Big banks lean on strong consumer amid trading troubles

If the U.S. economy is headed for a slowdown, the big banks aren’t seeing it in consumer trends. In earnings reports this week, the four biggest U.S. banks painted a bright picture of consumer credit, which helped them mask revenue concerns in their trading divisions.

“The U.S. consumer remains healthy, overall credit is in great shape, and the earning power of the company is evident,” JPMorgan Chase CEO Jamie Dimon said July 16.

JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup all beat earnings estimates on the top and bottom lines for the second quarter, thanks to a strong consumer.

Those earnings appear to reinforce the Federal Reserve’s observations on consumer strength.

Fed Chairman Jerome Powell told Congress July 10 that the “most reliable drivers” of economic momentum are consumer spending and business investment. Describing business investment as slow, Powell said consumer spending is looking good.

“While growth in consumer spending was weak in the first quarter, incoming data shows it bounced back, and is now running at a solid pace,” Powell said.

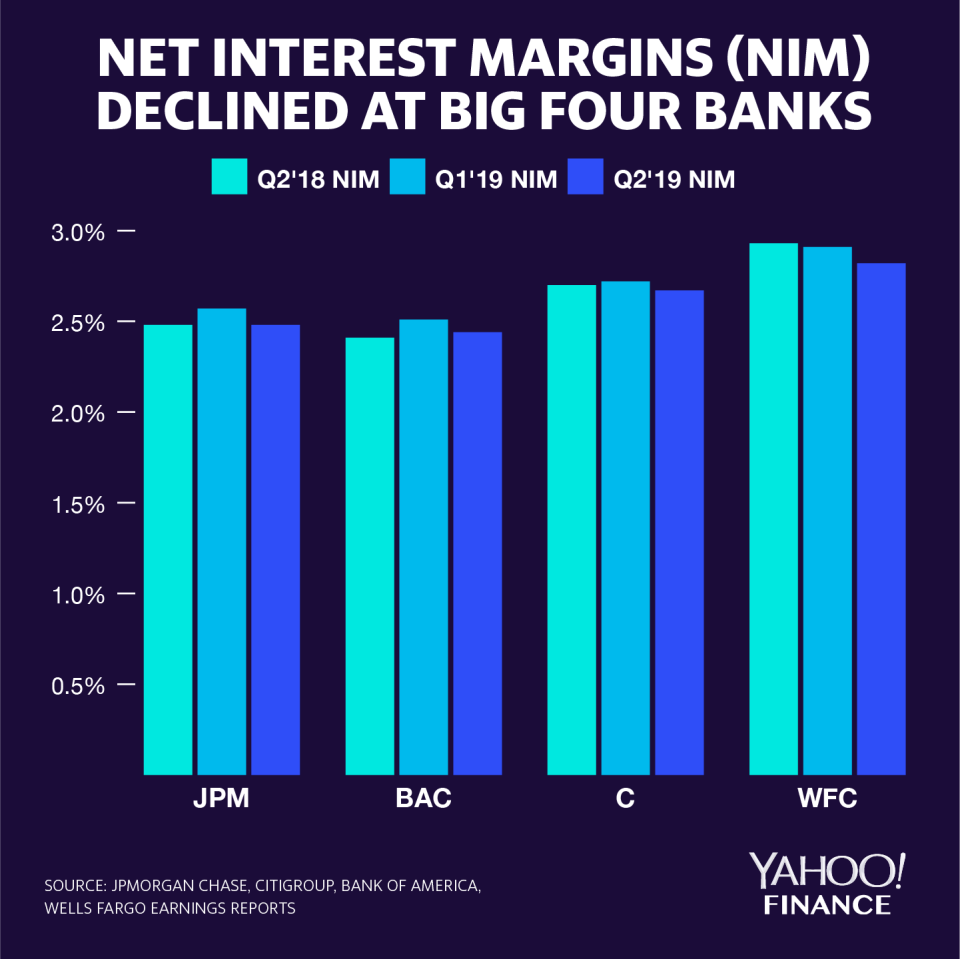

But interest rate-sensitive banks have faced compressed margins, raising questions about whether the big banks will face a further crunch on levels of profitability in future quarters.

All four big banks reported quarter-over-quarter declines in net interest margin, a key measure of the difference between interest collected on loans and interest paid on deposits. With the Fed’s four rate hikes in 2018, banks are still feeling pressure to pay their depositors more to stop them from moving their funds to rival banks.

In theory, a rate cut could alleviate upward pressure on deposit costs, but Wells Fargo CFO John Shrewsberry told analysts not to get too giddy.

“Where we have continued to outperform on the big massive consumer deposits, et cetera, deposits are still really, really inexpensive,” Shrewsberry said July 16. “And there isn't much leverage on the way down, so they will take a couple of quarters...to sort of fully stabilize.”

Strong consumer

JPMorgan Chase (JPM), the largest U.S. bank, reported a 22% year-over-year increase in its consumer and community banking net income driven by higher deposit margins and balance growth.

Competitors also saw robust consumer activity. Citigroup (C) reported “solid momentum” in its consumer banking revenues, where revenues from its credit card and retail banking divisions each grew by 3% year-over-year.

Bank of America, meanwhile, was able to grow loans by 6% year-over-year thanks to a strong pipeline of funding from customer deposits. On the bottom line, consumer banking net income rose 13% year-over-year.

“These are massive growth engines that have exceed the size of many institutions,” Bank of America (BAC) CEO Brian Moynihan said July 17, specifically pointing to their deposit growth.

Wells Fargo (WFC), which continues to face a cap on growth as a result of its consumer abuses, saw a contraction in net interest income but reported a 5% increase in total noninterest income due to higher deposit fees and credit card fees.

Trading woes

A strong consumer helped banks with large trading desks, since financial headwinds made it tough for investment banks to make money in the last quarter.

Total markets revenue was down 6% at JPMorgan Chase’s corporate and investment bank. Citigroup saw a 9% decline in its equity markets business and a 4% decline in its fixed income revenues. Bank of America’s sales and trading revenue fell 10%, with an 8% decline in fixed income and a 13% drop in equities.

Bank of America CFO Paul Donofrio told reporters June 17 that yields coming down globally hurt fixed income, pointing out that the U.S. June bond auction saw soft demand for 30-year Treasuries.

“What do you need to see? You probably just need to see a little bit more confidence about global growth,” Donofrio said. “It would help to clear some of the concerns people have about trade.”

Goldman Sachs (GS) did not have a large consumer banking division to lean on to hedge against its markets-focused businesses. On Tuesday the company reported yearly declines in its investment banking and management and institutional client services. But the company did report a 16% year-over-year increase in investing and lending.

The other large investment bank, Morgan Stanley (MS), is scheduled to report on Thursday morning.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Wells Fargo expenses to be on the 'high end' as it continues turnaround effort

Citi earnings cast spotlight on consumer lending amid economic headwinds

Powell: 'Just so important' to keep economic expansion going

Maxine Waters pushes against Trump's Fed criticism to 'get rid of any uncertainties'

Congress may have accidentally freed nearly all banks from the Volcker Rule

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance onTwitter,Facebook,Instagram,Flipboard,SmartNews,LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance