Should you buy shares in these scary times?

For novice investors, this might look like a scary time to invest but history has shown that this is actually a good time to buy stocks.

Also read: ASX claws back losses on steady unemployment data

Also read: Experts’ 9 top tips for starting to invest

Also read: Where to invest during coronavirus

And yes, even if the stock market should fall again, it could be ok to invest right now.

Howard Marks is the founder of US-based Oaktree Capital and is regarded as a legendary investor.

Late last year he was wary of the stock market being highly priced but he could not pinpoint a standout reason to be a seller. He just expressed concern about high stock prices.

However, after the coronavirus crash, he has changed his view on stocks.

The Irish Times recently noted that he said stocks “may well be considerably lower sometime in the coming months” but investors should nevertheless be buying now rather than waiting for the bottom, because he thinks picking the bottom of the market is too hard.

His advice is that if something is cheap but is a good quality company or asset, you should buy it. And if it cheapens further? Buy more.

“It’s not easy to buy when the news is terrible, prices are collapsing and it’s impossible to have an idea where the bottom lies,” says Marks, “But doing so should be the investor’s greatest aspiration.”

If you buy now, the market could fall on worsening virus data in the US or Europe but if this doesn’t happen, then future sell offs of stocks might be reasonably small.

Right now, CBA is a $62 stock but it was nearly $92 only in February. Let’s say over the next three years the economy improves and CBA goes to $92 again, then you would make $30 on a $62 outlay, which would be a 48 per cent return or a 16 per cent per annum result.

You then add in dividends of about 6 per cent per annum and you’re now making 22 per cent per annum on one of the best banks in the world.

During the GFC, CBA fell to about $27 and people who bought it then have not only pocketed great capital gain but are getting a huge dividend yield of 16 per cent before you add in franking credits of about 2 per cent. So that’s an 18 per cent pay off from investing in scary times.

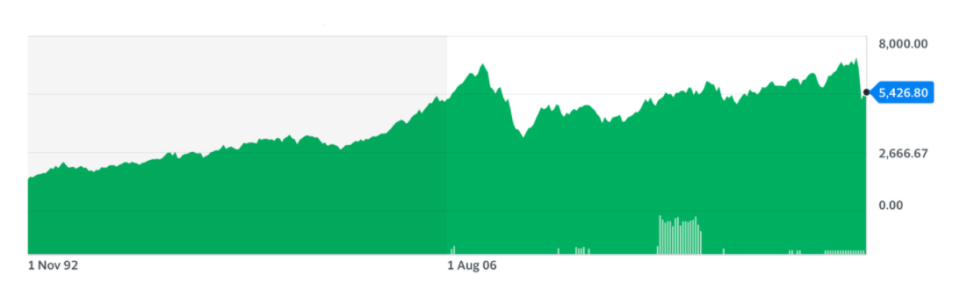

Of course, buying one stock can be dangerous, so if you bought the exchange traded fund IOZ that gives you the top 200 companies, this chart shows what happened if you include dividends.

S&P/ASX 200

If you draw an imaginary line at the slope of increase between November 1992 and where the market is now, it’s a fairly constant slope. Above the imaginary line are breakouts of optimism and breakouts of pessimism.

If you stay invested, you average about 10 per cent per annum where about 5 per cent comes from dividends.

So buying in scary times and just hanging in the market can be rewarding for the set-and-forget investor but you have to buy a collection of quality companies or an ETF that gives you the best 200 listed companies in Australia.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance