KBR to Implement ROSE Technology at HPCL's Mumbai Refinery

Being a global leader in solvent deasphalting (SDA) technology, KBR, Inc. KBR is set to implement ROSE at Hindustan Petroleum Corporation Limited’s (HPCL) Mumbai Refinery.

Per the contract, KBR will help HPCL with technology licensing, basic engineering, training, start-up support, and proprietary equipment. The new 850,000-ton-per-annum unit will be integrated with HPCL's existing facility.

Doug Kelly, KBR’s president, Technology segment, said, "This award marks the third ROSE license acquired by HPCL, reinforcing both HPCL's trust in KBR's superior technology and our market leadership. This unit will help HPCL enhance refinery economics by upgrading fuel oil into more valuable products while lowering the overall carbon footprint."

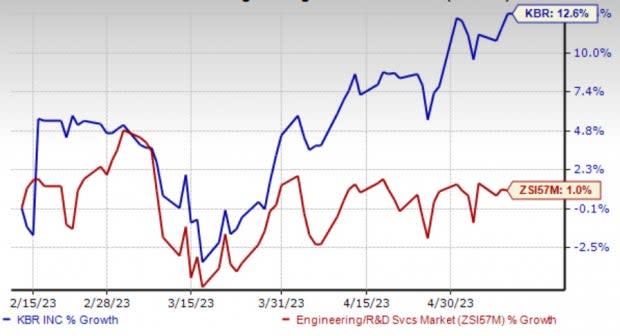

Image Source: Zacks Investment Research

Shares of the company jumped 0.92% on May 10 and have risen 12.6% in the past three months compared with the industry’s 1% increase. Earnings estimates for 2023 increased by two cents in the past seven days, implying 6.6% year-over-year growth. The trend is likely to continue, given the solid backlog level (including award options).

As of Mar 31, 2023, the total backlog (including award options) was $20.89 billion compared with $19.76 billion at 2021-end. Of the total backlog, Government Solutions booked $16 billion. The Sustainable Technology Solutions segment accounted for $4.9 billion of the total backlog.

Solid Technology Business Prospect

The company installed 71 ROSE units throughout the world. Its combined licensed capacity exceeds 1.65 million barrels per day.

KBR has been a leader in process technology development, commercialization and plant design for more than 50 years. For about four decades, KBR's process knowledge for the recovery and purification of inorganic materials has been used to design evaporation and crystallization technologies.

The determination to lower emissions, achieve product diversification and energy efficiency and develop more sustainable technologies and solutions has been driving KBR’s performance.

The demand for the company’s technologies across ammonia for food production, olefins for non-single-use plastics, refining for product diversification and greener solutions to meet tighter environmental standards has been going strong. A strategic shift to IP-enabled maintenance is also gaining traction and KBR’s advisory portfolio continues to see increasing activity, particularly in energy transition.

Zacks Rank

KBR currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Quanta Services Inc. PWR reported better-than-expected results for first-quarter 2023, wherein adjusted earnings and revenues surpassed the Zacks Consensus Estimate.

The company continues to experience high demand for its infrastructure solutions that support energy transition initiatives and increase reliability, safety and efficiency. Notably, project activities associated with renewable generation have been going strong and are expected to continue throughout the year.

AECOM ACM reported impressive results for second-quarter fiscal 2023, wherein earnings and revenues surpassed the Zacks Consensus Estimate. On a year-over-year basis, the top and bottom lines increased, backed by strong organic net service revenues (NSR) growth.

For fiscal 2023, ACM anticipates generating 8% organic NSR growth (4% for actual NSR), underpinned by robust momentum in the Professional Services business. The company expects adjusted EPS in the range of $3.55-$3.75, which indicates a 10% improvement from fiscal 2022 levels. Also, it projects an adjusted operating margin of 14.6%, suggesting an increase of 40 bps on a year-over-year basis. On a constant-currency basis, AECOM expects adjusted EBITDA in the range of $935-$975 million, indicating 10% year-over-year growth at the midpoint.

Fluor Corporation FLR reported mixed results for first-quarter 2023. Earnings missed the Zacks Consensus Estimate but increased from the previous year. Revenues surpassed the consensus mark and grew from the year-ago level.

FLR’s underlying performance continues to be impacted by a few remaining legacy projects.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

Fluor Corporation (FLR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance