Lazard (LAZ) Q3 Earnings & Revenues Fall Y/Y, Stock Down 2.9%

Shares of Lazard LAZ have declined 2.9%, following the third-quarter 2019 earnings release. Adjusted earnings of 76 cents per share come in lower than the prior-year quarter’s 86 cents.

Results were adversely impacted by fall in assets under management (AUM) balance and revenues. Further, rise in expenses acted as a headwind.

Adjusted net income in the reported quarter came in at $88 million, slipping 20.7% year over year. On a GAAP basis, Lazard’s net income came in at $47 million or 40 cents per share, down from $107 million or 82 cents per share recorded in the prior-year quarter.

Revenues Down, Costs Rise

Adjusted operating revenues came in at $588.3 million, down 2.9% year over year. This downside chiefly resulted from decrease in asset-management revenue.

Adjusted operating expenses came in at roughly $463.4 million in the quarter, flaring up 3.6% year over year. Higher compensation and benefits, and elevated non-compensation expenses resulted in this upsurge.

Adjusted compensation and benefits expense marginally rose to $338.3 million from the prior-year quarter’s $337.9 million. Adjusted non-compensation expense for the quarter came in at $125.2 million, up 14.5% year over year.

The ratio of compensation expense to operating revenues was 57.5%, up from the prior-year quarter’s 55.8%. The ratio of non-compensation expense to operating revenues was 21.3%, up from 18.1% reported in the year-ago quarter.

The company affirmed its annual targets of an adjusted non-compensation expense-to-operating revenue ratio between 16% and 20%, while the compensation-to-operating revenue ratio target is in the mid-to-high 50 percentage range.

Segment Performance

Financial Advisory: The segment’s total revenues came in at record $303.9 million, slightly up from the $303.8 million recorded in the year-earlier quarter. This upside primarily stemmed from increase in M&A completions in North America partly, muted by a decrease in Europe.

Asset Management: The segment’s total revenues were $282.6 million, down 6.3% from the prior-year quarter. Lower management fees and other revenues resulted in this decline.

Corporate: The segment generated total revenues of $1.8 million, significantly up from the $0.3 million reported in the comparable period last year.

Decline in AUM

As of Sep 30, 2019, AUM was recorded at $231 billion, down 3.8% from Sep 30, 2018. This decline is due to a foreign-exchange depreciation of $4.4 billion and net outflows of $4.4 billion, partly offset by market appreciation of $2.2 billion.

Average AUM came in at $234 billion, down 2.5% year over year.

Balance Sheet Position

Lazard’s cash and cash equivalents totaled $959 million as of Sep 30, 2019, compared with the $1.25 billion recorded as of Dec 31, 2018. The company’s stockholders’ equity was $686.2 million compared with $970.1 million as of Dec 31, 2018.

Steady Capital-Deployment Activity

During the July-September period, Lazard returned $130 million to its shareholders. This included dividend payment of $50 million, share repurchase of $79 million and $1 million paid for meeting employee-tax obligations in exchange of share issuances upon vesting of equity grants.

Business Restructuring

During the third quarter, Lazard conducted a review of its business, which resulted in reducing its employee headcount, and closing of sub-scale offices and investment strategies. Approximately 200 jobs in the financial advisory, asset management and corporate functions were slashed during this period. The company incurred $51.5 million of charges related to restructuring efforts. Majority of the restructuring was done in the July-September period, while the rest is expected to be completed in the ongoing quarter.

Our Viewpoint

Lazard put up a discouraging show in the third quarter. Though the company’s diverse footprint and steady capital-deployment activities position it favorably for the long haul, rising expenses, top-line pressure and stringent regulations act as headwinds for the bank’s financials.

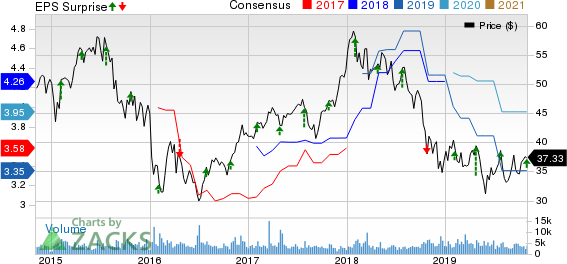

Lazard Ltd Price, Consensus and EPS Surprise

Lazard Ltd price-consensus-eps-surprise-chart | Lazard Ltd Quote

Currently, Lazard carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

Blackstone’s BX third-quarter 2019 distributable earnings of 58 cents per share surpassed the Zacks Consensus Estimate of 54 cents. However, the figure declined from the 63 cents earned in the prior-year quarter. Results benefited from growth in AUM and lower expenses. Yet, a decline in revenues acted as a headwind.

T. Rowe Price Group, Inc. TROW reported a positive earnings surprise of 7.6% in third-quarter 2019. Adjusted earnings per share came in at $2.13, outpacing the Zacks Consensus Estimate of $1.98. Results also improved 7% from the year-ago figure of $1.99. Results were driven by higher AUM and revenues. Nevertheless, escalating expenses were an undermining factor.

BlackRock, Inc.’s BLK third-quarter 2019 adjusted earnings of $7.15 per share surpassed the Zacks Consensus Estimate of $6.95. However, the figure was 4.9% lower than the year-ago quarter’s number. Results benefited from an improvement in revenues. Moreover, growth in AUM, driven by net inflows, was a positive. Nonetheless, higher expenses hurt results to some extent.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Blackstone Group Inc/The (BX) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Lazard Ltd (LAZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance