Lam Research (LRCX) Q2 Earnings & Revenues Beat, Rise Y/Y

Lam Research Corporation LRCX reported second-quarter fiscal 2023 non-GAAP earnings of $10.71 per share, which surpassed the Zacks Consensus Estimate by 7.6%. The figure increased by 25.6% from the year-ago fiscal quarter’s reading.

Revenues improved by 24.9% year over year to $5.28 billion. Further, the figure surpassed the Zacks Consensus Estimate of $5.08 billion.

Top line growth was driven by strong momentum in both the systems and customer support businesses.

Lam Research’s system revenues were $3.55 billion (67.2% of the total revenues), up 29.5% from the year-ago fiscal quarter’s figure.

In the Customer Support Business Group, revenues for the reported quarter were $1.73 billion (32.8%), up 16.4% from the year-ago fiscal quarter’s number.

Lam Research’s proper execution, expanding and diversifying global footprints and growing installed base remain positives. Further, the company remains optimistic about its technological advancements, with a focus on technology inflections, especially in foundry-logic devices, strength in ‘dry resist’ technology and solid momentum with SEMSYSCO.

However, the weak outlook for 2023 wafer fabrication equipment ("WFE") spending remains a concern. For 2023, WFE spending is estimated to plunge to the mid-$70 billion range.

Cautionary actions being taken by the customers in memory market, reductions in capacity additions and fab utilization and new export regulations remain overhangs.

Coming to price performance, Lam Research has lost 20.6% over a year against the industry’s decline of 4.4%.

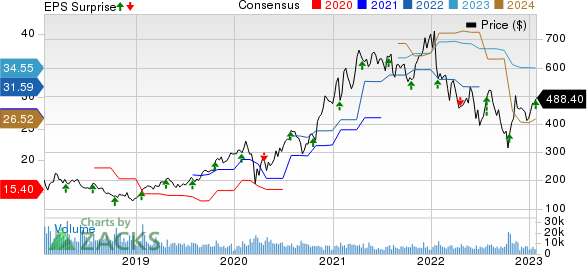

Lam Research Corporation Price, Consensus and EPS Surprise

Lam Research Corporation price-consensus-eps-surprise-chart | Lam Research Corporation Quote

Regions in Detail

China, Korea and Taiwan accounted for 24%, 20% and 19% of Lam Research’s total revenues for the fiscal second quarter, respectively. Additionally, Japan, Southeast Asia, the United States and Europe accounted for 11%, 10%, 10% and 6%, respectively.

Operating Details

The non-GAAP gross margin was 45.1%, which contracted 170 basis points (bps) from the year-ago fiscal quarter’s level.

Non-GAAP operating expenses were $686.3 million, up 9.4% from the prior-year fiscal quarter’s reading. As a percentage of revenues, the figure contracted 180 bps from the year-earlier fiscal quarter’s level to 13%.

The non-GAAP operating margin was 32.1%, expanding 10 bps from the year-ago fiscal quarter’s level.

Balance Sheet & Cash Flow

As of Sep 25, 2022, cash and cash equivalents and short-term investments increased to $4.59 billion from $4.38 billion.

Cash flow from operating activities was $1.14 billion for the reported quarter, down from $1.2 billion in the previous fiscal quarter. Capital expenditure was $163 million in second-quarter fiscal 2023 compared with $140 million in first-quarter fiscal 2023.

In the reported quarter, Lam Research paid out dividends of $236 million and repurchased shares worth $456 million.

Guidance

For third-quarter fiscal 2023, LRCX expects revenues of $3.8 billion (+/- $300 million). The Zacks Consensus Estimate for the same is pegged at $4.22 billion.

The non-GAAP gross margin is projected at 44% (+/-1%), while the non-GAAP operating margin is expected to be 27.5% (+/-1%).

Non-GAAP earnings are projected to be $6.50 (+/- 75 cents) per share on a diluted share count of 135 million. The Zacks Consensus Estimate for the same is pegged at $7.70 per share.

Zacks Rank and Stocks to Consider

Currently, Lam Research carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Computer & Technology sector are Agilent Technologies A, Arista Networks ANET and Asure Software ASUR. While Agilent Technologies sports a Zacks Rank #1 (Strong Buy), Arista Networks and Asure Software carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Agilent has gained 10.5% in the past year. A’s long-term earnings growth rate is currently projected at 10%.

Arista Networks has lost 5.7% in the past year. The long-term earnings growth rate for ANET is currently projected at 17.5%.

Asure Software has gained 35.8% in the past year. The long-term earnings growth rate for ASUR is currently projected at 23%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance