, outperforming current Formula 1 cars by around 30%.

The acquisition is pending regulatory approval and is expected to close before the end of the year. Once finalized, Liberty Global's increased stake will solidify its influence in the world’s fastest-growing motorsport, enhancing its long-term prospects and impact in the electric racing arena.

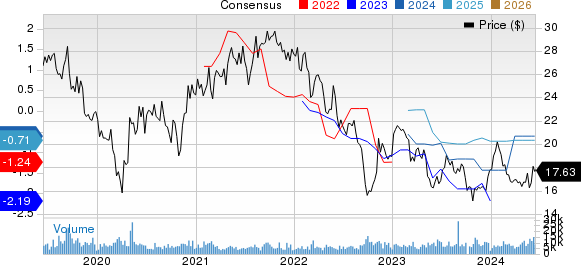

Liberty Global Ltd Price and Consensus

Liberty Global Ltd price-consensus-chart | Liberty Global Ltd Quote

Liberty Global Exhibits Bright Prospects Despite Stiff Competition

LBTYA is poised for bright prospects through strategic acquisitions and partnerships. Recently, Liberty Global also launched a collaboration with Accenture ACN to enhance connectivity solutions for U.K. businesses.

This initiative aims to strengthen the U.K.'s Mobile Private Network market by leveraging Virgin Media O2's 5G private network capabilities and Accenture's expertise in 5G applications across various industries. The collaboration is expected to deliver innovative and adaptable connectivity solutions, meeting the evolving needs of U.K. enterprises.

Moreover, Liberty Global and Warner Bros. Discovery have successfully sold All3Media, the U.K.’s largest independent TV production company, to RedBird IMI for $1.45 billion. With regulatory approvals secured, this deal underscores LBTYA's ability to capitalize on valuable media assets. These strategic moves reflect Liberty Global's commitment to expanding its influence and driving the long-term growth of the company.

In the first quarter of 2024, total revenues increased 4.1% year over year to $1.945 billion, driven by a year-over-year increase in revenues in Belgium, Switzerland and Central. The company’s profit from continuing operations in first-quarter 2024 amounted to $527 million, up 173.9% year over year. This trend is expected to continue in the upcoming quarters.

However, Shares of this Zacks Rank #3 (Hold) company have lost 2.8% year to date compared with the Zacks Consumer Discretionary sector’s decline of 2.4% due to tough competition from giants like Comcast CMCSA and MTN Group. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comcast-owned Xfinity, a provider of broadband, cable TV, streaming and voice services, competes directly with Liberty Global by offering similar entertainment and connectivity bundles. Similarly, MTN Group, which delivers a comprehensive range of services, such as traditional and mobile voice and data, digital and mobile financial services to both residential and enterprise customers, competes with LBYTA in terms of high-speed Internet and entertainment packages.

LBYTA’s partnerships, including the collaborations with Accenture and Warner Bros. Discovery, demonstrate the company’s dedication to enhancing its innovation and services. These recent alliances are expected to bolster Liberty Global’s prospects and help it effectively compete against its rivals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

Liberty Global Ltd (LBTYA) : Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance