The Kiddieland International (HKG:3830) Share Price Is Down 42% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Kiddieland International Limited (HKG:3830) share price slid 42% over twelve months. That contrasts poorly with the market return of -7.9%. Kiddieland International may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 11% in the last 90 days.

View our latest analysis for Kiddieland International

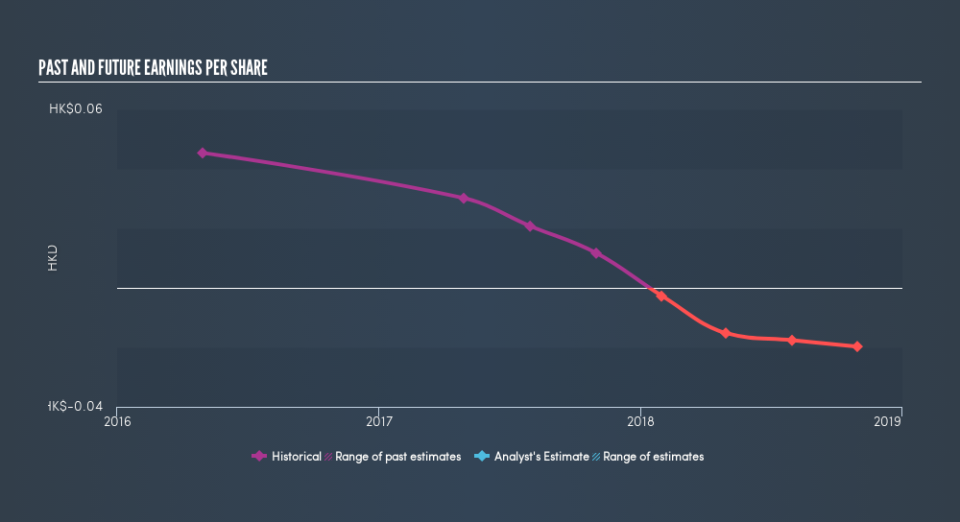

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Kiddieland International fell to a loss making position during the year. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. We hope for shareholders' sake that the company becomes profitable again soon.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Kiddieland International's key metrics by checking this interactive graph of Kiddieland International's earnings, revenue and cash flow.

A Different Perspective

We doubt Kiddieland International shareholders are happy with the loss of 42% over twelve months. That falls short of the market, which lost 7.9%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 11%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. You could get a better understanding of Kiddieland International's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance