Just Eat aims to take big bite out of Deliveroo's market share

Just Eat Takeaway has claimed to be winning market share from rivals Deliveroo and Uber Eats after its delivery business surged during the latest lockdown.

The Anglo-Dutch company said its delivery operations grew by 695pc in the first three months of 2021 compared with last year, which Just Eat said was “multiple times faster” than the growth rate of its main rivals.

Overall order growth nearly doubled in the UK, up 96pc, including both its logistics and marketplace businesses.

After years of battling fast-growing Deliveroo and Uber Eats, Just Eat has aimed to stage a fightback with a vast marketing drive including television advertising featuring rapper Snoop Dogg. It is also launching a new “Scoober” division of 2,000 riders employed as workers, rather than freelance contractors.

Just Eat recorded 23m credit card transactions in March, including 9m from its pure logistics business. Its unnamed number two and three competitors, understood to be Uber Eats and Deliveroo, recorded 13m and 9m respectively.

Deliveroo, which suffered a spectacular share flop when it listed last month, has also claimed a strong start to 2021. It posted a 121pc rise in the total value of orders during the first two months of the year.

Just Eat said it had completed 200m orders across its markets, its fourth quarter of growth. The company's rapid growth in delivery logistics implied it had eaten up market share from rivals, analysts said.

Ian Whittaker, an independent tech analyst, said: “I can’t imagine Uber Eats or Deliveroo did so much growth.”

Jitse Groen, chief executive of Just Eat, said the growth was driven by the pandemic and investment in the business.

He said: "We are expanding in both our marketplace and in delivery. A lot of these competitors are heavily loss making and are far more expensive than us.”

It comes as Deliveroo announced it was expanding its grocery delivery operations with Sainsbury’s to more than 100 stores in a two-year contract. It makes deliveries in as little as 20 minutes available to about 30pc of the UK population.

Just Eat previously pioneered a “marketplace” model which allowed restaurants to sell their food through its website but were responsible for completing the delivery using their own drivers.

Last year Just Eat began investing heavily in a delivery logistics division allowing it to take control of the delivery process - the same model used by Deliveroo. It has signed up new brands for deliveries including Leon, Chipotle, Starbucks and Costa.

This business had about 3m logistics orders at the start of 2020, Just Eat said, but that had risen to 23m in the first quarter of this year. Just Eat had a combined delivery and marketplace order total of 64m.

Mr Groen said credit card order data showed that “the absolute gap with our competitors has increased during the pandemic", adding that he expected it widen further.

He said the increase took place despite including grocery orders from Uber and Deliveroo, which Just Eat does not process.

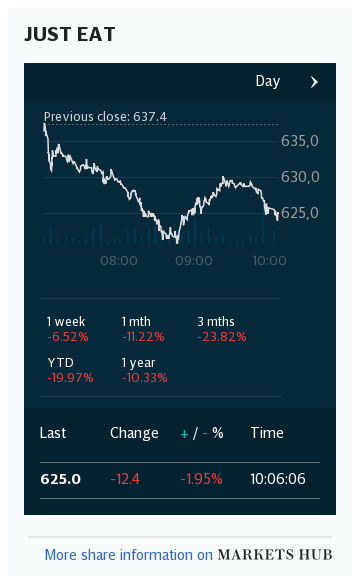

Shares in Just Eat rose 2.3pc while Deliveroo shares rose 3pc ahead of results on Thursday.

Yahoo Finance

Yahoo Finance