Key Risks to EUR, NZD, GBPAUD Scalp Setups

Talking Points

GBPAUD rally fizzles out ahead of key resistance- 1.8022/50 critical

NZDUSD eyes monthly low to validate broader reversal

EURUSD stuck in key inflection range 1.38-1.3830- weekly open in focus

GBPAUDDaily Chart

Notes: Our favored setup this week was the GBPAUD scalp highlighted on Tuesday. The breach above channel resistance dating back to the March high coupled with a weekly opening range break shifted our focus to the topside with the subsequent rally turning over just 3pips ahead of the 1.8022/50 key resistance range. The focus heading into next week is whether or not this breakout will materialize into a more substantial rally as we keep focus on the broader head and shoulders formation which broke last month. Note that price closed the week just below resistance as the daily RSI signature held below a longer-term resistance trigger dating back to the December high. The broader outlook comes back into focus as we open up trade next week with only a breach/close above 1.8050 suggesting that a more significant low may have been put in this week.

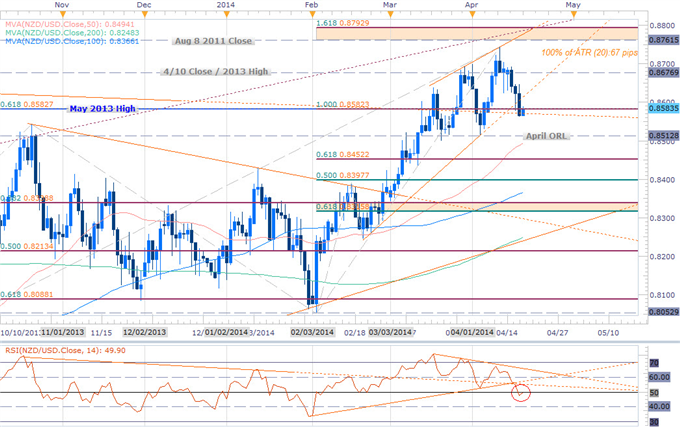

NZDUSDDaily Chart

Notes: The NZDUSD setup also played out well this week with a clear weekly opening range break below a Fibonacci support confluence at 8630 validating our bearish scalp bias early in the week. The resulting sell-off achieved two of our three support objectives before settling just below former trendline support/ Fibonacci confluence at 8582. A failure to hold above the initial April opening range highs keeps the focus on the monthly low at 8512 with a break below this threshold suggesting a more significant high was put in place this week.

EURUSD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Notes: Last week we noted the breach above the April opening range and although the pair continues to hold above the 1.38-handle (bullish invalidation) we remain neutral within the 1.38-1.3830 range. This region has riddled with reversals, throw-overs, and false breaks dating back to the October highs and is highlighted by key longer-term Fibonacci extensions and retracements. Note that we cannot invalidate the broader topside play here so long as price holds above 1.38 and we’ll look for the Sunday/weekly opening range to offer further clarity on our immediate scalp bias with a close below shifting our focus to the short-side of the euro.

Read more on the EURUSD setup

Follow the progress of these trade setups and more throughout the trading week with DailyFX on Demand.

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance