L3Harris Technologies (LHX) Q4 Earnings Beat Estimates

L3Harris Technologies, Inc.’s LHX adjusted earnings from continuing operations in fourth-quarter 2019 came in at $2.85 per share, which surpassed the Zacks Consensus Estimate of $2.75 by 3.6%. The bottom line also increased 28% from the year-ago quarter’s $2.22.

Excluding one-time items, the company reported GAAP earnings of $1.77 per share compared with $1.88 in the year-ago quarter.

The year-over-year uptick can be attributed to higher volumes from the L3Harris merger, strong operational performance and the integration savings gain on the sale of the Harris Night Vision business in the third quarter.

Total Revenues

In the quarter under review, the company’s revenues came in at $4,832 million, exceeding the Zacks Consensus Estimate of $4,809 million by 0.5%. Revenues in the reported quarter were favorably impacted by strong growth across Integrated Mission Systems, Space and Airborne Systems and Communication Systems.

Segmental Performance

Integrated Mission Systems: Net sales at the segment improved 11% to $1,471 million from the prior-year quarter’s $1,331 million, primarily driven by strength in the ISR and Electro Optical businesses.

Operating income came in at $197 million compared with $148 million in the year-ago quarter. Moreover, operating margin expanded 230 basis points (bps) to 13.4%.

Space and Airborne Systems: The segment recorded net sales of $1,198 million in the fourth quarter, up 12% year over year. The upside can be attributed to the ramping up of modernization in the F-35 platform in Avionics, increased production of B-52 aircraft in Electronic Warfare, and growth in ground-based adjacencies and exquisite systems in classified areas.

Operating income increased to $216 million from $199 million in the year-ago quarter. Operating margin contracted 60 bps to 18%.

Communication Systems: Net sales at the segment rose 10% to $1,119 million, led by a ramp-up in U.S. DoD modernization programs in Tactical Communications and Integrated Vision Solutions as well as increased demand from state and federal customers in Public Safety.

Operating income increased to $259 million from $227 million in the year-ago quarter. Operating margin expanded 80 bps to 23.1%.

Aviation Systems: Net sales at the segment improved 7% to $1,090 million, led by growth in defense and commercial aviation products.

Operating income increased to $162 million from $76 million. Operating margin expanded 740 bps to 14.9%.

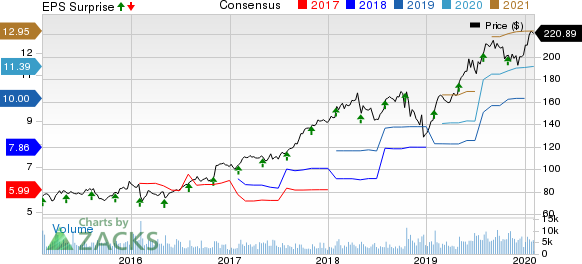

L3Harris Technologies Inc Price, Consensus and EPS Surprise

L3Harris Technologies Inc price-consensus-eps-surprise-chart | L3Harris Technologies Inc Quote

Financial Position

As of Jan 3, 2020, L3Harris had $824 million in cash and cash equivalents compared with $343 million as of Dec 28, 2018.

Long-term debt as of Jan 3, 2020, was $6,694 million compared with $3,411 million as of Dec 28, 2018.

Net cash inflow from operating activities amounted to $1,655 million at the end of the fourth quarter compared with the year-ago cash inflow of $847 million.

2020 View

As a result of strong momentum and performance in 2019, L3Harris provided the following guidance for 2020. The company expects organic revenues to grow 5-7% from combined full-year calendar 2019 revenues.

Non-GAAP earnings per share for 2020 are expected to be in the range of $11.35-$11.75. Operating cash flow is expected to be $2.8-$2.9 billion and adjusted free cash flow $2.6-$2.7 billion.

Zacks Rank

L3Harris currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Northrop Grumman NOC reported fourth-quarter 2019 earnings of $5.61 per share, beating the Zacks Consensus Estimate of $4.78 by 17.4%. Reported earnings also improved 13.8% from $4.93 in the year-ago quarter.

Lockheed Martin LMT reported fourth-quarter 2019 earnings of $5.29 per share, which surpassed the Zacks Consensus Estimate of $4.99 by 6%. The bottom line also improved 20.5% from $4.39 in the year-ago quarter.

Textron TXT reported fourth-quarter 2019 adjusted earnings of $1.11 per share, which surpassed the Zacks Consensus Estimate of $1.08 by 2.8%. The bottom line, however, declined 3.5% from $1.15 in the year-ago quarter.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.7% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance