Key Predictions as General Motors (GM) Gears Up for Q4 Earnings

General Motors GM is slated to release fourth-quarter 2022 results on Jan 31, before market open. The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at $1.63 per share and $41.54 billion, respectively.

The Zacks Consensus Estimate for General Motors’ fourth-quarter earnings per share has been revised downward by a penny over the past seven days. The bottom-line projection, however, indicates year-over-year growth of 20.7%. The top-line estimate implies year-over-year growth of 23.7%.

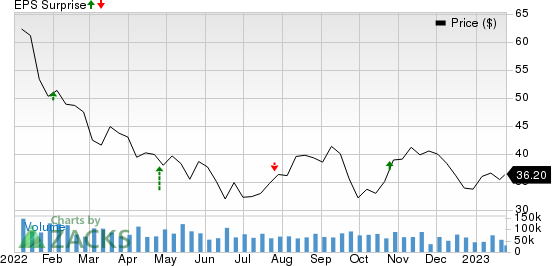

In the last reported quarter, GM beat earnings estimates on better-than-expected profits from North America and International segments. Over the trailing four quarters, the company topped the Zacks Consensus Estimate on three occasions and missed once, with the average surprise being 13.1%. This is depicted in the graph below:

General Motors Company Price and EPS Surprise

General Motors Company price-eps-surprise | General Motors Company Quote

Factors Shaping Q4 Earnings

General Motors was the top-selling carmaker in the United States in the fourth quarter of 2022. GM’s total fourth-quarter U.S. sales increased 41.4% year over year to 623,261 vehicles. While Buick deliveries skid 6.5% year over year, sales of the other three brands — Chevrolet, GMC and Cadillac — posted double-digit year-over-year percentage gains. Sales of Chevrolet, GMC and Cadillac jumped 43.3%, 42.3% and 74.8%, respectively.

The Zacks Consensus Estimate for the company’s GMNA segment’s wholesale vehicle sales is pegged at 798,000 units, implying an increase from 579,000 units in the fourth quarter of 2021. Thanks to higher unit sales and rising vehicle prices, the consensus mark for the segment’s revenues is $34,277 million, implying a rise from $26,865 million recorded in the year-ago quarter. The consensus mark for operating profit from the segment is pegged at $3,367 million, indicating an increase of 55.5% year over year.

The Zacks Consensus Estimate for the company’s GMI segment’s wholesale vehicle sales is pegged at 215,000 units, implying an increase from 163,000 units in the fourth quarter of 2021. The consensus mark for the segment’s revenues is $4,479 million, indicating a rise from $3,451 million recorded in the year-ago quarter. The consensus mark for the operating profit from the segment is pegged at $288 million, indicating growth from $275 million.

The Zacks Consensus Estimate for sales from the GM Financial unit is pegged at $3,258 million, up from $3,232 million recorded in the corresponding quarter of 2021. However. the company’s dimmed 2022 EBIT outlook from the segment raises concern. The consensus mark for GM Financial’s operating profit is $775 million, implying a fall from $1,180 million recorded in the year-ago quarter.

The consensus mark for the GM Cruise unit’s operating loss stands at $445 million, widening from $349 million incurred in the year-ago period.

While higher-year-over-year shipments and revenues from GMNA and GMI segments bode well, weak forecasts from GM Financial and GM Cruise dim the overall fourth-quarter view. It is also to be noted that high commodity costs, including platinum group metals and steel prices, are likely to have played spoilsports. General Motors expects headwinds from commodity inflation and logistical challenges to be around more than $5 billion higher from 2021 levels as well as the prior projection. This further softens the outlook for the to-be-reported quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for General Motors this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here

Earnings ESP: It has an Earnings ESP of +4.15%. This is because the Most Accurate Estimate of $1.70 per share is pegged 7 cents lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: General Motors currently carries a Zacks Rank of 4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks With the Favorable Combination

While an earnings beat appears uncertain for General Motors, here are a few players from the auto space, which, according to our model, have the right combination of elements to post an earnings beat for the quarter to be reported:

Lear LEA will release fourth-quarter 2022 results on Feb 2, before the opening bell. The company has an Earnings ESP of +2.78% and a Zacks Rank #3.

The Zacks Consensus Estimate for Lear’s to-be-reported quarter’s earnings and revenues is pegged at $2.52 per share and $5.26 billion, respectively. LEA surpassed earnings estimates in the trailing four quarters, with the average surprise being 18%.

Rivian Automotive RIVN will release fourth-quarter 2022 results on Feb 28, after the closing bell. The company has an Earnings ESP of +13.17% and a Zacks Rank #3.

The Zacks Consensus Estimate for Rivian’s to-be-reported quarter’s loss and revenues is pegged at $1.72 per share and $771 million, respectively. RIVN surpassed earnings estimates two of the trailing four quarters for as many misses, with the average negative surprise being 12.6%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance