Leisure Stocks Q1 Earnings Roster for Apr 30: MGM, SIX, HGV

The leisure industry is an amalgamation of companies providing recreational products and services, including swimming pools, golf courses, boats, gaming, outdoor spaces, cruises and travel.

The industry has been rattled by the coronavirus pandemic. Gaming, cruise and travel companies are likely to have been most affected by the deadly virus. Casinos have temporarily closed operations in the United States.

Moreover, the leisure industry has been weighed down by higher costs. The industry players generally work through multiple business models. Moreover, the current crisis does not bode well for most leisure and recreation service companies since these rely heavily on debt-financing owing to their capital-intensive nature.

Recently, Las Vegas Sands Corp. LVS reported first-quarter 2020 results, wherein both earnings and revenues declined sharply year over year on account of the coronavirus-induced shutdowns. The company reported adjusted loss per share of 3 cents, narrower than the Zacks Consensus Estimate of a loss of 8 cents. In the prior-year quarter, the company had reported adjusted earnings per share of 91 cents.

Per the latest Earnings Preview, total earnings of the Zacks Consumer Discretionary sector are expected to be down 25.3%. However, revenues for the sector are likely to improve 0.6%.

Let’s take a sneak peek into how the following leisure stocks are poised prior to their first-quarter earnings on Apr 30.

According to the proven Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

MGM Resorts International’s MGM earnings missed the Zacks Consensus Estimate by 66.7% in the last reported quarter.

The company’s domestic operations have been temporarily closed to contain the spread of the coronavirus. Although casinos in Macau properties are now open, the company is witnessing low visitation. It is safe to say that the coronavirus outbreak is likely to have dampened the company’s first-quarter performance.

Notably, the company reported preliminary first-quarter 2020 results. It anticipates Las Vegas Strip Resorts to report revenues of $1.1 billion, declining 21% from the prior-year period. Further, the company expects Regional operation revenues of $726 million, down 21% from the year-ago quarter. Revenues from MGM China are likely to witness a sharp decline of 63% to $272 million. (Read more: MGM Resorts to Report Q1 Earnings: What's in Store?)

The company has a Zacks Rank #3 and an Earnings ESP of -223.96%. You can see the complete list of today’s Zacks #1 Rank stocks here.

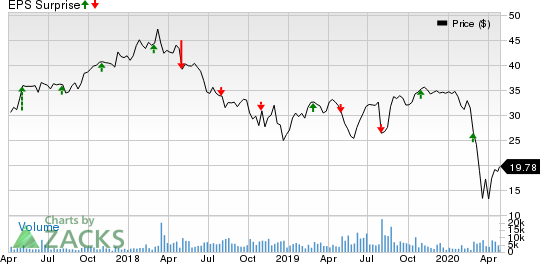

MGM Resorts International Price and EPS Surprise

MGM Resorts International price-eps-surprise | MGM Resorts International Quote

Six Flags Entertainment Corporation SIX is scheduled to report first-quarter 2020 results.

Due to the coronavirus pandemic, Six Flags temporarily closed its operations in mid-March. This along with higher cost of labor, unfavorable weather trends and beautification expenses is likely to show on first-quarter 2020 results.

Moreover, a dismal scenario with regard to sponsorship, international agreements and accommodation businesses is likely to have negatively impacted revenues in the first quarter.

Nonetheless, continuous focus on guests’ spending growth, membership and loyalty reward programs, and product expansion is expected to have aided the top line. (Read more: Likely Coronavirus Impact on Six Flags Q1 Earnings)

Six Flags Entertainment Corporation New Price and EPS Surprise

Six Flags Entertainment Corporation New price-eps-surprise | Six Flags Entertainment Corporation New Quote

The company has a Zacks Rank #3 and an Earnings ESP of -2.29%.

Hilton Grand Vacations Inc. HGV is slated to report first-quarter 2020 earnings, before the opening bell. In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate by 7%.

For the quarter to be reported, the Zacks Consensus Estimate for earnings per share declined to 43 cents from 45 cents in the past 60 days. This indicates a decline of 25.9% from 58 cents per share reported in the year-ago quarter.

Revenues are anticipated at $405.9 million, suggesting a decline of 9.8% from $450 million reported in the year-ago quarter.

The company has a Zacks Rank #3 and an Earnings ESP of 0.00%.

Hilton Grand Vacations Inc. Price and EPS Surprise

Hilton Grand Vacations Inc. price-eps-surprise | Hilton Grand Vacations Inc. Quote

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

Six Flags Entertainment Corporation New (SIX) : Free Stock Analysis Report

Hilton Grand Vacations Inc. (HGV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance