J&J (JNJ) to Pay $2.5B in Baby Powder Case on Appeal Rejection

Johnson & Johnson JNJ announced that the United States Supreme Court has denied accepting its petition for reviewing a verdict from a lower court related to its talc-based baby powder. Following this denial at the highest court in the country, the company will now make a payment of $2.5 billion in punitive charges, including total accrued interest, this month.

It has been alleged that its talc products contain asbestos, a known carcinogen, which caused many women to develop ovarian cancer.

We remind investors that in 2018, J&J was ordered by a Missouri court to pay $4.7 billion in damages to 22 women who made such allegations, affirming a St. Louis court jury’s verdict given earlier. J&J appealed against the decision and in October 2020, the Missouri Court of Appeals reduced the total charges to $2.1 billion. Following this verdict, J&J filed for transferring the case to the Missouri Supreme Court but the court denied any hearing to the case in November 2020. The company then moved to the U.S. supreme court where it has also faced a similar action.

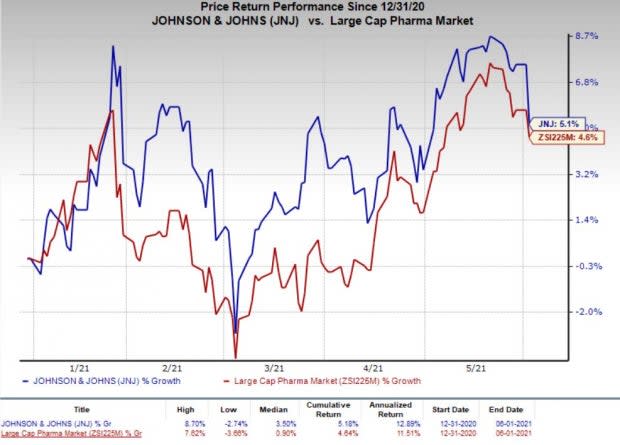

J&J’s stock has risen 5.1% this year so far compared with an increase of 4.6% for the industry.

Image Source: Zacks Investment Research

We note that the company has already recorded a reserve of approximately $2.1 billion during fiscal 2020, following its setback with the Missouri Supreme Court. Moreover, the company voluntarily stopped the sale of its talc-based Johnson’s Baby Powder in the United States and Canada in May 2020, citing declining demand for the product due to “misinformation around the safety of the product” amid a barrage of legal challenges. Hence, there will likely be no major financial impact on the company going forward.

Meanwhile, the company consistently denied allegations and insisted that its talc-based products are safe and do not cause cancer. The link between talc and cancer has been rumored for decades but remains scientifically unproven. It has been suggested that a link between talc and cancer may be due to the fact that talc and asbestos often occur together in deposits and get inadvertently mixed.

Although the company is set to pay more than $2 billion in damages, its litigations related to talc-based products remain an overhang as several thousands of cases are still pending in different courts. Following this verdict to pay the damages, pressure on the company is likely to increase. The sheer number of litigations increases the risk of financial burden on the company.

Johnson & Johnson Price

Johnson & Johnson price | Johnson & Johnson Quote

Zacks Rank & Stocks to Consider

J&J currently has a Zacks Rank #3 (Hold).

Some better-ranked large pharma or biotech stocks include Bayer AG BAYRY, BioNTech SE BNTX and Repligen Corporation RGEN. While BioNTech and Repligen sport a Zacks Rank #1 (Strong Buy), Bayer has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bayer’s earnings estimates have gone up by 4% for 2021 and by 5.8% for 2022 over the past 30 days. Bayer’s stock is up 6.5% this year so far.

BioNTech’s earnings estimates have risen 67% for 2021 and 231.8% for 2022 over the past 30 days. BioNTech’s shares are up 152.8% this year so far.

Repligen’s earnings estimates for 2021 and 2022 have risen 15.7% and 13.5%, respectively, over the past 30 days.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Repligen Corporation (RGEN) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance