Japanese Yen Back on its Heels as USD/JPY Makes Run at ¥100 Again

ASIA/EUROPE FOREX NEWS WRAP

Risk appetite has improved in the overnight with high beta currencies and riskier assets finding firming footing in the wake of Japanese Finance Minister Taro Aso’s commentary that the current policies being implemented by Japan have been deemed acceptable by the G20. The USDJPY, accordingly, has made a reinvigorated push back towards the psychologically significant ¥100.00 exchange rate (though the NZDJPY is the top performer, up nearly +2% on the day).

The commentary from Mr. Aso seems to be the catalyst as sentiment the past several days was gearing towards the G20 releasing a statement of condemnation regarding Japan’s aggressively easy fiscal and monetary policies. But now that the G20 has essentially approved the policies of arch-doves Shinzo Abe and Haruhiko Kuroda, there stands little in the way of the next leg of Yen weakness (barring significant risk-off conditions evolving out of Europe, for example).

Into the end of the week, I’m also keeping my eye on the Italian presidential elections, which are coming to a head now that a third round of voting has inconclusive results. Center-Left leader Pier Luigi Bersani has reportedly threatened to step down in the wake of the inconclusive elections. At this point in time, given the continued political strife in the country, it is likely that third party candidate Beppe Grillo is gaining popularity, which could spell trouble for the Euro-zone once new parliamentary elections take place in the coming months. Bond markets don’t seem to care, however.

Taking a look at European credit, peripheral yields have compressed further, giving the Euro breathing room to rally meagerly on Friday. The Italian 2-year note yield has decreased to 1.306% (--1.4-bps) while the Spanish 2-year note yield has decreased to 1.988% (-1.2-bps). Similarly, the Italian 10-year note yield has decreased to 4.223% (-2.4-bps) while the Spanish 10-year note yield has decreased to 4.611% (-3.6-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:00 GMT

NZD: +0.74%

AUD: +0.41%

GBP: +0.39%

EUR:+0.28%

CHF:+0.27%

CAD:+0.20%

JPY:-1.06%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.05% (+0.26%past 5-days)

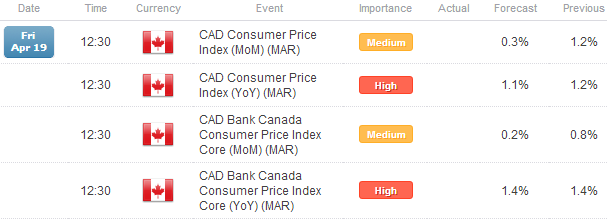

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators. Want the forecasts to appear right on your charts? Download the DailyFX News App.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: After stalling for several days at the 38.2% Fibonacci retracement from the Jul’12 low to the Feb’13 high at 1.3075, the EURUSD had surged to its highest level since February 25, when the inconclusive Italian election results were announced. But the bullish momentum was short-lived, with the pair falling right back below 1.3075 within a day. The daily RSI uptrend is starting to falter, suggesting that a big move higher will be necessary to sustain a near-term bullish outlook. For now, further upside should be capped by 1.3200/05, at which point 1.3245/325 should be a major zone of resistance above. Declines should be supported by the 8-EMA/21-EMA confluence zone at 1.3020/65, and given retail sentiment, we expect the EURUSD rally to continue.

USDJPY: On Monday I said: “After the USDJPY cleared the descending trendline off of the March 12 and March 20 highs, at 95.00/15, price sky rocketed right up to the topside rail at 99.30/55…While topside risks are still in play…price action or a move to fill the week’s opening gap are possible. Accordingly, dips into 97.50 and 96.60 are look to be bought on pullbacks.” An Evening Star candle cluster – a bearish reversal pattern – materialized on Friday, with further downside pressure today. Accordingly, I’m watching 96.60 as the ideal level to begin building longs again.” 96.60 has held, and price has rebounded back to 97.93.

GBPUSD: Monday I said: “While the Bearish Rising Wedge move proved to be a fake out, an upward sloping channel has materialized off of the early-March lows. Recent price action from last Thursday suggests a pennant may have formed on the 1H and 4H time frames, with a test of 1.5440 due by Monday. I remain long-term bearish, but for now, I am neutral.” Price did not achieve 1.5440 on Monday and closed below 1.5320, and confirming my assertion that “the ascending daily RSI trend dating back to the early-March low [should break], opening up the floor for a downside move towards 1.5245/50 and 1.5135/50.” 1.5245/50 was touched earlier today, and suggests that downside momentum into 1.5135/50 should continue.

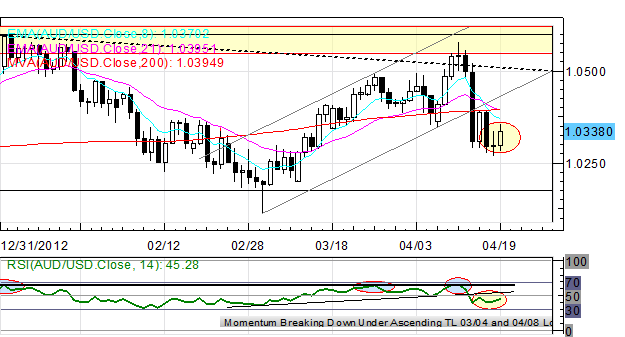

AUDUSD: Channel support off of the March 4 and April 8 lows at 1.0390/400 broke after another rejection at 66 in the daily RSI suggests that another period of weakness could be beginning. The retest of 1.0390/400 failed as well (a healthy retest), allowing the uptrend in daily RSI to remain broken as well. Now the 8-/21-EMA structure is compressing and close to flipping bearish. I’m neutral, but looking short now.

S&P 500: No change: “Is the top in? A dramatic sell-off yesterday dropped the S&P 500 below the crucial 1570/75 area, former swing highs as well as the ascending trendline support off of the late-December and late-February swings lows – coincidentally the pre-fiscal cliff deal low and the post-Italian election low. We’re in a bit of “no man’s land” here, with either a close back above 1570/75 necessary for a retest of the highs, or a close below 1530/35 to signal weakness towards and below 1500.”

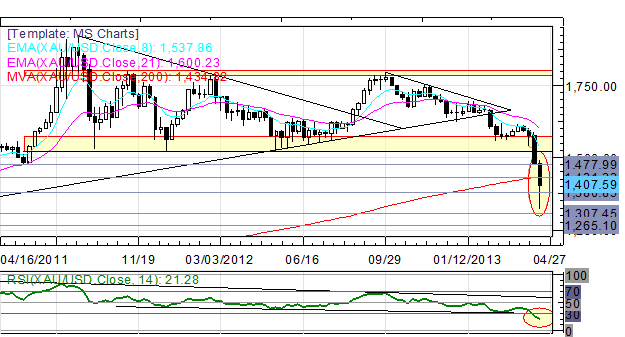

GOLD: No change: “The major support zone from the past 18-months from 1520 to 1575 gave way with fervor last week, as the combination of weak fundamentals (financial institutions scrambling for cash in Europe after Cyprus) and broken technicals produced the ideal selling climate. Precious metals in general have gotten hammered, and Gold has fallen back to the mid-March swing lows near 1380/85. A weekly close below 1430 this week leaves the possibility of a bigger dip towards 1305.”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance