Kadant (KAI) Stock Rises 16.2% in 3 Months: What's Driving It?

Shares of Kadant Inc. KAI have jumped an impressive 16.2% in the past three months. Shareholders’ rewards, buyouts and improved projections have enhanced the company’s attractiveness and supported the market’s positive sentiment. It presently sports a Zacks Rank #1 (Strong Buy).

The company manufactures and provides components and engineered systems mainly for use in the process industries. Kadant belongs to the Zacks Manufacturing - General Industrial industry, which is in the top 27% (with a rank of 69) of more than 250 Zacks industries. It is based in Westford, MA, and has a market capitalization of $2.4 billion.

In the past three months, the industry has declined 7.7%. The S&P 500 has gained 0.5% during the same period and the Zacks Industrial Products sector has declined 3.7%.

Image Source: Zacks Investment Research

Factors Influencing the Stock

In the past three months, Kadant delivered impressive results for the second quarter of 2021. Its earnings surpassed the Zacks Consensus Estimate by 33.11% and increased 89.6% from the year-ago quarter. Healthy sales growth and margin improvements supported bottom-line growth.

In addition to solid financial performance, Kadant’s exposure in diversified end markets (including mining, packaging, metals and others), solid product offerings, infrastructural development and solid demand for sustainable materials are tailwinds for the quarters ahead. Economic recovery, growing e-commerce businesses and efforts to boost digital capabilities are beneficial as well.

For 2021, Kadant anticipates revenues of $783-$793 million, up from $710-$730 million mentioned previously. The company’s commitment toward returning values to shareholders raises its appeal. It is due to pay the quarterly dividend of 25 cents per share in November.

Regarding buyout actions, Kadant acquired a manufacturer of balers and other automated waste-handling equipment, Balemaster, for $54 million in August. Also, Kadant added Joh. Clouth GmbH & Co. KG along with its affiliates to its portfolio in the third quarter of 2021.

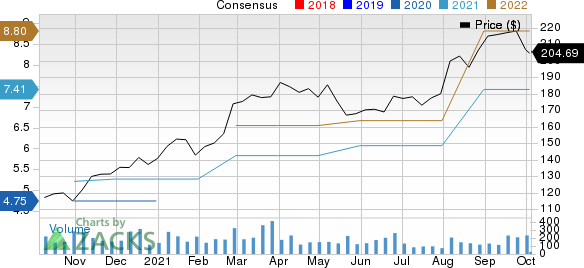

The Zacks Consensus Estimate for Kadant’s earnings per share is pegged at $7.41 for 2021 and $8.81 for 2022, marking increases of 6.6% and 10.7% from the respective 60-day-ago figures. The consensus estimate for third-quarter earnings improved from $1.56 per share to $1.64. Such upward revisions in earnings estimates are reflective of healthy operating conditions for the company.

Kadant Inc Price and Consensus

Kadant Inc price-consensus-chart | Kadant Inc Quote

Kadant’s Performance Versus Industry Players

Kadant’s performance in the past three months has been better than Nordson Corporation NDSN, DXP Enterprises, Inc. DXPE and Helios Technologies, Inc. HLIO. The companies belong to the same industry as Kadant. In the past three months, Nordson’s shares have gained 10.3% and Helios Technologies grew 7.7%, while DXP Enterprises fell 6%.

Nordson, DXP Enterprises and Helios Technologies currently sport a Zacks Rank #1 as well. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nordson Corporation (NDSN) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Kadant Inc (KAI) : Free Stock Analysis Report

Helios Technologies, Inc (HLIO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance