Kansas City Southern (KSU) Stock Gains on Q3 Earnings Beat

Kansas City Southern’s KSU third-quarter 2019 earnings (excluding 13 cents from non-recurring items) of $1.94 beat the Zacks Consensus Estimate by 17 cents. The bottom line also improved 23.6% on a year-over-year basis. Results were aided by a better operational performance. This outperformance on the earnings front seems to have found favor with investors. As a result, the stock gained in early trading.

The company delivered revenues of $747.7 million, surpassing the Zacks Consensus Estimate of $730.3 million. Moreover, the top line improved 7% on a year-over-year basis, mainly owing to strong performances at the Chemicals and Petroleum and the Agriculture & Minerals units.

Overall, carload volumes were flat year over year as growth in the above-mentioned units was mitigated by declines in the Energy, Automotive and Intermodal segments.

In the reported quarter, operating income (on a reported basis) increased 6.3% to $282 million. Moreover, operating income (excluding restructuring charges pertaining to Precision Scheduled Railroading initiatives and a gain on insurance recoveries) rose 15% to $294 million.

Kansas City Southern’s adjusted operating ratio (operating expenses as a percentage of revenues) improved to 60.7% from 63.4% a year ago. Lower the value of the metric the better.

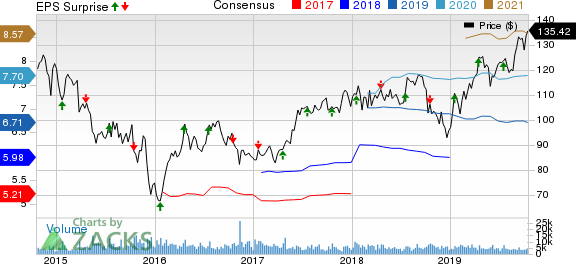

Kansas City Southern Price, Consensus and EPS Surprise

Kansas City Southern price-consensus-eps-surprise-chart | Kansas City Southern Quote

Segmental Details

The Chemical & Petroleum segment generated revenues of $194.2 million, up 21% year over year. Segmental revenues were aided by increased refined fuel products and liquid petroleum gas shipments to Mexico. Volumes expanded 12% year over year. Revenues per carload also climbed 7% from the prior-year quarter.

The Industrial & Consumer Products segment generated revenues of $155.9 million, up 2% year over year. While business volumes were flat, revenues per carload inched up 2% year over year.

The Agriculture & Minerals segment’s total revenues were $133.7 million, up 15% year over year owing to improved cycle times. While business volumes grew 10%, revenues per carload improved 4% on a year-over-year basis.

The Energy segment’s revenues logged $65 million, down 11% year over year. Notably, the positive impact of increased Utility Coal shipments was more than negated by declines in Frac Sand and Crude Oil operations. While business volumes contracted 8% year over year, revenues per carload dipped 3%.

Intermodal revenues were $100.5 million, up 1% year over year. While business volumes slipped 3%, revenues per carload increased 3% year over year.

Revenues at the Automotive segment slid 2% year over year to $64.8 million. While business volumes fell 4%, revenues per carload climbed 2% on a year-over-year basis.

Other revenues totaled $33.6 million, up 11% year over year.

Outlook

For 2019, volume growth is still expected to be flat to slightly down. Moreover, this Zacks Rank #3 (Hold) railroad operator still anticipates current-year revenue growth between 5% and 7%. Capital expenditures are still anticipated below $600 million in the year.

Additionally, Kansas City Southern still expects operating ratio at the lower end of the 60-61% range by 2021. Adjusted earnings per share are projected in the low-to-mid-teens band (compound annual growth rate for the 2019-2021 time frame).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Investors interested in the broader Transportation sector are keenly awaiting third-quarter 2019 earnings reports from key players, namely Canadian National Railway CNI, United Parcel Service UPS and Norfolk Southern NSC. While Canadian National and UPS will report third-quarter earnings on Oct 22, Norfolk Southern will announce the same on Oct 23.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

Kansas City Southern (KSU) : Free Stock Analysis Report

Canadian National Railway Company (CNI) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance