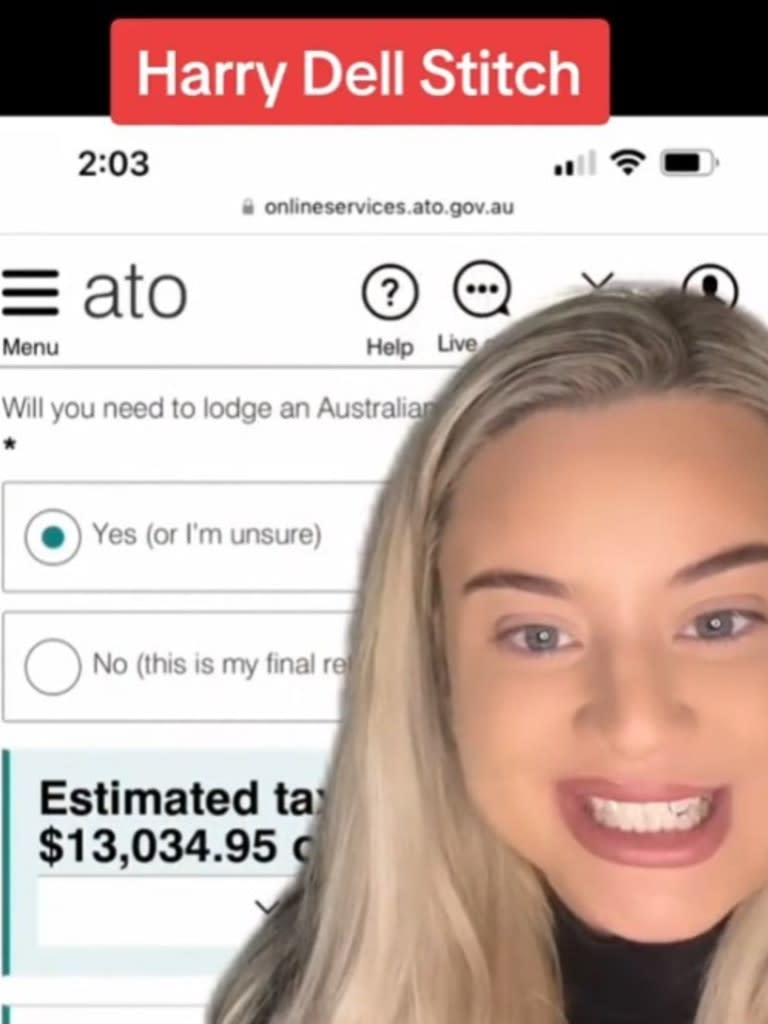

Lawyer tears apart $13k tax bill rant

A tax expert has quickly dismantled a woman’s TikTok rant about her $13,000 tax bill, claiming the figures are “basic maths”.

Gold Coast woman Marina Askew-Panetta copped a huge backlash after she took to social media to vent her frustration over her massive tax bill from the Australian Taxation Office (ATO).

In the now-deleted video, Ms Askew-Panetta claims: “Apparently I owe them (the tax office) $13,034.95.”

She goes on to say: “Guys, I have been absolutely f**king stitched up by the government. Can someone please explain to me how I paid $48,000 in tax?”

Tax expert Harry Dell responded with his own video where he swiftly dismantled parts of the woman’s rant.

“I just woke up, and I see this rubbish, and now I’ve got to make a video about basic maths,” the Sydney-based tax lawyer laments.

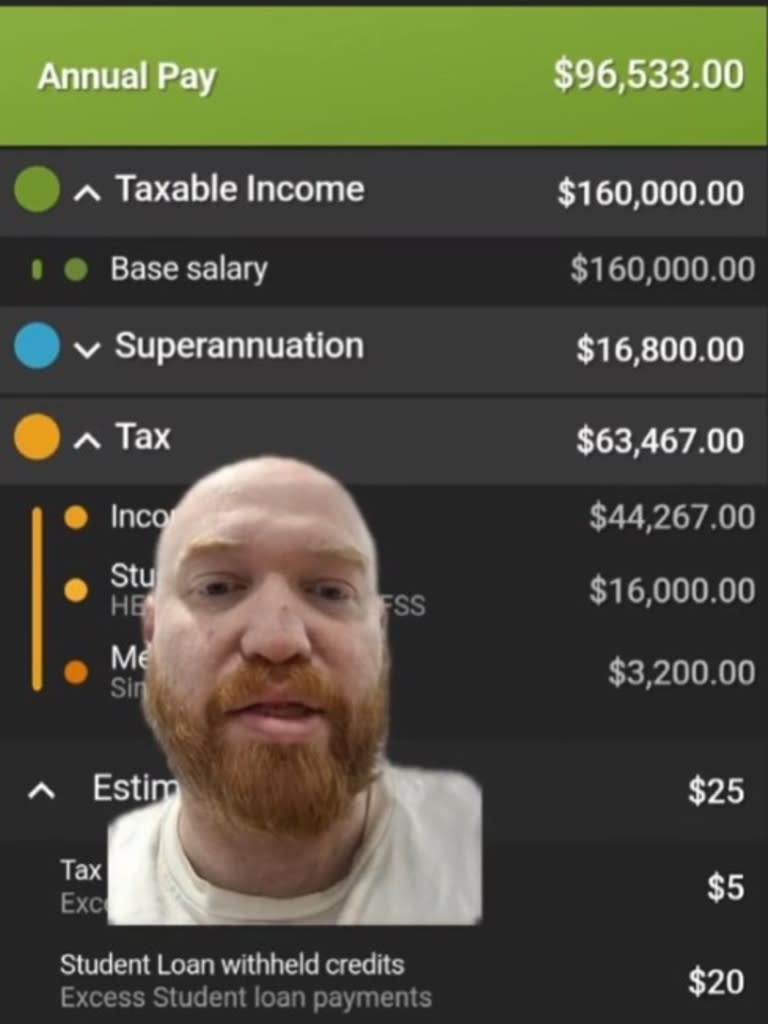

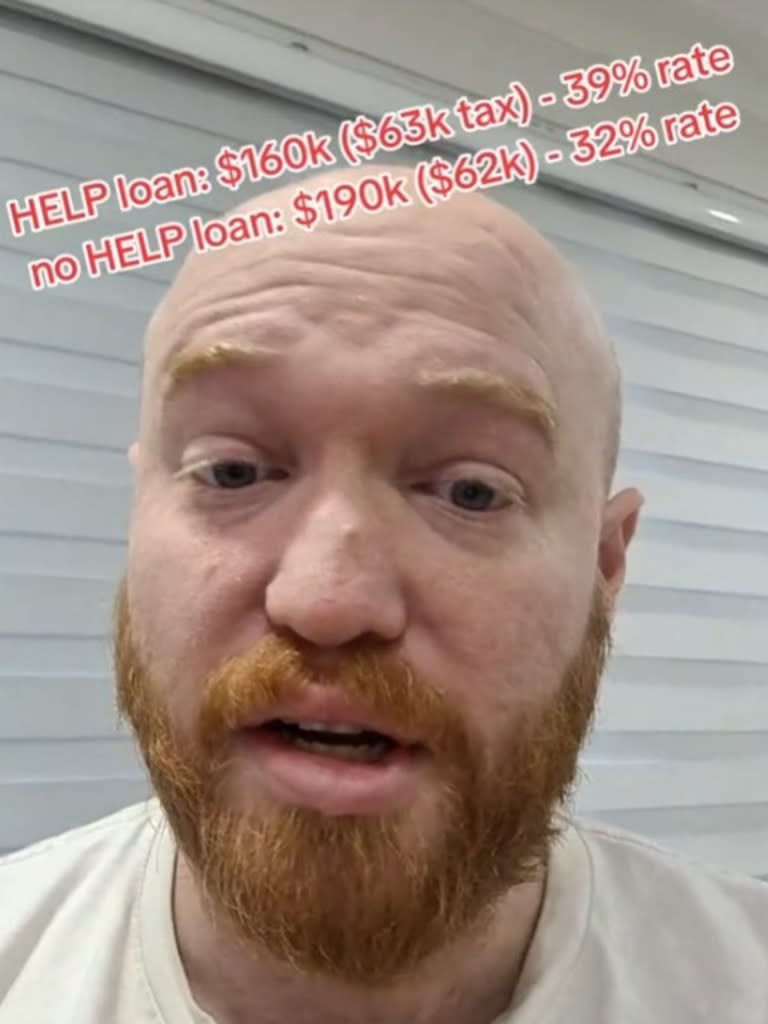

Mr Dell produced rough calculations determining Ms Askew-Panetta was likely on a base salary of $160,000 per year if she was paying off her student loans.

Without the loans, he estimates she would likely be on $195,000 per year.

Mr Dell then listed the tax rates for each of the salaries – 39 per cent ($63,000) for the $160,000 salary with HECS debt and 32 per cent ($62,000) for the $195,000 salary without the student loans.

“Is that fair? Everyone else on that income has to pay the same amount,” Mr Dell tells his followers.

He said one problem could have been that Ms Askew-Panetta didn’t advise her employer she had a HECS debt.

“Because the HECS repayment would be around $16,000 and if she earned that $160,000 and didn’t say she had HECS, she would owe about $16,000 less extra tax withheld on those commissions,” Mr Dell explains.

Mr Dell then offers to have a look at Ms Askew-Panetta’s tax return and explain the calculations.

The ATO last month warned Australians who were eager to lodge their tax returns they could face delays and be asked follow-up questions.

ATO assistant commissioner Tim Loh said waiting a few weeks until pre-filled information from employers, banks and health insurers was added was the smartest way to approach the returns.

“If you forget to include everything, it will slow down the progress of your return and you’ll likely end up with more work to do down the track,’ Mr Loh said.

Yahoo Finance

Yahoo Finance