Itau Unibanco (ITUB) Q2 Earnings & Revenues Up, '21 View Raised

Itau Unibanco Holding S.A. ITUB recorded recurring earnings of R$6.5 billion ($1.23 billion) in second-quarter 2021, which jumped 55.6% year over year. Including non-recurring items, net income came in at R$7.6 billion ($1.43 billion), up substantially.

Results benefited from higher revenues, rise in credit portfolio and fall in cost of credit. However, increase in non-interest expenses and decline in deposits acted as headwinds.

Revenues & Costs Rise

Operating revenues came in at R$30.6 billion ($5.77 billion), growing 9.3% on a year-over-year basis.

Managerial financial margin rose 5.7% to R$18.8 billion ($3.55 billion). Commissions and fees were up 18.9% to R$10 billion ($1.89 billion).

Non-interest expenses were R$12.6 billion ($2.38 billion), up 3.7% from prior-year quarter.

Efficiency ratio was 44.5%, down from 46.5% in the year-earlier quarter. A fall in this ratio indicates improved profitability.

Credit Quality Improves

Cost of credit plunged 39.6% on a year-over-year basis to R$4.7 billion ($0.89 billion).

The non-performing loan ratio (loan transactions more than 90 days overdue) came in at 2.3% during the June quarter, down from 2.7% in the prior-year quarter.

Strong Balance Sheet Position

As of Jun 30, 2021, Itau Unibanco’s total assets amounted to R$2.07 trillion ($0.42 trillion), down 2.8% sequentially. Deposits were R$793.5 billion ($159.55 billion), down 3.4%.

Itau Unibanco’s credit portfolio, including financial guarantees provided and corporate securities, reached R$909.1 billion ($182.8billion) as of Jun 30, 2021, up marginally.

Capital & Profitability Ratios Up

As of Jun 30, 2021, Common Equity Tier 1 ratio was 11.9%, up from 10.4% on Jun 30, 2020.

Annualized recurring return on average equity was 18.9% at the end of second quarter, up from the 13.5% in the year-earlier quarter.

Upbeat 2021 Guidance

The company now expects costs of credit to be R$19-R$22 billion, a change from prior expectation of R$21.3-R$24.3 billion.

Non-interest expenses are expected to either decline 2% or rise 2%.

Total credit portfolio is now projected to grow 8.5-11.5% compared with the previous outlook of 5.5-9.5% rise.

Commissions and fees from insurance operations are likely to be up 2.5-6.5%.

Managerial financial margin with clients is estimated to increase 2.5-6.5%. Financial marginal with the market is now projected to be in the range of R$6.5-R$8 billion, up from prior guidance of between R$4.9 billion and R$6.4 billion.

Effective tax rate is estimated to be 34.5-36.5%.

Our View

Results of Itau Unibanco highlight solid performance. The company’s prospects look encouraging as it is focused on building strategies to expand inorganically. In addition to these, business restructuring efforts will support financials.

However, inflated expenses are a concern. Heightening competition and stressed conditions in Brazil’s economy pose significant risks.

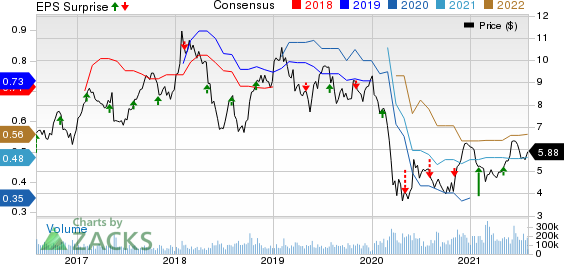

Itau Unibanco Holding S.A. Price, Consensus and EPS Surprise

Itau Unibanco Holding S.A. price-consensus-eps-surprise-chart | Itau Unibanco Holding S.A. Quote

Itau Unibanco currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

Barclays BCS reported second-quarter 2021 net income attributable to ordinary equity holders of £2.11 billion ($2.95 billion), up significantly from the prior-year quarter.

Deutsche Bank’s DB second-quarter 2021 net income of €828 million ($997.5million) increased substantially from the year-ago quarter’s €66 million. Also, the German lender reported profit before taxes of €1.17 billion ($1.4 billion) compared with the year-ago quarter’s €158 million.

UBS Group AG UBS reported second-quarter 2021 net profit attributable to shareholders of $2 billion, up 63% from the prior-year quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barclays PLC (BCS) : Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

Itau Unibanco Holding S.A. (ITUB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance