What To Know Before Buying National Presto Industries, Inc. (NYSE:NPK) For Its Dividend

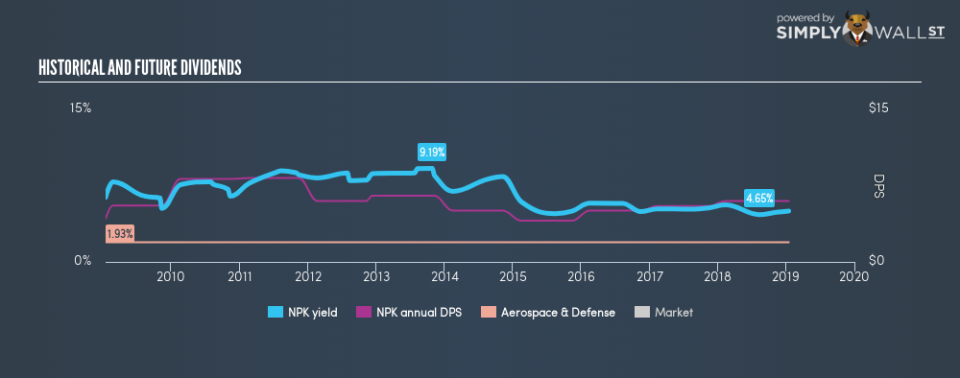

Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. Historically, National Presto Industries, Inc. (NYSE:NPK) has been paying a dividend to shareholders. Today it yields 5.0%. Let’s dig deeper into whether National Presto Industries should have a place in your portfolio.

See our latest analysis for National Presto Industries

Want to help shape the future of investing tools and platforms? Take the survey and be part of one of the most advanced studies of stock market investors to date.

5 questions I ask before picking a dividend stock

When assessing a stock as a potential addition to my dividend Portfolio, I look at these five areas:

Is their annual yield among the top 25% of dividend payers?

Has its dividend been stable over the past (i.e. no missed payments or significant payout cuts)?

Has the amount of dividend per share grown over the past?

Is its earnings sufficient to payout dividend at the current rate?

Will it have the ability to keep paying its dividends going forward?

Does National Presto Industries pass our checks?

The current trailing twelve-month payout ratio for the stock is 16%, meaning the dividend is sufficiently covered by earnings. Furthermore, analysts have not forecasted a dividends per share for the future, which makes it hard to determine the yield shareholders should expect, and whether the current payout is sustainable, moving forward.

When assessing the forecast sustainability of a dividend it is also worth considering the cash flow of the business. Cash flow is important because companies with strong cash flow can usually sustain higher payout ratios.

If there is one thing that you want to be reliable in your life, it’s dividend stocks and their constant income stream. Although NPK’s per share payments have increased in the past 10 years, it has not been a completely smooth ride. Shareholders would have seen a few years of reduced payments in this time.

In terms of its peers, National Presto Industries has a yield of 5.0%, which is high for Aerospace & Defense stocks.

Next Steps:

With these dividend metrics in mind, I definitely rank National Presto Industries as a strong income stock, and is worth further research for anyone who considers dividends an important part of their portfolio strategy. Given that this is purely a dividend analysis, you should always research extensively before deciding whether or not a stock is an appropriate investment for you. I always recommend analysing the company’s fundamentals and underlying business before making an investment decision. There are three relevant factors you should further research:

Future Outlook: What are well-informed industry analysts predicting for NPK’s future growth? Take a look at our free research report of analyst consensus for NPK’s outlook.

Valuation: What is NPK worth today? Even if the stock is a cash cow, it’s not worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether NPK is currently mispriced by the market.

Other Dividend Rockstars: Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance