Ironwood's (IRWD) Q3 Earnings Beat, Linzess Volume Grows

Ironwood Pharmaceuticals, Inc. IRWD reported adjusted earnings of 28 cents per share in third-quarter 2022, beating the Zacks Consensus Estimate of 27 cents. The company reported adjusted earnings of 33 cents per share in the year-ago quarter.

Total revenues of $109 million missed the Zacks Consensus Estimate of $112 million. Revenues were up 4.7% year over year.

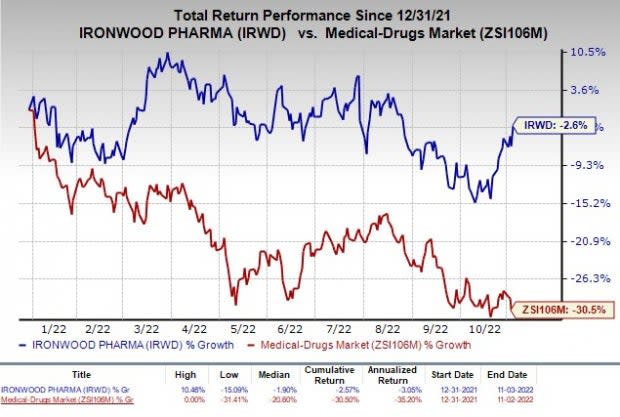

Shares of Ironwood were up 3.7% during market hours, following the third-quarter results. However, the company’s shares have declined 2.6% this year compared with the industry’s fall of 30.5%.

Image Source: Zacks Investment Research

Quarter in Detail

As reported by partner AbbVie ABBV, Ironwood’s sole marketed product — Linzess (linaclotide) — generated net sales of almost $261.13 million in the United States, up 3.4% year over year. Ironwood and AbbVie equally share Linzess’ brand collaboration profits or losses.

Ironwood's share of net profits from the sales of Linzess in the United States (included in collaborative revenues) was $105.2 million in the third quarter, up 5% year over year.

The performance can be attributed to a massive acceleration in new prescription volume. In the reported quarter, the new prescription share reached 38% and new-to-brand volume increased 9% year-over-year.

The company recorded $3.4 million in royalties and other revenues compared with $3.3 million in the year-ago quarter.

Ironwood has agreements with two partners — Astellas Pharma and AstraZeneca AZN — related to the development and commercialization of Linzess in Japan and China, respectively. Ironwood records royalties on sales of Linzess from Astellas and AstraZeneca in their respective territories.

Selling, general and administrative expenses were up 3.2% year over year to $28.6 million during the third quarter. Research & development expenses rose 5.8% year over year to $11.6 million.

2022 Guidance Maintained

Ironwood maintained its previously-issued guidance for 2022. The company expects its total revenues to be between $420 million and $430 million. It expects U.S. sales of Linzess to increase in low single-digit percentage points.

The company expects adjusted EBITDA to be more than $250 million for the year.

Pipeline Updates

Ironwood and AbbVie are currently developing their linaclotide clinical program for pediatric patients.

Ironwood reported positive top-line data from the phase III study evaluating 72 mcg of Lizness in pediatric patients between the ages of six to 17 with functional constipation (“FC”). Ironwood and its partner AbbVie intend to submit a supplemental new drug application (sNDA) to the FDA by the end of 2022. FC currently has no FDA-approved therapies for children.

Ironwood’s two early-stage studies are are ongoing on its pipeline candidates — IW-3300 and CNP-104 — for treating visceral pain conditions and primary biliary cholangitis, respectively.

Ironwood Pharmaceuticals, Inc. Price, Consensus and EPS Surprise

Ironwood Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Ironwood Pharmaceuticals, Inc. Quote

Zacks Rank & Stock to Consider

Currently, Ironwood carries a Zacks Rank #3 (Hold).

A better-ranked stock in the same sector is Neurocrine Biosciences NBIX, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Neurocrine’s earnings estimates for 2022 have improved from $1.73 to $1.80 in the past 30 days. Shares of NBIX have returned 43.3% year to date. Earnings of NBIX missed earnings estimates in all the last four quarters. NBIX delivered a negative earnings surprise of 80.17%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Ironwood Pharmaceuticals, Inc. (IRWD) : Free Stock Analysis Report

Neurocrine Biosciences, Inc. (NBIX) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance