Juniper (JNPR) Enhances Secure AI-Native Networking Platform

Juniper Networks Inc. JNPR has unveiled a series of enhancements to its AI-Native Networking Platform, aiming to elevate enterprise networking with advanced AI capabilities. These updates promise significant improvements in cost efficiency and network performance, positioning Juniper as a leader in the AI-driven networking market.

The company has introduced innovations to its WAN Assurance, Premium Analytics and Marvis Virtual Network Assistant products, enhancing their AI for networking capabilities to ensure secure and seamless SD-WAN and SASE experiences. Additionally, Juniper has launched a pioneering Routing Assurance product, integrating AI-native automation and insights into traditional edge routing topologies.

These enhancements make Juniper the only provider offering a unified AI-Native Platform that can reduce operational expenditures by up to 85% across the entire networking spectrum. The platform's new features leverage AI to deliver proactive AIOps for assured SD-WAN experiences, now including Marvis Minis' extended capabilities for diagnosing network issues without user intervention. This unique solution spans wired, wireless and WAN environments, ensuring exceptional end-to-end user experiences.

Juniper’s WAN Assurance solution now includes a new WAN Congestion Service Level Expectation, which alerts operators to over-utilized network interfaces, preventing poor user experiences. Moreover, the expanded dynamic packet capture solution now covers WAN, aiding in swift issue resolution and reducing costly site visits. Enhanced application insights also provide network operators with a detailed visualization of SD-WAN traffic, facilitating efficient bandwidth management and problem-solving.

The updated Premium Analytics product introduces a security insights dashboard, offering comprehensive visibility into security events and enabling prompt threat responses. This feature promotes collaboration between networking and security teams, streamlining operations and enhancing efficiency.

Juniper's new Routing Assurance product integrates its enterprise edge routing platforms with Mist AI, providing customizable service levels for swift issue resolution across WAN edge and peering locations. The expanded Marvis VNA now covers enterprise WAN edge routing, allowing IT teams to resolve issues using simple language queries powered by Generative AI.

With these advancements, Juniper solidifies its position as the sole vendor offering a single AI-Native and cloud-native solution across all key networking domains, from campuses and branches to data centers and WAN links. This comprehensive approach ensures secure, efficient and user-friendly network management, driving significant value for enterprises and reinforcing Juniper's market leadership in the evolving networking landscape.

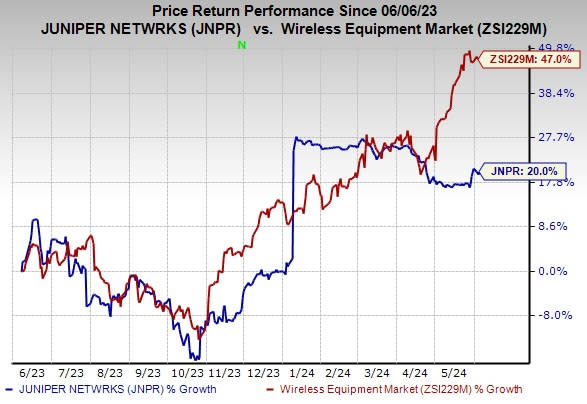

The stock has gained 20% over the past year compared with the industry’s growth of 47%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Juniper currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

NVIDIA Corporation NVDA, currently flaunting a Zacks Rank #1, is another key pick in the broader industry. It is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit or GPU. Over the years, the company’s focus has evolved from PC graphics to AI-based solutions that now support high-performance computing, gaming and virtual reality platforms.

The company’s GPU platforms are playing major roles in developing multi-billion-dollar end-markets like robotics and self-driving vehicles. NVIDIA has a long-term earnings growth expectation of 30.9% and delivered an earnings surprise of 18.4%, on average, in the trailing four quarters.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 (Buy) at present, delivered an earnings surprise of 7.5%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 9.5%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products, and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance