Jamf Holding Corp (JAMF) Q1 2024 Earnings: Exceeds Revenue Forecasts and Demonstrates Robust Growth

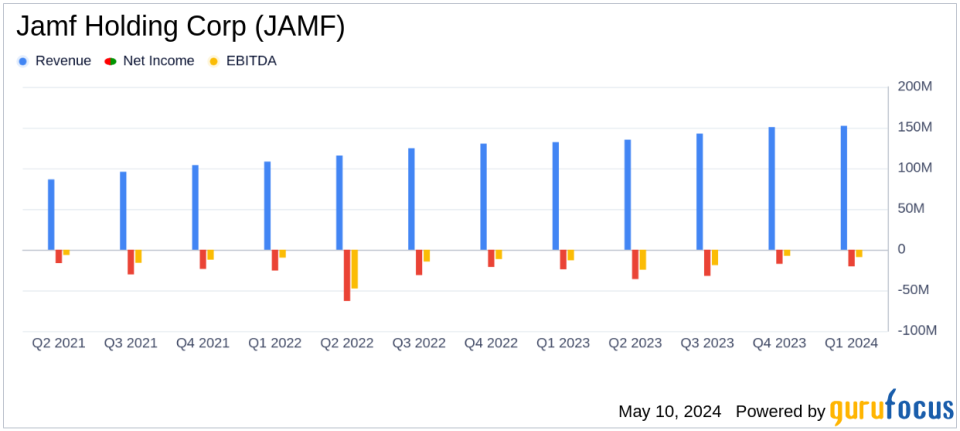

Total Revenue: $152.1 million, marking a 15% increase year-over-year, surpassing the estimate of $150.53 million.

Annual Recurring Revenue (ARR): Reached $602.4 million as of March 31, 2024, a 14% increase from the previous year.

GAAP Operating Loss: Reported at $21.1 million, an improvement from a loss of $25.5 million in the same quarter last year.

Non-GAAP Operating Income: Stood at $22.1 million, significantly higher than $6.1 million in the first quarter of 2023.

GAAP Gross Profit: Increased to $117.0 million, or 77% of total revenue, up from $102.5 million in the prior year's quarter.

Unlevered Free Cash Flow: Reported at $72.6 million for the trailing twelve months, maintaining nearly the same level as the previous period's $72.8 million.

Net Loss: Amounted to $20.524 million, or $0.16 per share, showing a slight improvement from a net loss of $24.2 million, or $0.20 per share, year-over-year.

Jamf Holding Corp (NASDAQ:JAMF), a leader in Apple Enterprise Management, announced its first quarter financial results for 2024, revealing a significant revenue increase and operational improvements. The company released its earnings report on May 8, 2024, through its 8-K filing. This summary provides an in-depth look at the financial health and strategic direction of Jamf as it continues to expand its market presence and enhance profitability.

Company Overview

Jamf Holding Corp is at the forefront of managing and securing Apple devices in the workplace. With a cloud-based platform, Jamf helps a diverse range of organizationsfrom businesses to educational institutionseffectively manage and protect Apple products. The company operates globally, offering its Software-as-a-Service (SaaS) solutions through direct sales and channel partners, including Apple.

Financial Highlights

The first quarter of 2024 saw Jamf achieve a total revenue of $152.1 million, marking a 15% increase year-over-year and surpassing the estimated revenue of $150.53 million. This growth is attributed to the company's robust Annual Recurring Revenue (ARR), which grew by 14% to $602.4 million as of March 31, 2024. Notably, the company's non-GAAP operating income significantly improved to $22.1 million, or 15% of total revenue, up from $6.1 million in the previous year.

Operational and Strategic Developments

Jamf reported several key achievements in the quarter that underscore its commitment to innovation and market expansion. The company now serves over 75,900 customers with 32.8 million devices under management. A highlight of the quarter was the 31% year-over-year growth in security ARR, which now stands at $138.4 million, representing 23% of Jamfs total ARR. Additionally, Jamf launched support for Apple Vision Pros new release and introduced several product enhancements that bolster its competitive edge.

Financial Position and Future Outlook

Despite a GAAP operating loss of $21.1 million, which is an improvement from the $25.5 million loss in the first quarter of 2023, Jamf's non-GAAP figures reflect a healthier financial trajectory. The company ended the quarter with strong cash flow from operations amounting to $44.9 million for the trailing twelve months, representing 8% of the total revenue for the period. Looking ahead, Jamf expects Q2 2024 revenue to be between $150.5 million and $152.5 million and projects full-year revenue to reach between $618.5 million and $622.5 million.

Analysis of Financial Statements

The balance sheet as of March 31, 2024, shows total assets of $1.56 billion with a slight decrease from the previous quarter. The company maintains a solid liquidity position with $224.5 million in cash and cash equivalents. Total liabilities stood at $847.7 million, with a notable portion allocated to convertible senior notes. Stockholders equity was reported at $716.1 million.

Conclusion

Jamf's first quarter of 2024 illustrates a company on the rise, with significant revenue growth and strategic advancements in product offerings and market reach. While challenges remain in terms of GAAP profitability, the strong non-GAAP performance and positive cash flow metrics indicate a robust underlying financial health. Investors and stakeholders may look forward to continued growth and operational enhancements as Jamf progresses with its long-term strategic goals.

For detailed financial tables and further information, please refer to the full earnings report on Jamfs Investor Relations website.

Explore the complete 8-K earnings release (here) from Jamf Holding Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance