JPMorgan launches Chase in UK: 1% cashback and 5% savings rate behind aggressive push for customers

JPMorgan today announced an aggressive move into Britain’s retail banking market with best-in-class cash back and savings offerings aimed at luring customers from established rivals.

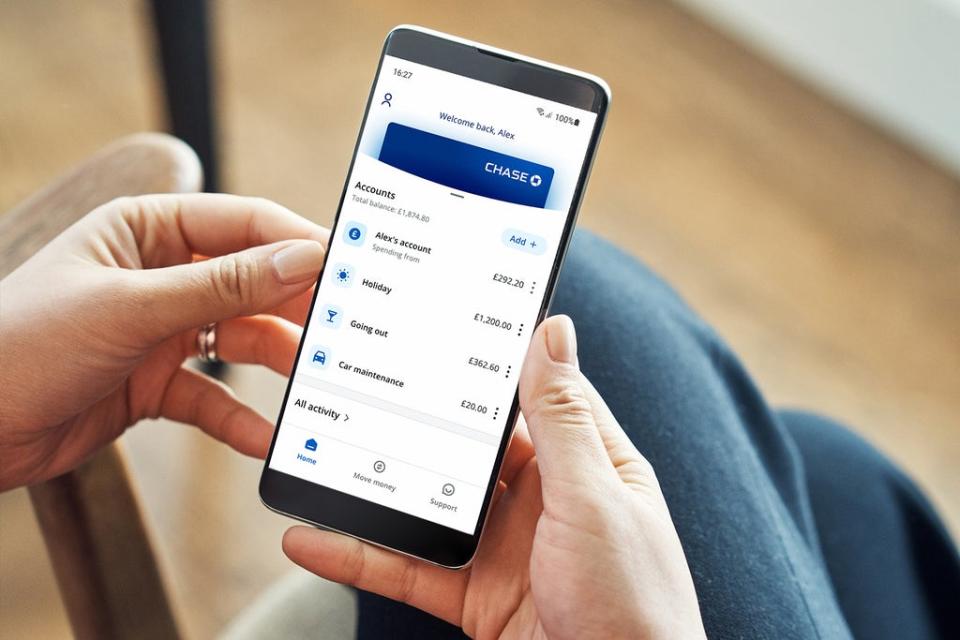

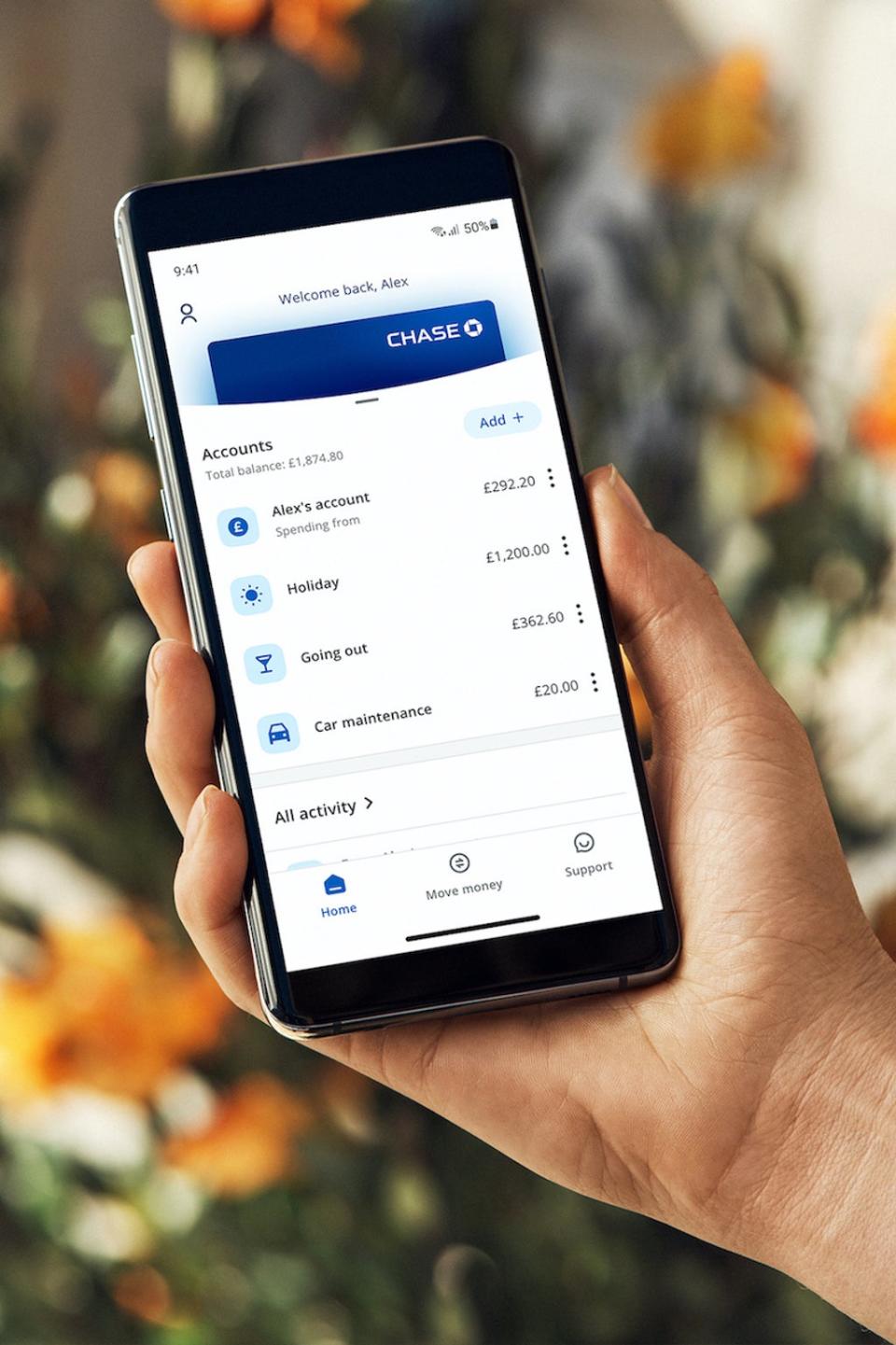

Chase, JPMorgan’s new digital bank, officially launches in the UK today. The bank will offer customers 1% cashback on debit card spending for the first year. The offer covers everyday expenditure including groceries, travel, meals, entertainment, fashion, homewares, and electronics. The deal could see the bank hand tens or even hundreds of pounds back to customers who use Chase as their main current account.

Chase customers will also be able to round-up card purchases to the nearest pound and have the spare cash automatically deposited in a savings account offering 5% annual interest for the first 12 months. Overseas foreign exchange spending is fee free and offers market leading exchange rates.

“The product is very, very competitive,” Sanoke Viswanathan, the executive in charge of the launch, told the Standard.

The customer giveaways represent a significant opening salvo from JPMorgan in the already crowded British retail banking market. Viswanathan said JPMorgan had spent hundreds of millions building the new digital business and would spend tens of millions on its launch.

“This is a big strategic effort for the bank,” he told the Standard. “We’ve been working on this for a few years. It’s a big deal for us. This is a bank that’s going to be here for a long time.”

Other features at launch include the ability to set up multiple accounts and switch between them on one debit card. Debit cards will be made from recycled plastic and won’t feature account numbers on the front, which the bank says is a security feature.

Chase will go head-to-head with High Street giants Barclays, Lloyds, HSBC and NatWest, as well as digital startups including Monzo, Starling and Revolut. The new bank will also compete with JPMorgan’s arch Wall Street rival Goldman Sachs, which offers retail savings accounts in the UK under the Marcus brand.

Viswanathan said JPMorgan was attracted to the UK because of the high level of consumer adoption of digital banking, the strong regulatory regime, and the “terrific pool of talent” for fintech in the UK. He said London would form the global headquarters for Chase, with further international expansion expected in future.

JPMorgan has 600 people working on Chase in the UK and Viswanathan said it was likely to hire many more in its first year. The company has set up a customer service center in Edinburgh that it will scale up as the bank acquires customers.

Chase will initially offer current accounts but plans to expand to savings, investments, lending, and pensions products. JPMorgan acquired digital wealth manager Nutmeg earlier this year and plans to integrate its services into Chase.

Viswanathan said the bank was not looking at any other acquisitions at the moment but added: “I wouldn’t rule it out.”

Read More

JPMorgan to launch digital bank Chase in the UK next week

Monzo confirms plans for buy now pay later product called ‘Flex’

FTSE as-it-happened: Bank fires up Sterling, pushing FTSE 100 down

Yahoo Finance

Yahoo Finance