Kellogg (K) Set to Report Q4 Earnings: What Should You Know?

Kellogg Company K is likely to register a top-and-bottom-line increase from the respective year-ago fiscal quarter’s reading when it reports fourth-quarter 2022 earnings on Feb 9. The Zacks Consensus Estimate for quarterly revenues is pegged at $3,660 million, suggesting a rise of around 7% from the prior-year fiscal quarter’s reported figure.

The Zacks Consensus Estimate for quarterly earnings has remained unchanged in the past 30 days at 84 cents per share. This indicates growth of 1.2% from the figure reported in the prior-year fiscal quarter.

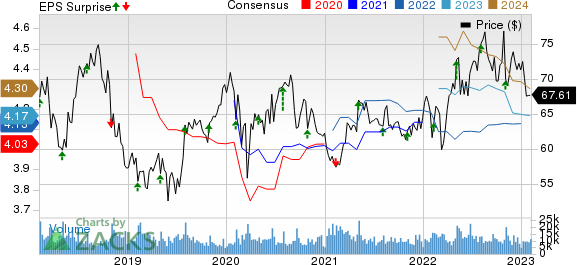

The renowned food company has a trailing four-quarter earnings surprise of 10.6%, on average. K delivered an earnings surprise of 4.1% in the last reported quarter.

Kellogg Company Price, Consensus and EPS Surprise

Kellogg Company price-consensus-eps-surprise-chart | Kellogg Company Quote

Factors to Consider

Kellogg has been gaining from its robust brand portfolio, backed by regular innovation and gains from acquisitions. The company’s Deploy for Growth Strategy has been yielding. Strength in the snacks business and emerging markets has also been working well. Further, Kellogg is benefiting from the efficient price/mix, which increased across all four regions in the last reported quarter.

Considering its solid year-to-date performance, underlying trends and confidence in the future, management raised its 2022 guidance on its third-quarter earnings call. Organic net sales growth in 2022 is now estimated to be up 10% compared with the 7-8% growth expected earlier.

Our estimate for organic sales growth is 9.9%. The raised view reflects better-than-anticipated growth through the third quarter, actions related to revenue growth management and impressive in-market momentum, especially in the snacks and emerging markets. These aspects bode well for the quarter under review.

The adjusted operating profit is expected to have risen nearly 6% at cc, up from the previous view of 4-5%. The view reflects better-than-anticipated growth through the third quarter, elevated cost inflation, economy-wide shortages, and hurdles and escalated brand investments in the second half of the year. Management expects the adjusted EPS growth of roughly 3% at cc, up from the prior guidance of around 2% growth.

We note that Kellogg is seeing the adverse impacts of input cost inflation stemming from global constraints and shortages. Management expects the abovementioned bottlenecks and shortages to persist in the fourth quarter. Kellogg also expects to see an even greater rise in SG&A expenses in the fourth quarter, with the North America cereal business restoring more activity.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Kellogg this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here.

Kellogg has a Zacks Rank #3 and an Earnings ESP of +4.12%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With the Favorable Combination

Here are some other companies worth considering as our model shows that these also have the right combination of elements to beat earnings this season.

Performance Food Group Company PFGC has an Earnings ESP of +0.39% and a Zacks Rank #3. The Zacks Consensus Estimate for its fourth-quarter 2022 earnings is pegged at 76 cents, calling for 33.3% growth from the year-ago period figure. PFGC has a trailing four-quarter earnings surprise of 15.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus mark for Performance Food’s top line is pegged at $13.9 billion, suggesting growth of 8.4% from the prior-year quarter’s reported figure.

Freshpet, Inc. FRPT is likely to register top and bottom-line growth when it reports fourth-quarter 2022 results. FRPT has an Earnings ESP of +2.04% and a Zacks Rank #3. The Zacks Consensus Estimate for Freshpet’s bottom line has remained unchanged at a loss of 8 cents in the past 30 days compared with a loss of 21 cents reported in the year-ago period.

FRPT has a trailing four-quarter negative earnings surprise of roughly 88%, on average. The consensus mark for Freshpet’s top line is pegged at $151.1 million, calling for growth of 30.4% from the prior-year quarter’s reported figure.

Nu Skin NUS currently has an Earnings ESP of +11.32% and a Zacks Rank of 3. NUS is expected to register a top-and-bottom-line decline when it reports fourth-quarter 2022 numbers.

The Zacks Consensus Estimate for Nu Skin’s quarterly revenues is pegged at $543.8 billion, calling for a decline of 19.3% from the prior-year quarter’s reported figure. The Zacks Consensus Estimate for the quarterly EPS of 53 cents suggests a 52.3% decrease from the figure reported in the year-ago fiscal quarter. NUS has a trailing four-quarter negative earnings surprise of 5.3%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Freshpet, Inc. (FRPT) : Free Stock Analysis Report

Kellogg Company (K) : Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS) : Free Stock Analysis Report

Performance Food Group Company (PFGC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance