Jollibee has a cult-like following in the Philippines and among the Filipino diaspora. But can its ‘Chickenjoy’ and sweet spaghetti ever truly challenge McDonalds globally?

There may be no busier place in Hong Kong on a Sunday than the Jollibee restaurant on Connaught Road. Nestled between skyscrapers in the city’s Central District, the Filipino fast-food outpost is packed. At lunchtime, there’s no place to sit. Customers are waiting to pounce on a free chair as soon as one opens up.

Sunday is a day off for the city’s domestic helpers—most of whom are Filipino. Dozens of them are crowded in the basement of this outlet to socialize with friends and post on social media. The room is so loud you have to shout to be heard. The gathering spot also offers them a taste of home.

“It’s about the chicken,” says Mary, a Filipino domestic helper who’s worked in the city for a decade. “It’s crunchy and juicy.” She also loves Jollibee’s spaghetti, a pasta dish featuring ground beef and hot dog slices slathered in a signature sweet red sauce. “Taste is all that matters.”

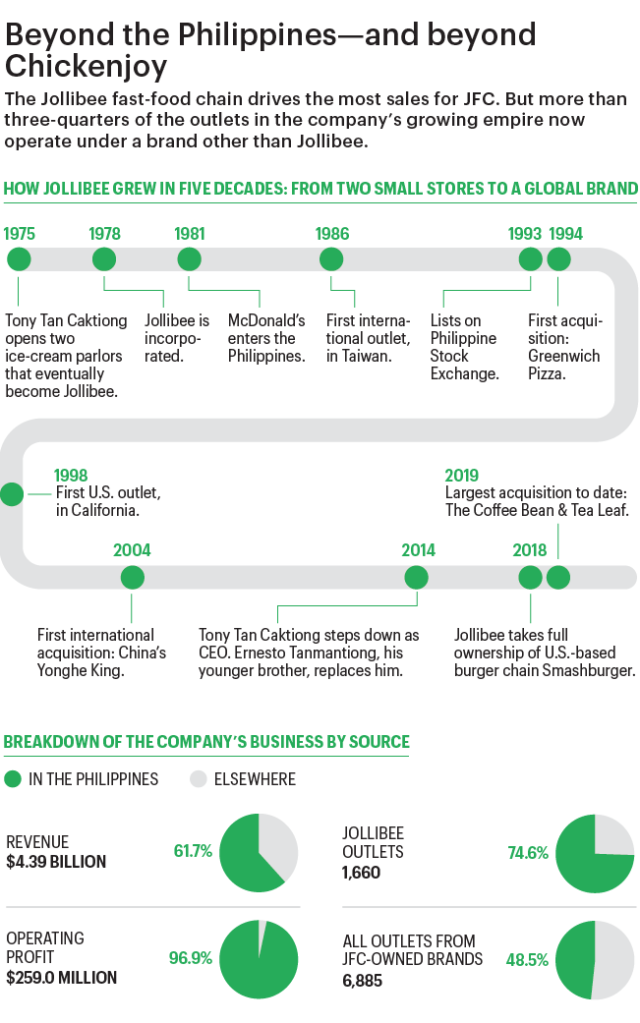

Jollibee is an icon in its home country and among the Filipino diaspora. Founded in 1978, Jollibee won over diners in the Philippines by serving hamburgers and fried chicken—its “Chickenjoy” makes up 30% of all orders—as well as dishes with more local flavor like its spaghetti.

What started as a single restaurant in Quezon City, outside Manila, is now a global operation called Jollibee Foods Corp. (JFC) that has over 6,800 locations and earned $4.4 billion in revenue in the 2023 fiscal year, landing it at No. 86 on Fortune’s inaugural Southeast Asia 500 list.

JFC has grown by serving its core customers—Filipinos—the world over. Its flagship Jollibee brand has 1,240 restaurants in the Philippines and another 420 in other countries. JFC has also expanded by acquiring brands in Southeast Asia, the U.S., and China whose outlets serve pizza, Cantonese dim sum, Filipino barbecue, Taiwanese bubble tea—essentially a globally diversified portfolio of comfort foods.

The buying spree is part of CEO Ernesto Tanmantiong’s mission to make JFC one of the world’s top five restaurant companies by market cap. “That’s the North Star,” he says. “We said we had to be the No. 1 Asian food company in Asia. And then when we were again about to achieve that, we set our vision to the world arena.”

JFC has a long way to go. Despite Jollibee’s fervent following, the parent company is about a fifth the size of McDonald’s by revenue, and experts are skeptical that it will ever come close to catching up.

But Tanmantiong, a company lifer, is convinced that the thing that’s won over Filipino customers—the taste of Jollibee’s food—will appeal to non-Filipinos the world over; they just need a chance to try it.

Jollibee is such a staple in the Philippines that it has become an obligatory stop for visiting dignitaries. When New Zealand Prime Minister Chris Luxon went to the Philippines in April, he ate at a Jollibee in Manila’s business district on his first day. Philippines President Ferdinand “Bongbong” Marcos Jr. said that Luxon’s visit made him an “honorary Filipino.” Marcos posted his own Jollibee order to Facebook a week later: hamburgers, fried chicken, and “palabok,” a Filipino noodle dish.

At another Manila Jollibee in May, CEO Tanmantiong braves the heat—officials warned of a heat index over 113° F—for a photo shoot with a bucket of Chickenjoy and the chain’s mascot: a chubby, friendly bumblebee.

Tanmantiong doesn’t carry himself like the CEO of one of the Philippines’ largest companies. He arrives wearing a red Jollibee-branded polo shirt styled closely to the uniform worn by his employees. He grins as he talks about Jollibee’s 40-year-plus history. You can tell he’s told these tales many times—and he’s excited to tell them again.

Tanmantiong—or “Sir Ato” to his employees—has worked at Jollibee since its founding. (It’s Filipino tradition to refer to all customers as “sir” or “madam.”) Jollibee grew out of two ice-cream parlors Tanmantiong’s older brother, Tony Tan Caktiong, opened in 1975 in Cubao, Metro Manila. Tanmantiong, then a college student, helped out with odd jobs.

There were “ice-cream parlors starting all over Manila,” Tanmantiong recalls, so Tan Caktiong differentiated his menu by adding hot dishes like hamburgers. Customers preferred the new fare, so Tan Caktiong pivoted, settling on the name “Jollibee”—a combination of “jolly” and the industrious “bee.” Tanmantiong became manager of Jollibee’s smallest outlet.

Four years later, Jollibee faced an existential threat when McDonald’s entered the market. “We were told that in any country that McDonald’s entered, they swallowed their competitors,” Tanmantiong remembers.

Management ordered a SWOT analysis of both companies. McDonald’s beat Jollibee in all but one category: taste. “Their products are bland, while Asians prefer flavored food,” he says. It took McDonald’s a decade to localize its menu, giving Jollibee a meaningful head start.

Perhaps unintentionally, Jollibee also took inspiration from its bee mascot, swarming its competition. “If McDonald’s opened one big store, we surrounded them with six small stores,” Tanmantiong says. He notes that Jollibee’s smaller, more efficient stores surpassed its Western rival on sales per square meter.

The strategy worked. Today, Jollibee controls about 50% of the Philippines’ chicken-and-burger market, to McDonald’s 29%.

But it wasn’t enough for JFC to be No. 1 in hamburgers and fried chicken. “When we were about to achieve that, we raised the bar,” Tanmantiong said.

Andrew Delios, a professor at the National University of Singapore’s business school, explains that it’s common for a large Filipino company to funnel local earnings into an “acquisition spree.” A dominant company like JFC can get only “marginal gains” from increasing market share, he says, meaning it “must grow by acquisition.”

That’s exactly what JFC did starting in 1994 when it acquired Greenwich Pizza, a local chain. JFC bought other Filipino brands in the coming years: Chinese-food chain Chowking in 2000, cake bakery Red Ribbon in 2005, and Mang Inasal, serving Filipino-style barbecue, in 2010.

Tanmantiong climbed the ranks as Jollibee expanded, becoming CEO in 2014. Tan Caktiong is JFC’s chairman, looks after its M&A strategy, and serves as “CTO,” Tanmantiong says: “chief taste officer.”

JFC’s spending spree cemented its dominance in its home market. Combined, its brands represent over half of the Philippines’ quick-service restaurant sector, with individual brands often cornering up to 90% of the market for a given cuisine.

Jollibee also followed the Filipino diaspora to overseas markets. It opened its first international outlet in Taiwan in 1986 and its first U.S. outlet in Daly City, Calif.—a San Francisco suburb with a large Filipino American community—in 1998. But Tanmantiong admits to a lot of early missteps in Singapore, Taiwan, Indonesia, and the Middle East.

In 2018, JFC renewed its push to take Jollibee global, opening branches in prime locations like downtown Los Angeles, New York City’s Times Square, and Earls Court in London.

Jollibee’s overseas clientele are still mostly Filipino, but word of mouth and good chicken are winning over others. In 2022, the digital publication Eater crowned the brand the “best fast-food fried chicken in America,” an honor Jollibee outlets in the Philippines proudly advertise. Tanmantiong claims that half of Jollibee’s U.S. customers are non-Filipino. In some markets, like Vietnam, its customers are entirely local.

JFC set a second big goal in March: to triple its profits to $450 million by 2028. Tanmantiong plans to achieve that feat with “strategic acquisition” and “aggressive expansion.” “It’s easy to say that we want to have superior products, but in reality it’s difficult to develop,” he says. “If it’s already available out there, why not just acquire it?”

JFC has already bought up brands around the world, including Hong Kong’s Michelin-rated dim sum chain Tim Ho Wan, California-based café chain The Coffee Bean & Tea Leaf, and Denver-based fast-casual burger joint Smashburger.

For all its overseas deals, JFC’s heart is still in the Philippines. It generated 62% of revenue and 97% of operating profits in its home market in 2023.

Delios calls JFC’s new profit target “an unlikely proposition,” citing the difficulty of adapting to demanding international markets. Global fast-food giants like McDonald’s have decades of experience, which lets them scale at speed. “[KFC owner] Yum Brands is opening a new franchise every two hours,” he says. JFC is also focusing its growth on the U.S. and mainland China, where competition is fierce. There’s “room to grow” in these crowded markets, Delios says, but JFC will need “a credible offering … beyond the Filipino diaspora,” and can’t just rely on what worked in its home market.

JFC is also struggling with inflation. The Philippines reported a headline inflation rate of 6% in 2023. A weak Philippine peso makes Jollibee’s imports more expensive. Tanmantiong says inflation is the worst he’s ever seen, but claims JFC has only passed about half of price hikes onto consumers.

But Jollibee’s existing base of die-hard fans are good brand ambassadors, even if the chicken’s getting a bit more expensive. “When you’re about to board an 18-hour flight back to the States, nothing hits like Chickenjoy at Manila airport,” says Dale Talde, a Filipino American celebrity chef. “That’s a core memory for me.”

This article appears in the June/July 2024 Asia issue of Fortune with the headline, “Filipino fried chicken takes flight.”

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance