Kinder Morgan (KMI) Q4 Earnings & Revenues Beat Estimates

Kinder Morgan Inc. KMI reported fourth-quarter 2021 adjusted earnings per share of 27 cents, beating the Zacks Consensus Estimate by a penny. The bottom line suggests no movement from the prior-year reported number.

Total quarterly revenues of $4,425 million beat the Zacks Consensus Estimate of $3,387 million. The top line also increased from $3,115 million in the prior-year quarter.

The better-than-expected results were due to increased contributions from the Permian Highway Pipeline and a rebound in fuel demand. The positives were partially offset by a decline in CO2 sales and crude volumes.

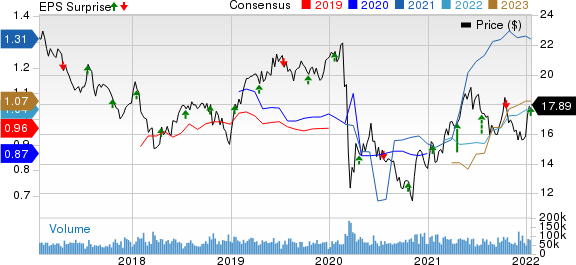

Kinder Morgan, Inc. Price, Consensus and EPS Surprise

Kinder Morgan, Inc. price-consensus-eps-surprise-chart | Kinder Morgan, Inc. Quote

Segment Analysis

Natural Gas Pipelines: For the December-end quarter of 2021, adjusted earnings before depreciation, depletion and amortization expenses, including the amortization of the excess cost of equity investments (EBDA), rose to $1,215 million from $1,189 million a year ago. An increase in contributions from Permian Highway Pipeline primarily aided the segment. Fayetteville Express Pipeline’s lower contributions partially offset the positives.

Products Pipelines: The segment’s EBDA for the fourth quarter was $281 million, reflecting a jump from $258 million a year ago. The continued recovery in demand for refined products has aided the business unit.

Gasoline transported volumes increased 6.8% year over year in the December-end quarter, while jet fuel volumes skyrocketed almost 48%.

Terminals: Through the segment, Kinder Morgan generated quarterly EBDA of $244 million, down from the year-ago period’s $258 million. A decline in liquids utilization was responsible for the underperformance.

CO2: The segment’s EBDA was recorded at $158 million, down from the year-ago quarter’s figure of $167 million. The segment was hurt by a decline in CO2 sales and crude volumes.

Operational Highlights

Expenses related to operations and maintenance totaled $658 million, up from $606 million a year ago. Total operating costs increased to $3,475 million for the fourth quarter from $2,135 million in the corresponding period of 2020.

DCF

The company’s fourth-quarter distributable cash flow (DCF) was $1,093 million compared with $1,250 million a year ago.

Balance Sheet

As of Dec 31, 2021, Kinder Morgan reported $1,140 million in cash and cash equivalents. The company’s long-term debt amounted to $29,772 million at the quarter-end, resulting in a debt to capitalization of 50.4%.

Guidance

For 2022, Kinder Morgan expects to generate a net income of $2.5 billion. The company anticipates DCF and adjusted EBITDA of $4.7 billion and $7.2 billion, respectively.

For the year, the midstream player announces a dividend payout of $1.11 per share, reflecting a year-over-year increase of 3%.

Zacks Rank & Stocks to Consider

Kinder Morgan currently has a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BP plc BP, based in London, the U.K., is a fully integrated energy company, with a strong focus on renewable energy. BP has a strong portfolio of upstream projects, which has been backing impressive production growth.

BP announced that before declaring the results for the December-end quarter, it intends to execute an additional $1.25 billion of share repurchases. The company continues to anticipate buying back shares worth $1 billion every quarter, considering Brent crude price at $60 per barrel. On the dividend front, the company projects a hike in annual dividend per ordinary share of 4% through 2025.

Eni SPA E is among the leading integrated energy players in the world. Its upstream operations involve the exploitation and production of oil and natural gas resources. Through midstream activities, the company transports and stores hydrocarbons. Eni also engages in refining hydrocarbons and distributing the end products in 71 nations. Apart from providing natural gas, the company generates and sells electricity.

Eni currently has a Zacks Style Score of A for Momentum, and B for Value and Growth. It beat the Zacks Consensus Estimate three times in the last four quarters and missed once, with an earnings surprise of 0.43%, on average.

Murphy USA Inc. MUSA, based in El Dorado, AR, is a leading independent retailer of motor fuel and convenience merchandise in the United States. MUSA’s unique high-volume, low-cost business model helps it retain high profitability, even in the fiercely competitive retail environment.

Murphy USA is committed to returning excess cash to shareholders through continued share buyback programs. As part of the initiative, the fuel retailer recently approved a repurchase authorization of up to $1 billion, which will commence once the existing $500-million authorization expires and be completed by Dec 31, 2026. The move underscores MUSA’s sound financial position and commitment to rewarding shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Eni SpA (E) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance