KBR's Q1 Earnings & Revenues Beat Estimates, Backlog High

KBR, Inc. KBR reported better-than-expected results for first-quarter 2024 (ended Mar 29), wherein earnings and revenues surpassed the Zacks Consensus Estimate.

Both earnings and revenues grew on a year-over-year basis, particularly showcasing solid performance in adjusted EBITDA and operating cash flow. Bookings during the quarter were well-aligned with end markets across energy security, national defense, human performance, and sustainability.

However, KBR's stock experienced a 1.6% decline in the trading session on Apr 30 following the earnings release. This dip coincided with a broader downturn in the stock market toward the end of April, reflecting concerns that persistent inflationary pressures may necessitate a prolonged period of higher interest rates by the Federal Reserve. The convergence of these factors, along with a notable drop in consumer confidence, exerted significant downward pressure on equities.

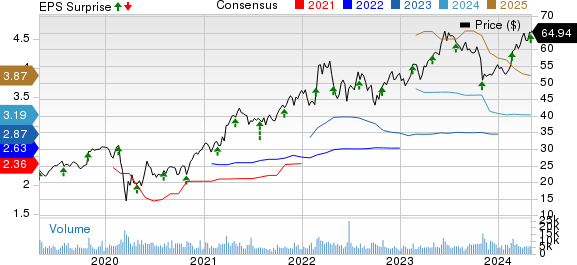

KBR, Inc. Price, Consensus and EPS Surprise

KBR, Inc. price-consensus-eps-surprise-chart | KBR, Inc. Quote

Inside the Headlines

Adjusted earnings per share (EPS) of 77 cents topped the consensus estimate of 70 cents by 10% and grew 15% from a year ago.

Total revenues of $1.82 billion beat the consensus mark of $1.8 billion by 1.1% but grew 7% year over year. This growth was predominantly driven by expansion in Sustainable Technology Solutions and notable advancements within Government Solutions. Specifically, the International, Defense & Intel, and Science and Space sectors witnessed new contracts and on-contract growth. However, this positive trend was partially offset by a decline in Readiness & Sustainment, attributed to delays in Ukraine funding.

Adjusted EBITDA increased 14% year over year to $207 million in the quarter. Adjusted EBITDA margin was up 70 basis points to 11.4%. Our model expected adjusted EBITDA to grow 5.1% year over year to $191.4 million and an adjusted EBITDA margin of 10.6% in the quarter.

Segmental & Backlog Details

Revenues in the Government Solutions or GS segment increased 4.4% year over year to $1.39 billion. The upside was backed by new and on-contract growth across its businesses. Our model predicted that the segment revenues would grow 4.7% in the quarter.

Adjusted EBITDA was $140 million, up from $132 million in the prior-year quarter. Also, adjusted EBITDA margin of 10.1% grew 20 bps year over year. The segment benefited from the favorable international mix, excellent award fees and strong project execution.

Sustainable Technology Solutions' or STS revenues rose 15% year over year to $432 million, driven by increased sustainable services and technology. Our model predicted that the segment revenues would grow 11% to $416.1 million in the quarter.

Adjusted EBITDA increased 15% to $94 million from a year ago. Adjusted EBITDA margin for the segment was down 10 bps to 21.8%. The growth was attributable to a favorable revenue mix, the achievement of certain licensing milestones, joint venture performance and increased demand.

As of Mar 29, 2024, the total backlog (including award options of $3.596 billion) was $20.8 billion compared with $21.73 billion at 2023-end. Of the total backlog, Government Solutions booked $12.89 billion. The Sustainable Technology Solutions segment accounted for $4.36 billion of the total backlog.

At the end of the first quarter, the company delivered a trailing 12-month book-to-bill of 1.1x.

Liquidity & Cash Flow

As of Mar 29, 2024, KBR’s cash and cash equivalents were $314 million, up from $304 million at 2023-end. Long-term debt was $1.84 million at the first quarter of 2024-end, up from $1.8 million at 2023-end.

In the first quarter, cash provided by operating activities totaled $91 million, up from $35 million in the year-ago period. It had an adjusted free cash flow of $66 million, up from $16 million a year ago.

Reaffirms 2024 Guidance

KBR still expects total revenues in the range of $7.4-$7.7 billion and an adjusted EBITDA between $810 and $850 million.

Adjusted EPS is still projected to be in the band of $3.10-$3.30. Operating cash flow is projected to be in the range of $450-$480 million.

Zacks Rank & Recent Construction Releases

KBR currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Watsco, Inc. WSO reported tepid first-quarter 2024 results, with earnings and revenues lagging the Zacks Consensus Estimate. On a year-over-year basis, the top line grew while the bottom line dwindled.

Watsco’s first-quarter’s results reflect a seasonal sales trend, wherein the sales of HVAC equipment and other HVAC products declined year over year. Furthermore, high costs and expenses impacted the bottom line of the company. This was partially offset by increased sales volume for commercial refrigeration products.

Otis Worldwide Corporation OTIS reported mixed results in first-quarter 2024, wherein its earnings surpassed the Zacks Consensus Estimate but net sales missed the same. The top and bottom lines grew on a year-over-year basis.

OTIS’ quarterly results reflected 14 consecutive quarters of organic sales growth, and the results were marked by high-teens growth in adjusted EPS. Thanks to the strength in modernization, the company witnessed orders growth of more than 10%, leading to mid-teens backlog growth. Otis has been leveraging its Service-driven business model and intends to focus on enhancing its operational performance and shareholder value through a capital-allocation strategy and pursue additional progress toward ESG goals.

United Rentals, Inc. URI reported impressive first-quarter 2024 results. The company surpassed the Zacks Consensus Estimate for both earnings and revenues, with notable year-over-year growth.

United Rentals’ adjusted EPS of $9.15 topped the Zacks Consensus Estimate of $8.35 by 9.6%. The reported figure increased 15.1% from the prior-year figure of $7.95 per share. Total revenues of $3.5 billion beat the consensus mark of $3.4 billion by 2.1% and grew 6.1% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance