June 2024 Insight Into TSX Growth Companies With High Insider Ownership

As the Canadian market navigates a period of economic stabilization and potential recovery, highlighted by recent rate cuts from the Bank of Canada, investors are closely watching how these shifts could influence stock performance. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.8% |

Payfare (TSX:PAY) | 15% | 46.7% |

Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

Aritzia (TSX:ATZ) | 19% | 51.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Magna Mining (TSXV:NICU) | 10.5% | 95.1% |

Ivanhoe Mines (TSX:IVN) | 13% | 65.5% |

Artemis Gold (TSXV:ARTG) | 31.8% | 48.8% |

Let's explore several standout options from the results in the screener.

Aritzia

Simply Wall St Growth Rating: ★★★★★☆

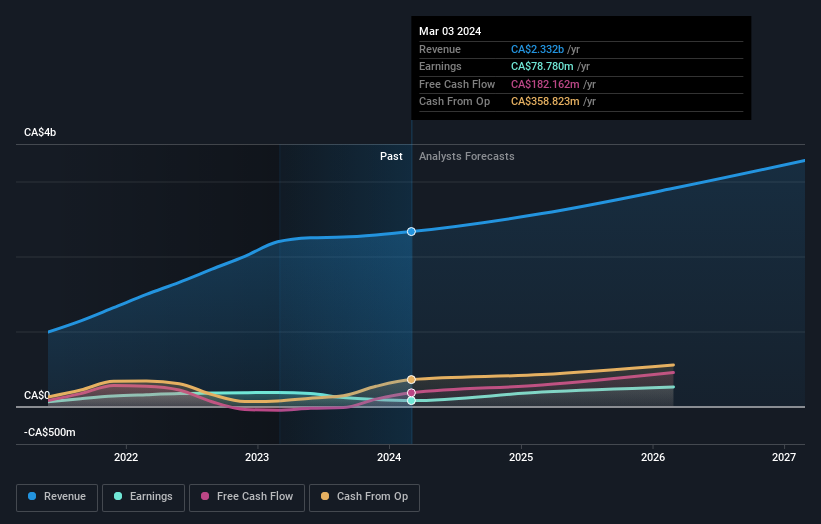

Overview: Aritzia Inc., a Canadian company, designs, develops, and sells women's apparel and accessories primarily in the United States and Canada, with a market capitalization of approximately CA$4.22 billion.

Operations: The company generates its revenue primarily from the sale of women's apparel, totaling CA$2.33 billion.

Insider Ownership: 19%

Aritzia, a Canadian retailer, is trading at 81.1% below its estimated fair value and shows promising growth prospects with earnings expected to increase by 51.19% annually over the next three years. Despite this, its profit margins have declined from last year's 8.5% to 3.4%. Recently, Aritzia reported a decrease in net income for the fiscal year ending March 2024 but provided an optimistic revenue forecast for fiscal 2025, projecting up to CAD 2.62 billion in sales.

Click here to discover the nuances of Aritzia with our detailed analytical future growth report.

Our valuation report unveils the possibility Aritzia's shares may be trading at a discount.

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

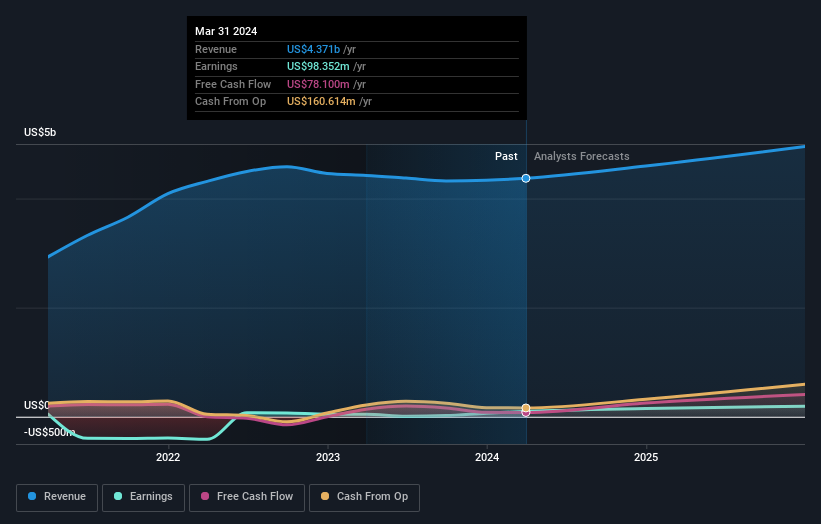

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.69 billion.

Operations: The company's revenue is segmented as follows: Americas at CA$2.53 billion, Asia Pacific at CA$616.58 million, Investment Management at CA$489.23 million, and Europe, Middle East & Africa (EMEA) at CA$730.10 million.

Insider Ownership: 14.2%

Colliers International Group has seen a mixed performance with significant insider selling over the past three months, and shareholder dilution occurring within the last year. Despite these challenges, the company's earnings have surged by 119.8% over the past year and are projected to grow at 38.34% annually. Additionally, Colliers' revenue growth is expected to outpace the Canadian market, though it remains below a high-growth benchmark of 20% per year. Recent filings indicate a new shelf registration aimed at supporting employee stock ownership plans, suggesting ongoing investment in its workforce despite financial complexities.

Vitalhub

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across multiple regions including Canada, the US, the UK, Australia, and Western Asia, with a market capitalization of approximately CA$378.12 million.

Operations: The company generates CA$55.17 million from its healthcare software segment.

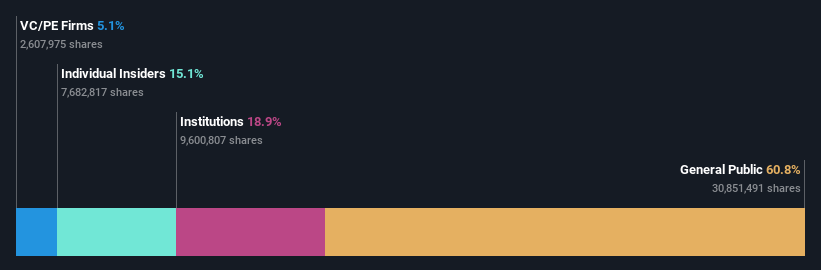

Insider Ownership: 15.1%

Vitalhub, trading at a significant discount to its estimated fair value, has not seen insider sales in the past three months but has experienced substantial insider buying. While shareholder dilution occurred last year, Vitalhub's earnings are forecasted to grow significantly over the next three years, outpacing both its previous performance and market averages. Recent strategic moves include a partnership with Lumenus Community Services and leadership restructuring to bolster growth prospects.

Delve into the full analysis future growth report here for a deeper understanding of Vitalhub.

Our expertly prepared valuation report Vitalhub implies its share price may be too high.

Key Takeaways

Reveal the 28 hidden gems among our Fast Growing TSX Companies With High Insider Ownership screener with a single click here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:ATZTSX:CIGI and TSX:VHI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance