June Top Dividend Stock

AVJennings is one of the ten dividend stocks that can help raise your investment income by paying sizeable dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. As a long term investor, I favour these great dividend-paying stocks that continues to add value to my portfolio.

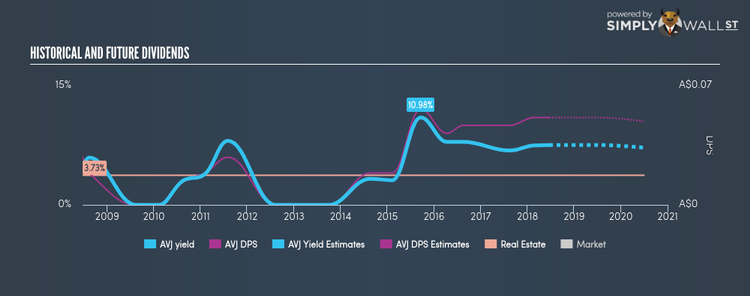

AVJennings Limited (ASX:AVJ)

AVJennings Limited engages in the development of residential properties in Australia. The company was established in 1932 and with the company’s market capitalisation at AUD A$278.28M, we can put it in the small-cap stocks category.

AVJ has a juicy dividend yield of 7.53% and has a payout ratio of 57.00% . Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from AU$0.03 to AU$0.055. Continue research on AVJennings here.

Nick Scali Limited (ASX:NCK)

Nick Scali Limited, together with its subsidiaries, engages in sourcing and retailing household furniture and related accessories in Australia. The company provides employment to 370 people and with the company’s market cap sitting at AUD A$558.90M, it falls under the small-cap stocks category.

NCK has an appealing dividend yield of 5.78% and is paying out 72.33% of profits as dividends , with analysts expecting a 74.32% payout in the next three years. Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again. Continue research on Nick Scali here.

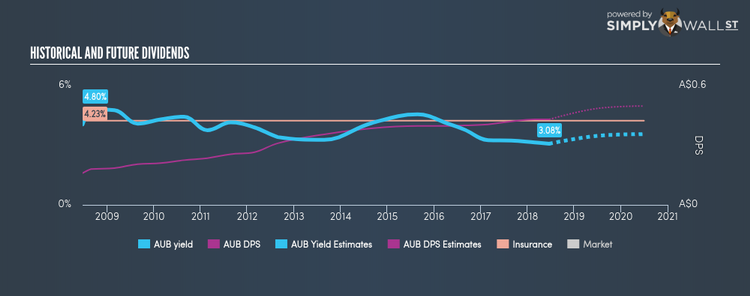

AUB Group Limited (ASX:AUB)

AUB Group Limited provides insurance broking, underwriting, and risk services in Australia and New Zealand. Started in 1885, and now run by Mark Searles, the company provides employment to 3,500 people and with the stock’s market cap sitting at AUD A$889.38M, it comes under the small-cap group.

AUB has a wholesome dividend yield of 3.08% and distributes 61.88% of its earnings to shareholders as dividends , and analysts are expecting a 64.54% payout ratio in the next three years. AUB has increased its dividend from AU$0.16 to AU$0.43 over the past 10 years. It should comfort existing and potential future shareholders to know that AUB hasn’t missed a payment during this time. More on AUB Group here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance