JPMorgan Hikes BYD’s Price Target by More Than 80% on Outlook

(Bloomberg) -- JPMorgan Chase & Co.’s analysts raised their price targets for BYD Co. by more than 80% on expectations the Chinese automaker will deliver 6 million vehicles globally in the next two years.

Most Read from Bloomberg

Trump Emerges Defiant From Rally Attack Set to Shake Up ’24 Race

BlackRock Says Gunman From Trump Rally Appeared in Firm’s Ad

I Was at the Trump Rally Where He Was Shot. Here Is What I Saw

Trump’s Bloodied, Defiant Image After Shooting Pumps Up His Base

The bank, which now has the highest target prices for BYD’s Hong Kong and Shenzhen shares based on data compiled by Bloomberg, increased them to HK$475 and 440 yuan, respectively, while maintaining an overweight weighting. It estimates BYD will deliver about 1.5 million units in overseas markets and three times that domestically by 2026. The company sold around 3 million vehicles in 2023.

Shares rose as much as 2.6% to HK$241.40 during early trade in Hong Kong on Wednesday.

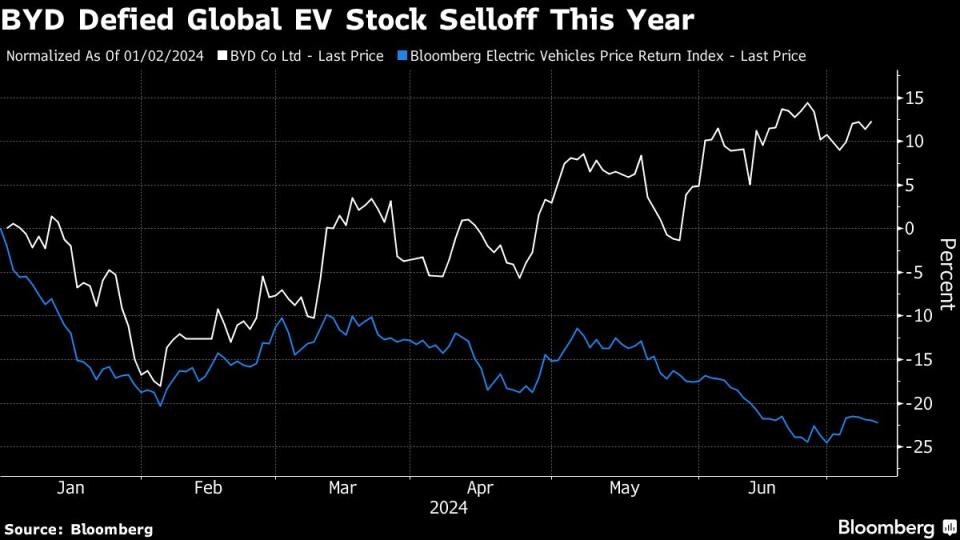

BYD has focused on boosting international sales and localization efforts while engaging in a brutal price war in its home Chinese market. Its shares have defied heavy losses in electric-vehicle stocks to gain around 12% this year in Hong Kong, while those of its smaller peers Li Auto Inc. and XPeng Inc. have each tumbled more than 45%.

“BYD could see a re-rating in the next 1 to 2 years, driven by its global expansion and potential rising plug-in hybrid electric vehicle opportunity,” JPMorgan analysts including Nick Lai wrote in a note.

The company will start to export price-competitive plug-in hybrid EV products such as the Seal U SUV in Europe from July and Shark in Mexico from June, according to JPMorgan.

Read: BYD Plays Winning Hand in China EV Market With Hybrid Models

In 2026, BYD will also mark an important milestone for its global ambitions as four of its overseas production bases or assembly lines in Thailand, Indonesia, Brazil, and Hungary should be completed and ramping up, the analysts wrote.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance