Johnson Controls (JCI) Q1 Earnings Beat Estimates, Up Y/Y

Johnson Controls International plc JCI reported adjusted earnings per share of 40 cents in first-quarter fiscal 2020, surpassing the Zacks Consensus Estimate of 38 cents. The reported figure also comes in higher than the prior-year quarter earnings of26 cents per share. This outperformance wasmainly aided by higherrevenues and EBITA across all its segments.

Johnson Controls reported revenues of $5,576 million, up 2% year over year, in the first quarter. The revenue figure also beat the Zacks Consensus Estimate of $5,547 billion. Gross profit increased to $1.8 billion from the year-earlier quarter’s $1.72 billion.

Selling, general and administrative expenses in the fiscal first quarter totaled $1,427 million, lower than the prior-year quarter’s $1,438 million.

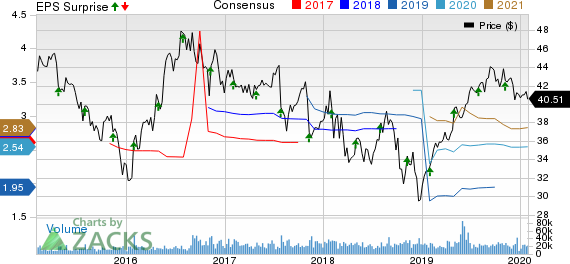

Johnson Controls International plc Price, Consensus and EPS Surprise

Johnson Controls International plc price-consensus-eps-surprise-chart | Johnson Controls International plc Quote

Segmental Results

Building Solutions North America: This segment’s adjusted revenues were $2,167 million, up from the year-ago quarter’s $2,116 millionon strong growth in HVAC & Controls and Fire & Security. The segment’s EBITA rose to $259 million from the $253 million reported in first-quarter fiscal 2019onfavorable volume leverage, and cost synergies and productivity savings.

Building Solutions Europe, Middle East, Africa/Latin America: Adjusted revenues in this segment was $928 million, up 2.3% year over year, owing to solid growth in project installations and service. Segment’s EBITA was $90 million, up from the first-quarter fiscal 2019 level of $77 million. This upswing was mainly driven by favorable volume as well as cost synergies and productivity savings.

Building Solutions Asia Pacific: Adjusted revenues rose to $629 million from the year-ago quarter’s $613 million on growth in project installations, particularly in Fire & Security. This segment’s EBITA was $72 million, up from the first-quarter fiscal 2019 level of $66 million, owing to solid volume as well as cost synergies and productivity savings.

Global Products: Adjusted revenues in this segment increased to $1,852 million from the prior year’s $1,828 million, mainly driven by robust growth in Building Management Systems and to a lesser extent, Specialty Products. This segment’s EBITA was $204 million, up from the first-quarter fiscal 2019 level of $194 million, mainly aided by positive price/cost as well as cost synergies and productivity savings.

Financial Position

Johnson Controls had cash and cash equivalents of $2.16 billion as of Dec 31, 2019, down from $2.81 million as of Sep 30, 2019. Long-term debt declined to $5.92 billion in the quarter from $6.71 billion as of Sep 30, 2019. The debt-to-capital ratio stands at 27.36%.

In the reported quarter, the company repurchased 15 million shares for $651 million.

2020 Guidance

The company reaffirmed its fiscal 2020 adjusted EPS from continuing operations of $2.50-$2.60, suggesting a 28-33% increase from the year-ago reported figure.

Zacks Rank & Other Stocks to Consider

Johnson Controls currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the Auto-Tires-Trucks sector include Gentex Corporation GNTX, Blue Bird Corporation BLBD and SPX Corporation SPXC, each carrying a Zacks Rank of 2, at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Gentex Corporation has an estimated earnings growth rate of 7.32% for 2020. The company’s shares have appreciated 50.2% in a year’s time.

Blue Bird has a projected earnings growth rate of 25.47% for the ongoing year. Its shares have gained 2.6% over the past year.

SPX has an expected earnings growth rate of 8.09% for the current year. The stock has rallied 69.5% in the past year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blue Bird Corporation (BLBD) : Free Stock Analysis Report

Johnson Controls International plc (JCI) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report

SPX Corporation (SPXC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance