Kellanova (K) Not Too Palatable Before Q1 Earnings: How to Play?

As Kellanova K prepares to announce its first-quarter 2024 results on May 2 before market open, investors face a pivotal moment, evaluating the company's trajectory amid a challenging operational landscape. With quarterly projections indicating a year-over-year decline in both revenue and bottom-line figures, it might be prudent for investors to approach Kellanova with caution before the impending release.

Analysts' expectations for Kellanova’s upcoming release paint a rather dull picture. The Zacks Consensus Estimate for first-quarter revenues is pegged at $3.16 billion, which suggests a slump of 21.9% from the prior year’s levels. Although the consensus mark for quarterly earnings has risen by a penny in the past 30 days to 85 cents per share, it indicates a 22.7% fall from the year-ago quarter’s reported figure.

As Kellanova prepares to unveil its first-quarter earnings, a closer look reveals a mix of optimism, albeit with several underlying challenges. While the company's leadership emphasizes a focused and growth-oriented strategy, there are a few key points of concern that investors should consider. These include pricing pressures, slowing growth in certain categories, cost inflation, volatile currency movements and broader economic uncertainties.

Kellanova Price, Consensus and EPS Surprise

Kellanova price-consensus-eps-surprise-chart | Kellanova Quote

Decoding Kellanova's Tough Situation

Kellanova is experiencing a slowdown in category growth, particularly evident in the North American snacks sector and the salty snacks segment in Europe. The company grapples with increasing elasticity across its North American categories, resulting in volume challenges and the need to revamp commercial strategies for enhanced performance. This rise in elasticity poses a hurdle to top-line growth in key categories.

Moreover, the company is operating amid a tough economic landscape characterized by consumer spending constraints against a backdrop of higher interest rates and lower pension income. The broader industry challenges are likely to take time to abate, keeping revenues under pressure.

Although moderating compared to previous periods, Kellanova continues to face input cost inflation, which casts shadows on its profit margins. Apart from this, the ongoing currency fluctuations add another layer of complexity. Foreign currency movements had an adverse impact of nearly 6% on the fourth-quarter 2024 top line. Based on current exchange rates, management expects currency headwinds of 5-6% on revenues in 2024.

That being said, Kellanova has been reaping gains from its robust investments in innovation, including advancements in product offerings and digital capabilities. Brand strength, optimal merchandise strategy and strong momentum in emerging markets have also been pivotal in helping Kellanova navigate industry challenges.

Valuation Picture

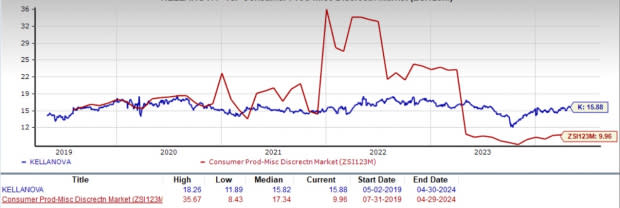

From a valuation perspective, Kellanova’s shares do not seem attractive as the stock is currently trading at a premium relative to historical and industry benchmarks. The company has a forward 12-month price-to-earnings ratio of 15.98, higher than the five-year median of 15.82 and quite above the Consumer Products – Discretionary industry’s average of 9.96. Additionally, with a current Value Score of C, the stock is not enticing for value investors either.

Image Source: Zacks Investment Research

Well, the road ahead for Kellanova appears bumpy, with the Zacks Consensus Estimate for sales for the current fiscal year standing at $12.76 billion, which suggests a 16.1% decline from the year-ago period. While the consensus mark for the next fiscal year stands at $13.11 billion, indicating 2.8% year-over-year growth, near-term headwinds cannot be ignored.

The Final Call

While the strong brand presence and customer loyalty work well for Kellanova, investors should remain vigilant about the aforementioned challenges that could temper near-term expectations and warrant careful monitoring during the upcoming earnings release of this leader in global snacking, international cereal and noodles and North America frozen foods.

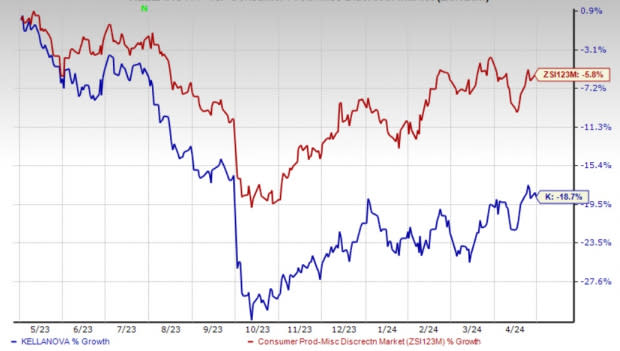

Image Source: Zacks Investment Research

Moreover, investors should take note of the Zacks Rank of #4 (Sell) assigned to the stock. With a decline of 18.7% over the past year, Kellanova has underperformed the industry's downturn of 5.8%. These indicators collectively point toward a potentially turbulent path ahead for Kellanova, prompting caution among investors considering this stock.

What the Zacks Model Unveils

Although Kellanova boasts an impressive earnings surprise history, with an average beat of 10.3% in the trailing four quarters, it appears that this positive trend may come to a halt this time.

Incidentally, our proven model does not predict an earnings beat for Kellanova this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, this is not the case here, as the company presently has an Earnings ESP of -0.45%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are three companies worth considering as our model shows that these have the correct combination to beat on earnings this time:

The Hershey Company HSY has an Earnings ESP of +1.42% and a Zacks Rank #3. The company is likely to witness top-line growth when it reports first-quarter 2024 results. The Zacks Consensus Estimate for Hershey’s quarterly revenues is pegged at $3.12 billion, which suggests a rise of 4.5% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Hershey’s quarterly earnings is pegged at $2.72, which calls for a decline of 8.1% from the year-ago quarter’s levels. HSY has a trailing four-quarter earnings surprise of 6.5%, on average.

Church & Dwight CHD currently has an Earnings ESP of +1.00% and a Zacks Rank of 3. The company is likely to register top and bottom-line increases when it reports first-quarter 2024 numbers. The Zacks Consensus Estimate for Church & Dwight’s quarterly revenues is pegged at $1.49 billion, which indicates growth of 4.3% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Church & Dwight’s quarterly earnings of 86 cents suggests a rise of 1.2% from the year-ago quarter’s levels. CHD has a trailing four-quarter earnings surprise of 9.7%, on average.

Coty COTY currently has an Earnings ESP of +4.23% and a Zacks Rank #3. The company is expected to register top-line growth when it reports third-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for COTY’s quarterly revenues is pegged at $1.37 billion, which indicates an increase of 6.6% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for COTY’s quarterly earnings has been unchanged at 6 cents in the past 30 days, suggesting a 68.4% decline from the year-ago quarter’s reported number. COTY delivered an earnings beat of 115.3%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Kellanova (K) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance